Demand for risk suddenly returned again after the Fed announced its intention to start buying individual corporate bonds. This secondary market of corporate credit facilities up to 250 billion was announced back in March, but until today, only 5.5 billion ETFs have been purchased. It is obvious that the official start of the implementation of the next support package could not be ignored by the markets, which led to a surge of positive emotions.

In addition, the Reuters report cannot be ignored, according to which the US government is going to allow US companies to work with Huawei on 5G network standards.

Amid such serious support, the American indices closed in positive territory, the S & P500 added 0.83%, but the Asian indices reacted much more rapidly - the Shanghai Composite added 1.2% as of 5.40 Universal time, the Australian S & P / ASX 200 by more than 4%, and the Japanese Nikkei added 4.8% after a dull closing of the previous day. This is a very strong growth, which characterizes a high level of optimism of the players.

Apparently, if nothing extraordinary happens, the growth of positivity will be supported on Tuesday, which will be reflected in the growth in demand for commodity currencies.

NZD/USD

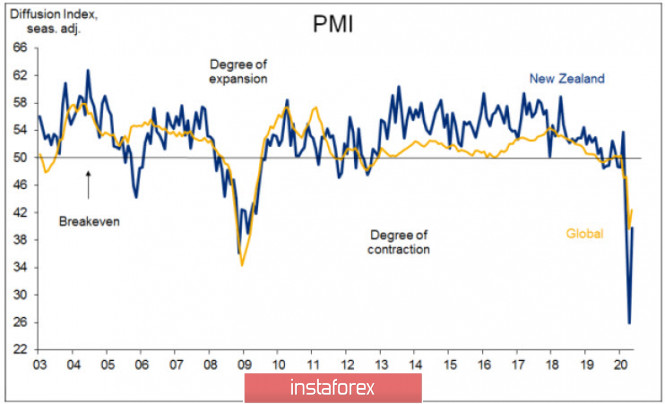

Macroeconomic reports look noticeably better than those of most countries in Europe, and especially the United States. Business activity indices are still below 50p, but the dynamics is obvious – the PMI level for both the services sector and the manufacturing sector is starting from a low base and is noticeably higher than in March-April.

The price index for dairy products is stable, and the "pandemic hysteria" has not caused significant damage to the main export industry. The inflation report from ANZ turned out to be confidently positive, since a slight increase of 0.2% was recorded in May, and the annual index corrected to 2.8%, which is noticeably higher than in most G10 countries and corresponds to a good recovery in consumer demand.

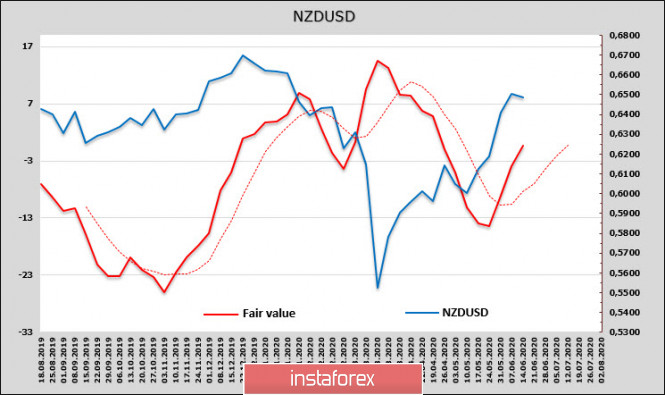

The net short position of NZD declined over the previous week by 91 million to 0.732 billion, the estimated fair price is behind the spot price, which increases the risk of corrective reduction of NZD/USD, but has a clear upward direction, which should be interpreted as an obvious bullish direction in the current conditions.

The positivity is supported by the transition to alert level 1, which means almost complete removal of quarantine measures. There are 8 days left before the RBNZ meeting, and banks are not predicting a rate change, but it is likely that QE will increase to about $ 90 billion either at the next meeting or at the next one in August.

NZD/USD entered the siderange, exit from which is more likely to go up; there are no reasons to close long positions. Another small correctional wave is possible to support 0.6315/20, where it will be possible to add to purchases after the base is formed.

AUD/USD

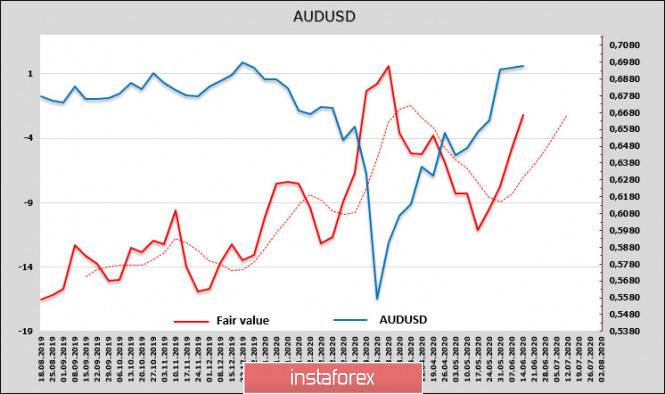

Despite the fact that inflation expectations in June were slightly overestimated, the prospects for the Aussie at the current stage are quite good, the chances of continued growth remain high. According to the latest CFTC report, the net short position declined by 267 million, the AUD responded with growth to the removal of quarantine measures. The estimated price has a similar dynamic with NZD.

The RBA minutes do not contain any surprises, the regulator's policy remains unchanged at the current stage, and the gloomy outlook on the prospects for recovery essentially repeats the rhetoric of other Central banks. An employment report in May will be published on Thursday, unemployment is projected to increase from 6.2% to 7% and a further 125 thousand jobs will be lost. These expectations are already in the current AUD rate.

A support zone of 0.6775/80 has formed with a high probability, we should expect a second attempt to move to the resistance 0.7021 and consolidate higher, after which the upward trend will receive an additional impulse.

The material has been provided by InstaForex Company - www.instaforex.com