GBP/USD 1H

The pound/dollar, as well as the euro/dollar, continues a rather sluggish decline inside the downward channel and has almost reached the upward trend line, which can gain serious support for trading on the rise. Therefore, formally, an upward trend is still in place in the medium term. However, we still believe that the pound has already exceeded the plan in the past few weeks. Given the scale of the problems that the British economy has faced in recent years, not even months, the national currency simply cannot show anything but a fall in the long run. Thus, we expect the upward trend line to be overcome, which will allow the bears to increase their pressure on the British pound and continue to sell it up to $1.23 (the goal for the near future). At the same time, if it is not possible to overcome the trend line, we expect to consolidate above the downward channel and resume the upward trend.

GBP/USD 15M

Both linear regression channels are directed downward on the 15-minute timeframe, so the pair shows their readiness for a moderate downward movement.

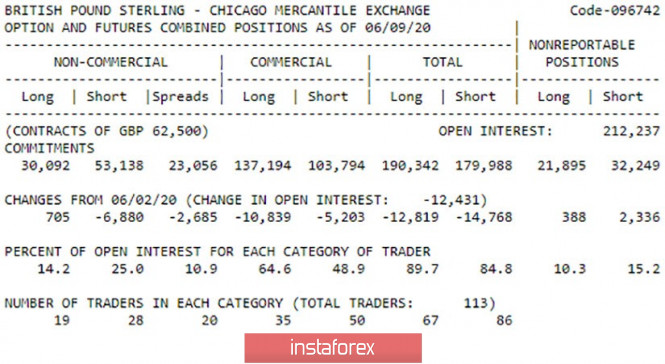

COT Report

The latest COT report for the British pound, published on Friday, showed a strong drop in the number of open purchase contracts among professional traders. Their number decreased by almost 7,000, but there were only 705 new open buy-positions. Thus, traders didn't buy the pound sterling very much, and nevertheless, the British currency rose in price in the reporting week. If you look at the behavior of all categories of large traders, then they closed both purchase contracts and sale contracts. A total of 25,000 contracts were closed. Thus, in general, the pound was not in demand, but at the same time it was growing against the dollar. The pair is falling more instead of growing this week, but now it's very difficult to talk about the behavior of large traders.

The fundamental background for the GBP/USD pair remains unchanged. There are no fundamentally new statements or news on the main topic for the pound sterling - Brexit. A few days ago, a wave of unfounded optimism swept the markets, which quickly vanished as soon as everyone realized that London and Brussels were not even close to concluding an agreement. Today, the Bank of England will sum up the results of the next meeting. According to experts, the British regulator will expand the quantitative easing program by 100 billion pounds. This news is unlikely to stir the markets, since all the central banks of the major economies of the world and the governments of these countries are now doing the same thing - allocating money to support the population and business. However, traders will expect information from the final communique or BoE Chairman Andrew Bailey regarding the key rate. Recently, representatives of the BoE have somehow often talked about negative rates and the possibility of their application, so it is possible that soon we will see a decrease. By and large, we expected a new rate cut back in February-March, when the coronavirus problem was not as acute as it is now. The UK economy continued to contract and experience serious problems because of Brexit, the uncertainty of future Britain-EU relations. But investors and businesses do not like uncertainty. We wrote repeatedly over recent years that a large company decided to leave Britain and move its offices or production outside the country. Thus, even without a crisis, the BoE could and should have resorted to a new easing of monetary policy. And now, from our point of view, there are practically no other options. Therefore, it may not be in June, but at one of the following meetings, the regulator may resort to new dovish measures.

There are two main scenarios as of June 18:

1) The initiative for the pound/dollar pair is still in the hands of buyers, since the upward trend line is still relevant. Therefore, formally, it is now relevant for long positions with targets at resistance levels of 1.2740 and 1.2946. However, we consider it inappropriate to consider purchases before you consolidate the price above the downward channel and Senkou Span B and Kijun-sen lines. Potential Take Profit in this case is from 100 to 320 points.

2) At the moment, sellers have fulfilled correctional goals and will seek to overcome the trend line in order to form a new downward trend. In this case, it is recommended to resume trading on the downside with the target support levels of 1.2401 and 1.2268. Take Profit will be from 90 to 220 points.

The material has been provided by InstaForex Company - www.instaforex.com