OPEC + countries have reached an agreement on the extension of restrictions on the reduction of oil production, a decline of 9.7 million barrels per day will last until the end of July, which is more than the originally planned reduction of 7.7 million. The Monitoring Committee will meet every month until December, besides, OPEC + will oblige countries that have not fully fulfilled the terms of the April agreement to fully fulfill their obligations by September.

The day after the meeting, Saudi Aramco sharply increased selling prices, the monthly growth was the highest over the past 20 years. As a result, the oil price also sharply increased. On Monday morning, Brent futures for August execution exceeded $ 43 per barrel, reaching a three-month high. Thus, one gets the impression that the official end of the "coronavirus recession" has been launched and now only growth is waiting for the global economy.

This conclusion is being pushed by the latest CFTC report. The long position in yen declined by 272 million, the long gold position also declined, which, together with the incredible growth of the US labor market, should indicate a steady resumption of economic activity.

EUR/USD

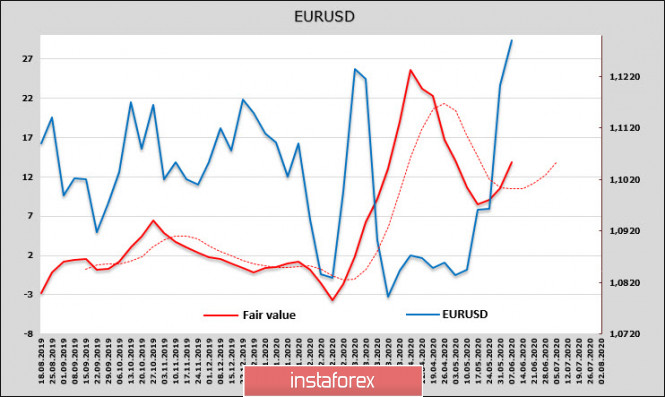

The euro lost some ground by Friday's close, but this was not due to the weakness of the euro, but to the reaction of the markets to the unexpectedly strong US employment report. At the same time, the reaction was short and unclear, as the ECB's support for the European currency was stronger than market expectations.

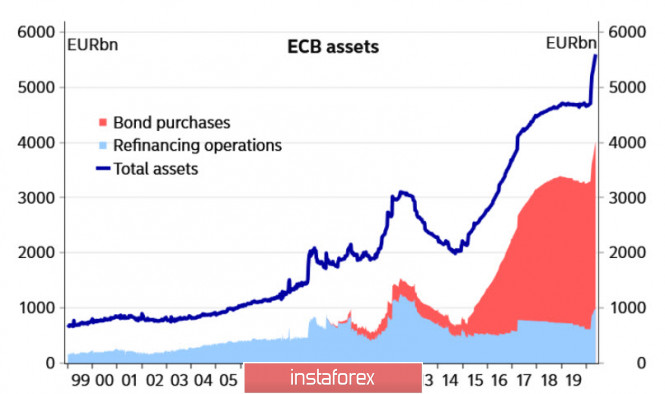

At Thursday's meeting, the ECB increased its asset repurchase program by 600 billion. euros, which was higher than the projected 500 billion. The PEPP program is extended until at least June 2021, and the main payments with an upcoming maturity from PEPP will be reinvested at least until the end of 2022. .

However, most experts agree that the ECB, after a short break, will announce further measures to expand the repurchase program. The reason for such confidence lies directly in the ECB forecast. According to which the recovery of GDP, even under an optimistic scenario, will catch up with the trend calculated in March for at least 3 years, and inflation will return to the levels of the beginning of the year only by the end of 2021. The ECB's balance sheet resumes rapid growth.

Markets liked the ECB's decision - European stock indexes added an average of about 7% over 2 days.

The currency exchange traders, as follows from the CFTC report, remain optimistic about the euro. The net long position increased by more than $ 1 billion for the reporting week, and although the estimated level is behind the spot, the direction of the euro to the upside in the long run is certain.

It can be noted that with the euro's rapid decline in March, the estimated fair price remained at levels higher than at the end of 2019, that is, from the point of view of the long-term goals of the major players, the euro was supposed to resume growth in 2020. The Corona-crisis slowed down this process, but did not reverse it, and the continuation of the growth of the euro is the most likely scenario in the long run. From the point of view of technical analysis, EUR/USD is ready to break through the resistance level of 1.1494, you can buy at the breakdown of 1.1383. On the other hand, a short-term correction to the support of 1.1210/20 is slightly unlikely. In the second case, you need to wait for the formation of the local bottom and signs of continued growth.

GBP/USD

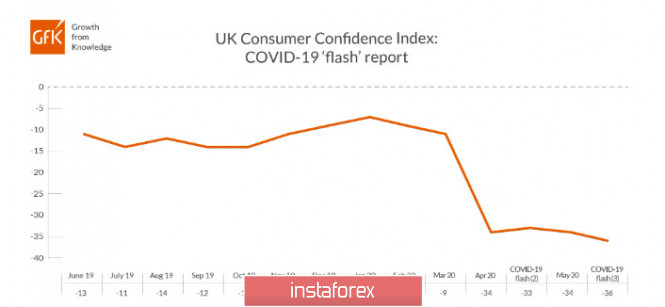

The GfK Consumer Confidence Index continues its downward trend, declining to -36p in May, which is only 3 points higher than the historical record in 2008. The consumers remain negative about the state of their finances and the broader economic picture for the coming year.

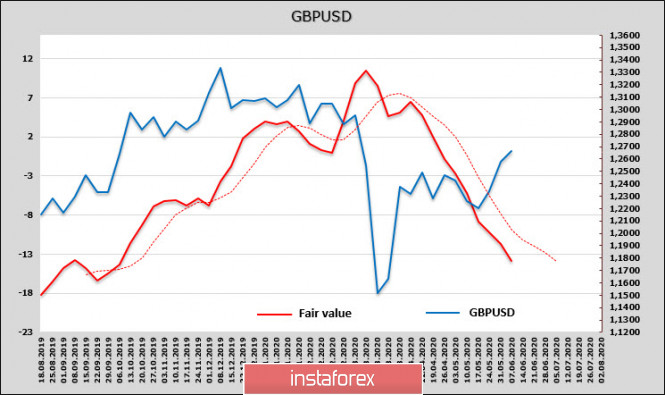

As for the CFTC report, the pound looks like a clear outsider against most G10 currencies, especially when compared with the euro. After a short stabilization period, the net short position increased by $ 1.112 billion, which is a very strong drop, indicating that investors expect the pound to weaken. The estimated price is confidently directed downwards.

Everything indicates that it is necessary to look for a sale opportunity. A short-term impulse may end in the zone 1.2760/80, or extend to the trend line 1.2830/40, after which the pound will turn downwards.

The material has been provided by InstaForex Company - www.instaforex.com