The week ended with the flag of worsening tensions on the Korean Peninsula, an outbreak of coronavirus infection in Beijing, and the non-decreasing COVID-19 pandemic in America.

Tensions have clearly increased in the markets due to geopolitical tensions between North Korean and South Korea, which again demonstrated to investors the fragility of the peace established in this region. In addition, fears in the world are caused by the not decreasing coronavirus pandemic infection in the States amid social protests and political confrontation between D. Trump and his opponents from the Democratic Party. And the news of the outbreak of COVID-19 in the Chinese capital reminded of the WHO's promised likelihood of a second wave of pandemics closer to autumn.

All this fully reflected on the demand for risky assets in the financial markets. Stock markets in the wake of the uncertainty of what the global economy expects, nervously jump up and down in the near future. Demand for defensive assets rose again during the week.

The US dollar ended the week in different directions. Despite its weakness due to the large-scale stimulus measures that have revived its function as a funding currency, it has not only managed to maintain its previous positions, but also to grow against all currencies except the Japanese and Swiss, which are in demand during periods of instability and increased financial risks.

Despite the fact that the dollar potentially remains an extremely weak currency due to its wide supply in the financial system and the revived function of the funding currency, it is likely that it will retain its previously won positions in the currency market this week, unless, of course, some important and really strong positive news, for example, about the beginning of the recession of the pandemic in America or the news about a really real test of a new anti coronavirus vaccine.

Generally, evaluating the likely development of events, we believe that the mood of the market can radically improve only after the first reporting data on the economies of countries important to the world for the second quarter of this year have been received. The absence of worse news from the battle front against COVID-19 and more encouraging quarterly reporting may serve as a basis for renewed demand for risky assets and a weakening dollar, yen and franc.

Forecast of the day:

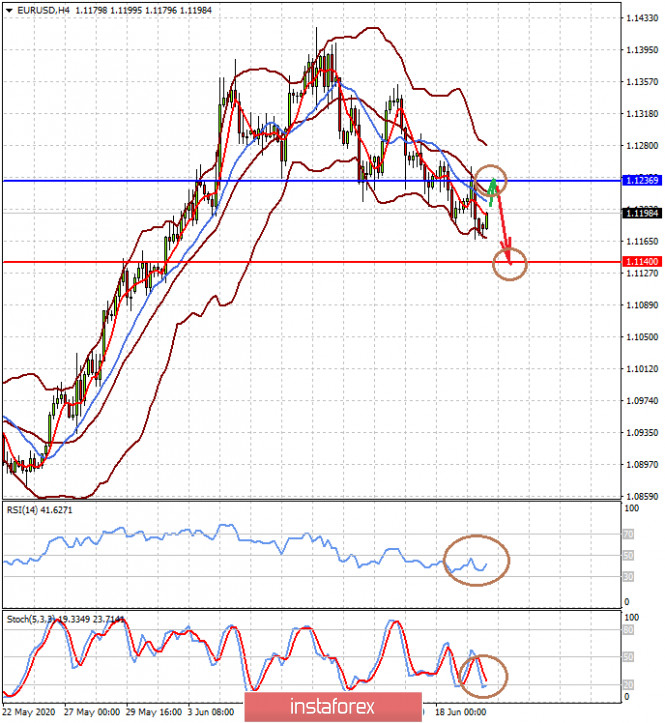

The EUR/USD pair remains in a short-term downward trend amid weak demand from investors for risky assets. The pair is likely to rise to 1.1235 before rushing to the level of 1.1140 again.

The AUD/USD pair is consolidating in the range 0.6800-0.6955. Amid the recovery of the Chinese stock market and the positive dynamics of futures for US stock indices, the pair has every chance to grow to the level of 0.6955.