The only thing that worries all the media right now is the protests in the United States.This is the only thing that determines the mood of investors at the moment. To determine the trend for yesterday, there was enough information that four St. Louis police officers were hospitalized with bullet wounds. That is, now not only does the police use firearms, but also the demonstrators. So violence goes to a new level. The trend towards a weakening dollar was reinforced by reports that during the protests, a total of at least eleven people were killed. In general, the situation in the United States is very difficult, and does not contribute to investment. So big business is clearly looking for a quieter place.

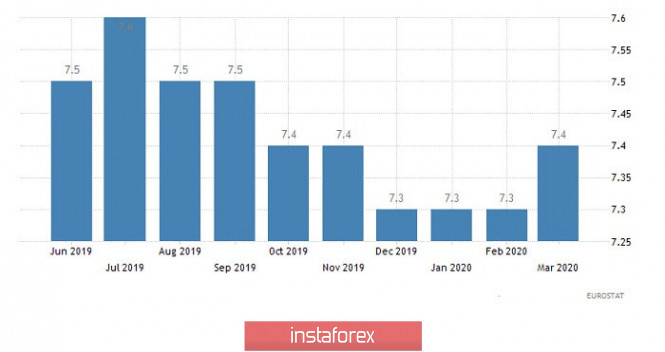

It is clear that as long as mass protests and clashes with the police continue, including with the use of firearms, no macroeconomic data will worry anyone. They will begin to think about them later. Nevertheless, today's macroeconomic data for Europe will be quite mixed. On the one hand, the summary data on business activity indices should confirm a slight increase in European business sentiment. Thus, the index of business activity in the service sector should grow from 12.0 to 28.7. Given yesterday's growth in the index of business activity in the manufacturing sector, this should lead to an increase in the composite business activity index from 13.6 to 30.5. This is not surprising, since the gradual removal of restrictive measures introduced due to the coronavirus epidemic is perceived by businesses as an exceptionally positive factor. After all, a working business is better than a closed one. Even if consumer demand has noticeably decreased, it is still much better than the complete absence of any activity. However, the unemployment rate could rise from 7.4% to 8.1%. Consequently, the growth potential of consumer activity is clearly very, very small. Another negative factor will be data on producer prices, the decline rate of which should accelerate from -2.8% to -3.2%. This already indicates an ever-increasing threat of Europe slipping into full deflation. Moreover, a meeting of the Board of the European Central Bank will take place tomorrow, and in anticipation of such an event, the release of such weak data on prices is rather an extremely alarming call. Bottom line, we have statistics offsetting each other, so that the market will continue to monitor protests in the United States.

Unemployment Rate (Europe):

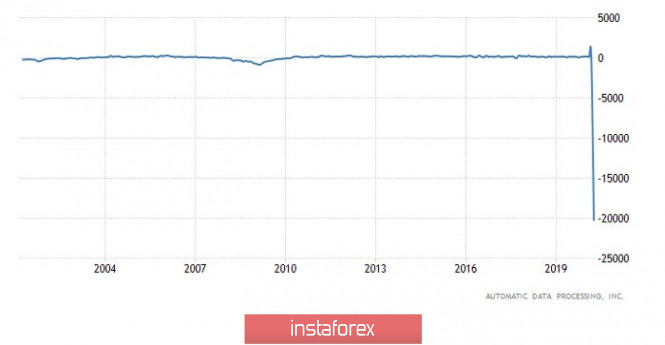

In turn, US statistics will also be purely multidirectional in nature. The restrictions previously imposed due to the coronavirus epidemic are also gradually being removed in the United States, and business is clearly looking forward with optimism. Exactly for the same reasons as in Europe. They are generally universal for the whole world. So the index of business activity in the service sector should grow from 26.7 to 36.9. Along with the recent increase in the index of business activity in the manufacturing sector, this could lead to an increase in the composite index of business activity from 27.0 to 36.4. But this is for the positive news, and now it's time to move on to the negative. So, ADP data can show a decrease in employment by another 9,600,000. The volume of factory orders should be reduced by another 16.0%. So all this news will overlap. It can be seen that if we rely solely on macroeconomic statistics, then, in theory, the market should just stand still. It turns out that the horrors that are happening on the streets of American cities help market participants determine their preferences and moods. We can say that they save the market from stagnation.

Employment Change from ADP (United States):

From the point of view of technical analysis, you can see a constant upward interest that has been kept in the market for 2.5 weeks. So the bullish mood of market participants not only changed the clock component, but also stormed an important range level of 1.1180/1.1200, locally focusing above it. It is worth considering that having a movement has recently grown into a momentum, and its slope signals a growing overbought.

In terms of a general review of the trading chart, the daily period, you can see significant changes in the short term, but when analyzing global ticks, the downward trend remains unchanged.

We can assume that with the current external background, weakening the US dollar in the direction of 1.1300 is not ruled out, but it should be noted that with each subsequent upward movement, the quote overheats more and more, this means that a technical correction will occur at the slightest weakening of the external background.

From the point of view of a comprehensive indicator analysis, we see that the indicators of technical instruments unanimously signal a purchase due to stable upward momentum.