EUR/USD 1H

The EUR/USD pair calmed down on Monday, but already on Tuesday resumed a strong upward movement on the hourly timeframe, while remaining inside the upward channel, which is very narrow, which indicates an almost recoilless upward movement. In recent days, buyers did not completely take the initiative out of their hands, sellers did not have a single chance to consolidate under the ascending channel. Thus, today, buyers can continue to trade with the objectives of the two nearest resistance levels of 1.1205 and 1.1312. We also recall that the upward trend is supported by two upward trend lines, which previously repeatedly supported the traders to increase and did not let the bears down. Bears can enter the battle not before closing the quotes of the euro/dollar pair below the rising channel.

EUR/USD 15M

We see the same picture on the 15-minute timeframe. Two linear regression channels, both still directed upward and clearly signal an upward trend. Thus, at the moment, there is no signal at the disposal of traders regarding the end of the upward trend.

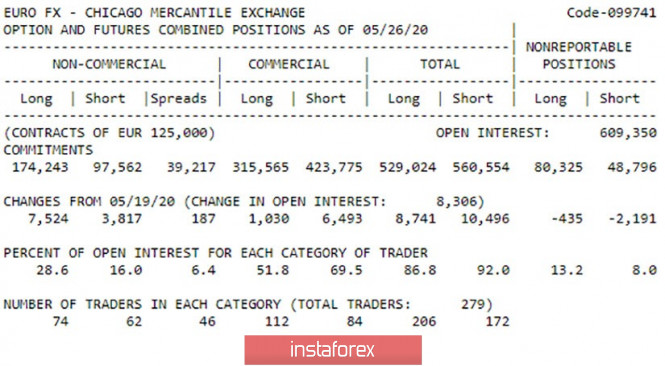

COT Report

The latest COT report showed that professional traders unexpectedly started buying the European currency during the reporting week. Suddenly - because, from our point of view, the fundamental background was not in favor of the euro. However, during the current week it became expectedly in favor of the euro due to mass rallies and protests in the US. Large traders found reason to open new 7524 purchase contracts last week. Only 3817 sales contracts were opened for the reporting week, if we take into account the most important group of traders - professional players who work in the market with the goal of making profit due to exchange rate differences. This information is already enough to understand that the mood of large traders for the reporting week has changed to bullish. The beginning of the new week also remains with the buyers, so in the new COT report we can see an even greater increase in purchase contracts among professional traders.

The overall fundamental background for the pair remains neutral, given news of an economic nature only. However, market participants are now very worried about the future of the US economy, which is on the verge of a new trade war with China, which will have a negative impact on it, and the whole country is covered by rallies, protests and outright riots that do not allow us to expect economic recovery in the near future. But they allow us to expect the second wave of the epidemic of the coronavirus. Doctors warned before the riots and rebellions that Donald Trump prematurely weakened the quarantine and a new outbreak could happen in the country. Now the likelihood of a new outbreak has increased many times over. No macroeconomic statistics were published yesterday, but today there are several reports that deserve attention. Firstly, it is data on unemployment and on the number of applications for unemployment benefits in Germany for May and June. These reports will make it possible to conclude whether the worst is left behind. It is expected that the unemployment rate will rise to 6.2%, which is not so much, and the number of new unemployed will be 200,000. Secondly, the unemployment rate will also be released in the European Union, which threatens to jump to 8.2% in April. Thirdly, the ADP report on the level of employment in the private sector for May will become known (forecast -9 million workers). Fifth, business activity indices for Markit and ISM services in the United States will be published. We believe that absolutely all of these reports will have practically no effect on the course of trading. Just because traders are absolutely ready for the numbers that appear in the forecasts.

Based on the foregoing, we have two trading ideas for June 3:

1) It is possible for quotes to grow further with the goals of resistance levels for the 4-hour chart of 1.1205 and 1.1312. However, the bulls simply need to stay within the rising channel for this. Stop Loss levels can be placed below the channel and gradually transferred to the top. Potential Take Profit in this case will be from 30 to 130 points.

2) The second option - bearish - involves consolidating the EUR/USD pair under the upward channel, which will allow sellers to join the game and start trading lower with targets at 1.1074 (Kijun-sen) - 1.0990 (upward trend ) - 1,0931 (support level). Overcoming each of the barriers will keep sales open. Potential Take Profit range from 50 to 200 points.

The material has been provided by InstaForex Company - www.instaforex.com