Forecast for June 11:

Analytical review of currency pairs on the scale of H1:

The key levels for the euro / dollar pair on the H1 scale are: 1.1533, 1.1488, 1.1457, 1.1408, 1.1334, 1.1299 and 1.1238. Here, we are following the local rising structure of June 9th. The continuation of the upward movement is expected after the breakdown of the level of 1.1408. In this case, the target is 1.1457. Short-term upward movement, as well as consolidation are in the range of 1.1457 - 1.1488. For the potential value for the top, we consider the level of 1.1533. We expect a downward pullback upon reaching this level.

We expect short-term downward movement, as well as consolidation in the range 1.1334 - 1.1299. The breakdown of the last reading will have the downward structure development. In this case, the first goal is 1.1238. This is the key resistance level for the bottom.

The main trend is the local structure for the top of June 9

Trading recommendations:

Buy: 1.1408 Take profit: 1.1457

Buy: 1.1488 Take profit: 1.1533

Sell: 1.1334 Take profit: 1.1300

Sell: 1.1297 Take profit: 1.1240

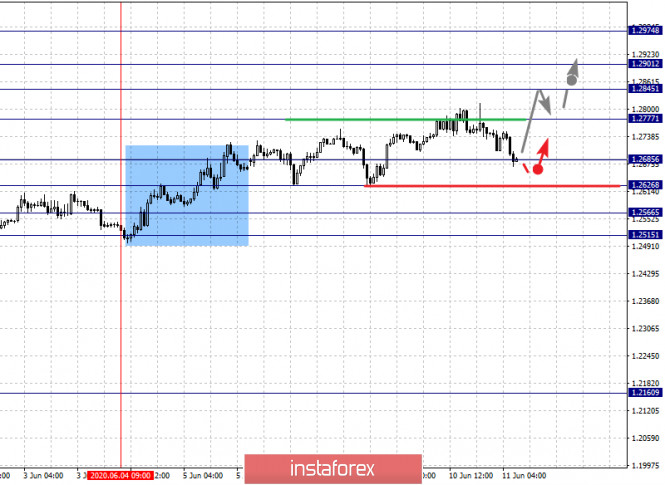

The key levels for the pound / dollar pair on the H1 scale are: 1.2974, 1.2901, 1.2845, 1.2777, 1.2685, 1.2626, 1.2566 and 1.2515. Here, we are following the ascending structure of May 25. The continuation of the upward movement is expected after the breakdown of the level of 1.2777. In this case, the target is 1.2845. Short-term upward movement, as well as consolidation are in the range of 1.2845 - 1.2901. For the potential value for the top, we consider the level of 1.2974. We expect a downward pullback upon reaching this level.

A short-term downward movement is expected in the range of 1.2685 - 1.2626. The breakdown of the last level will lead to a deeper correction. Here, the target is 1.2566. The range of 1.2566 - 1.2515 is the key support for the top, We expect the initial conditions for the downward cycle to be formed to the level of 1.2515.

The main trend is the local ascending structure of May 25

Trading recommendations:

Buy: 1.2777 Take profit: 1.2845

Buy: 1.2845 Take profit: 1.2900

Sell: 1.2685 Take profit: 1.2628

Sell: 1.2640 Take profit: 1.2568

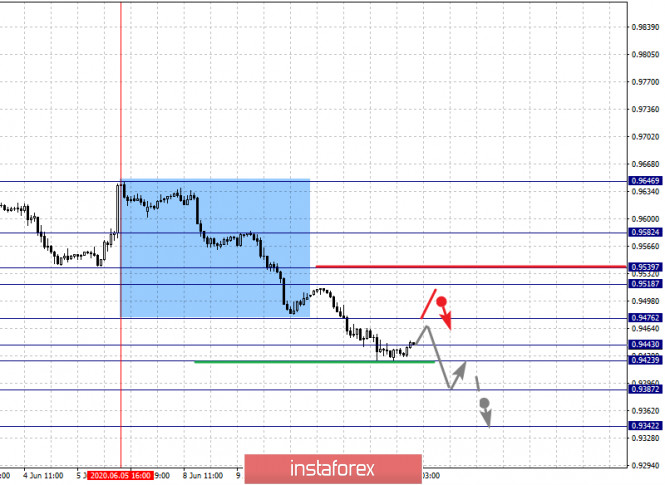

The key levels for the dollar / franc pair on the H1 scale are: 0.9582, 0.9539, 0.9518, 0.9476, 0.9443, 0.9423 and 0.9387. Here, we are following the development of the descending structure of June 5th. The continuation of the downward movement is expected after the price passes the noise range of 0.9443 - 0.9423. In this case, the target is 0.9387. Price consolidation is near this level. We consider the level of 0.9342 to be a potential value for the downward cycle. We expect an upward pullback upon reaching this level.

It is possible to avoid correction after the breakdown of the level of 0.9476. In this case, the target is 0.9518. The range of 0.9518 - 0.9539 is the key support for the bottom. We expect the top of the initial conditions to form at the level of 0.9539.

The main trend is the downward cycle of June 5

Trading recommendations:

Buy : 0.9476 Take profit: 0.9516

Buy : 0.9540 Take profit: 0.9580

Sell: 0.9422 Take profit: 0.9388

Sell: 0.9385 Take profit: 0.9343

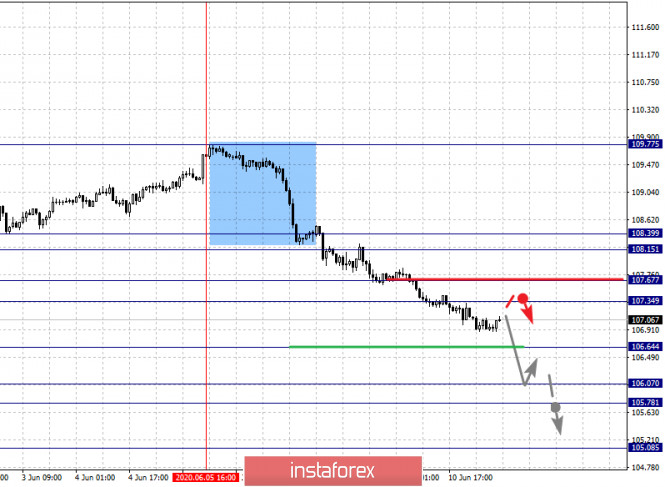

The key levels for the dollar / yen pair on the scale are : 108.39, 108.15, 107.67, 107.34, 106.64, 106.07, 105.78 and 105.08. Here, we are following the development of the descending structure of June 5th. The continuation of the downward movement is expected after the breakdown of the level of 106.64. In this case, the target is 106.07. A short-term downward movement, as well as consolidation are in the range of 106.07 - 105.78. We consider the level of 105.08 to be a potential value for the downward trend. We expect an upward pullback upon reaching this level.

A short-term upward movement is possible in the range of 107.34 - 107.67. The breakdown of the last level will lead to a deeper correction. Here, the target is 108.15. We expect the initial conditions for the upward cycle to be formed before the noise range 108.15 - 108.39.

The main trend: the downward cycle of June 5

Trading recommendations:

Buy: 107.35 Take profit: 107.66

Buy : 107.69 Take profit: 108.15

Sell: 106.64 Take profit: 106.07

Sell: 105.76 Take profit: 105.10

The key levels for the Canadian dollar / US dollar pair on the H1 scale are: 1.3634, 1.3579, 1.3510, 1.3452, 1.3371, 1.3340 and 1.3283. Here, the price has entered an equilibrium zone. The continuation of the downward movement is expected after the price passes the noise range 1.3371 - 1.3340. In this case, the potential target is 1.3283, after which we expect consolidation, as well as an upward pullback.

A short-term upward movement is possible in the range of 1.3452 - 1.3510. The breakdown of the last level will lead to the development of a deeper correction. Here, the target is 1.3579. We consider the level 1.3634 to be the potential value for the top, to which we expect the initial conditions to be formed for the upward cycle.

The main trend is the local descending structure of May 29

Trading recommendations:

Buy: 1.3452 Take profit: 1.3510

Buy : 1.3512 Take profit: 1.3578

Sell: 1.3340 Take profit: 1.3285

Sell: Take profit:

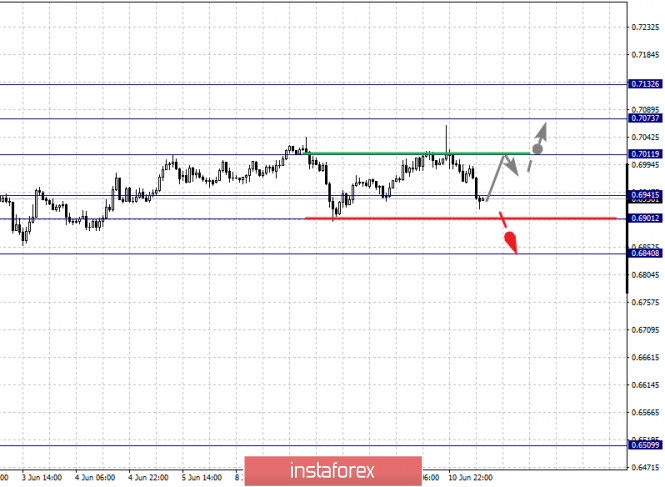

The key levels for the Australian dollar / US dollar pair on the H1 scale are : 0.7132, 0.7073, 0.7011, 0.6941, 0.6901 and 0.6840. Here, we are following the development of the upward cycle of May 15. The continuation of the upward movement is expected after the breakdown of the level of 0.7011. In this case, the target is 0.7073. For the potential value for the top, we consider the level of 0.7132. After which we expect a downward pullback. However, it is most likely that the reversal to the correction will occur earlier than reaching the potential value, namely from the range 0.7011 - 0.7073.

A short-term downward movement is possible in the range of 0.6941 - 0.6901. The breakdown of the last level will lead to an in-depth correction. Here, the target is 0.6840. This is the key support level for the top.

The main trend is the upward structure of May 15

Trading recommendations:

Buy: 0.7011 Take profit: 0.7070

Buy: 0.7075 Take profit: 0.7130

Sell : 0.6940 Take profit : 0.6903

Sell: 0.6900 Take profit: 0.6843

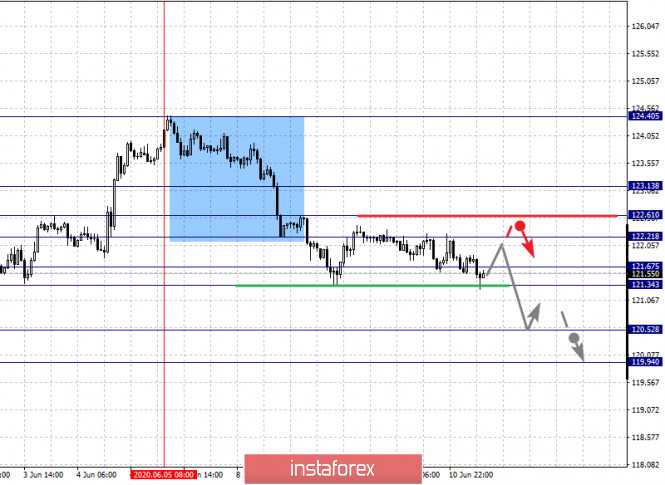

The key levels for the euro / yen pair on the H1 scale are: 123.13, 122.61, 122.21, 121.67, 121.34, 120.52 and 119.94. Here, we are following the descending structure of June 5th. A consolidated movement is expected in the range of 121.67 - 121.34. The breakdown of the last level should be accompanied by a pronounced downward movement. Here, the target is 120.52. For the potential value for the bottom, we consider the level of 119.94. Upon reaching which, we expect consolidation, as well as an upward pullback.

A short-term upward movement is expected in the range of 122.21 - 122.61. The breakdown of the last level will lead to a deeper correction. Here, the goal is 123.13. This level is a key support for the bottom.

The main trend is the building of potential for the downward cycle of June 5

Trading recommendations:

Buy: 122.21 Take profit: 122.60

Buy: 122.63 Take profit: 123.10

Sell: 121.32 Take profit: 120.55

Sell: 120.50 Take profit: 119.96

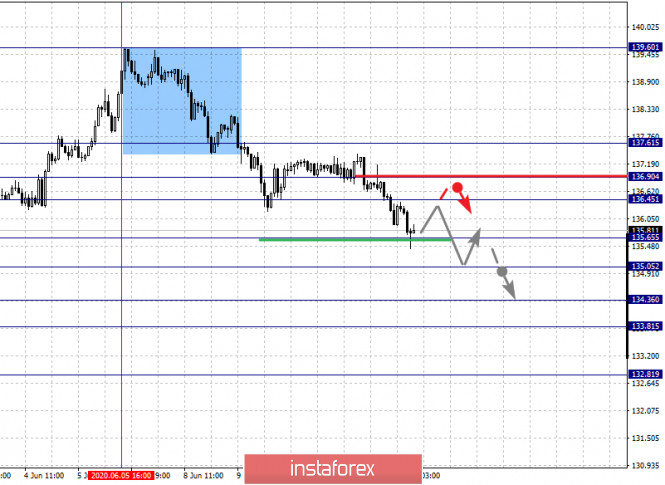

The key levels for the pound / yen pair on the H1 scale are : 137.61, 136.90, 136.45, 135.65, 135.05, 134.36, 133.81 and 132.81. Here, we are following the development of the descending structure of June 5th. A short-term downward movement is expected in the range of 135.65 - 135.05. The breakdown of the last level will allow us to count on movement to the level of 134.36. Short-term downward movement, as well as consolidation are in the range of 134.36 - 133.81. For the potential value for the bottom, we consider the level of 132.81. Upon reaching which, we expect an upward pullback.

A short-term upward movement is possible in the range of 136.45 - 136.90. The breakdown of the last level will lead to a deeper correction. Here, the potential target is 137.61. This is the key support level for the downward structure.

The main trend is the descending structure of June 5

Trading recommendations:

Buy: 136.45 Take profit: 136.90

Buy: 136.92 Take profit: 137.60

Sell: 135.65 Take profit: 135.08

Sell: 135.00 Take profit: 134.40

The material has been provided by InstaForex Company - www.instaforex.com