Incredibly technical and beautiful, the dollar won back exactly half of its losses in the first two days of the week. And all this happened ami a completely empty macroeconomic calendar. So investors prepared for today's American statistics. There will be no other today.

So, at first glance, the main event of the day is the publication of final data on US GDP for the first quarter. Moreover, the final assessment should be slightly worse than the preliminary one. If the last preliminary estimate showed a decline of 4.8%, then today's data should show a decline of 5.0%. So it is likely that the dollar will begin to lose its position literally before the publication of these data. Like it or not, but we are talking about a much more impressive decline than anticipated. However, the decline in US GDP is already taken into account by the market, so the scale of the dollar's fall will not be significant. It will only be a minor adjustment. But other macroeconomic data that is published today will subsequently lead to a resumption of the strengthening of the dollar, as they are purely positive. Especially if you look at orders for durable goods, which can grow as much as 8.5%. And such growth indicates a recovery in consumer demand, which will affect industry. In addition, a further gradual reduction in the number of applications for unemployment benefits is expected. In particular, the number of initial applications should decrease from 1,508,000 to 1,380,000. The number of repeated applications may decrease from 20,544,00 to 20,100,000. So for the most part, macroeconomic statistics will be more positive.

GDP growth rate (United States):

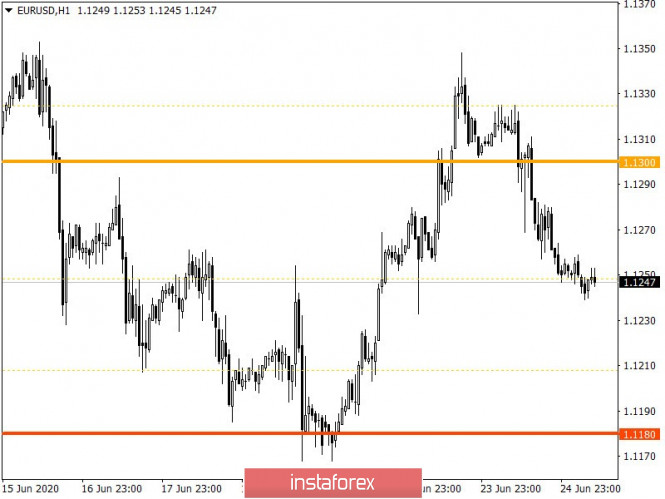

From the point of view of technical analysis, we see the price reversal relative to the correction course, where the quote managed to return to the area of 1.1250, and this is more than half the output. Regarding the development of quotes, the recovery process is already being discussed here as the second week, which carries with it not just a return of the price to the range of 1.1180, but to the region of April of the current year.

In terms of volatility, there are high indicators of daily dynamics on a stable basis here, which indicates the prevailing speculative interest.

Considering the trading chart with respect to the daily period, one can see that the area of interaction of the trading forces of 1.1440/1.1500 is the main point of resistance from which the recovery process originated.

We can assume a temporary price fluctuation within the range of 1.1240/1.1260, where prior to the publication of data on the United States, a local pullback to the direction of the 1.1275 value is not ruled out. The main prospect is still the downward development, where in case the price is consolidated lower than 1.1230, a sequential course will open for us in the direction of 1,1200-1,1180.

Specifying all of the above into trading signals:

- We consider the buy positions higher than 1.1260, with the prospect of a move to 1.1275.

- We consider selling positions as a recovery process lower than 1.1230, with the prospect of a move to 1.1200-1.1180.

From the point of view of a comprehensive indicator analysis, we see that the performance of technical instruments relative to hour and day periods signal a sale due to the recovery process.