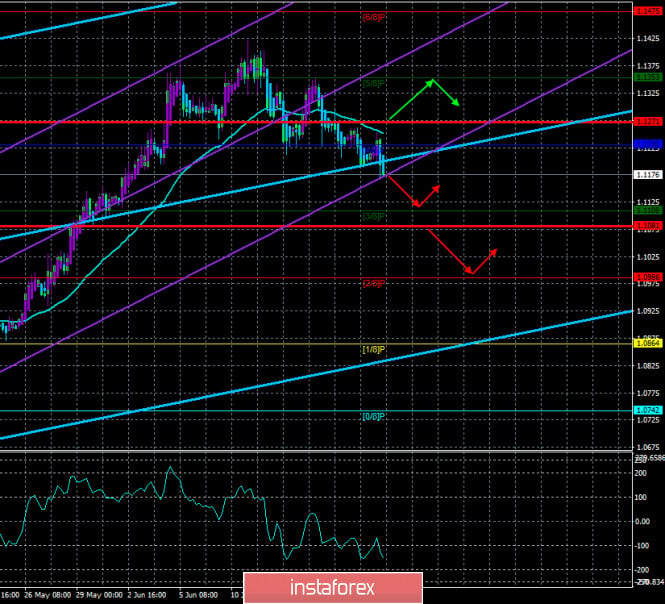

4-hour timeframe

Technical details:

Higher linear regression channel: direction - upward.

Lower linear regression channel: direction - upward.

Moving average (20; smoothed) - down.

CCI: -154.1407

The downward movement continued for the euro/dollar pair over the past week. Thus, the trend at the moment is already downward and there are no prerequisites for its change to an upward one. We still believe that the euro currency has completely exhausted its growth potential soon, although many factors can hypothetically allow the euro to rush up again. The fact is that now the markets have calmed down after the March and April panic, however, the general situation in the world and separately in the US and the European Union does not allow traders to trade in the usual way. First, the whole world is simply in crisis right now. And when there is a crisis in the yard, there is no question of any measured trade. Many major market players are trying to hedge their risks against possible future shocks, many market participants are trying to think far ahead because now the whole world knows how dangerous the "coronavirus" is and what consequences it can have for the economy. Thus, traders simply cannot trade following macroeconomic statistics, as was previously the case. And the statistics themselves are now a failure in the European Union, in the UK, and the US. What should traders do if on Monday there is a failed package of statistics in the US, and on Tuesday there is an equally failed package in the EU? On each news package, sell off the currency in the issuing country of which the next collapse of macroeconomic indicators? Even now, when the outright decline in indicators seems to have been suspended, there is no talk of any stabilization or recovery. "Coronavirus" has not yet been defeated. It continues to spread rapidly in many countries around the world. Even in countries that seem to have successfully managed the epidemic, no one is immune from new waves. Thus, the general situation in the world simply does not allow you to trade calmly now. Second, many traders previously paid increased attention to the key rates and monetary policies of the countries whose currencies they traded. And the advantage was clear for the United States. A relatively high bid, relatively "hawkish" policy. However, now all the central banks of the world have lowered their rates almost to zero (and some even lower), so there is no advantage for the United States and the US dollar. Moreover, it is not clear what the real consequences of the "coronavirus crisis" will be for the European Union, for America and other countries. It is unclear how many more waves of the epidemic will be when a cure is found, when mass production of this medicine begins. In general, now there are a huge number of questions that no one can answer. As Jerome Powell correctly said, the economic recovery will depend directly on the results of the fight against COVID-2019. Third, the European Union and the United States now have a huge number of so-called internal problems, which are still unknown how governments will cope. In the European Union, the biggest headache now is the 750 billion euro recovery fund, which is being considered by the 27 member countries of the alliance. Although everything will depend on the "greedy four" - Denmark, the Netherlands, Sweden, and Austria. Recall that these countries are opposed to providing grants to all the most affected countries from the "coronavirus crisis". In the United States, a political crisis is thundering, and more and more ordinary Americans, politicians, party members, and just high-ranking officials are speaking out against Donald Trump. Trump himself continues to accuse everyone in a row of what, in theory, he should be responsible for. And all these six months before the presidential election. Moreover, we should not forget that the conflict between China and America has not gone away. The "cold war" still looms on the horizon, however, it is unclear who will continue it if Trump is not re-elected? Have you noticed how recently the American President stopped commenting on the "coronavirus", stopped blaming China for the spread of the epidemic, and no one has seen evidence of China's guilt? Well, in addition to the figure of Donald Trump, there is also an economic crisis in the United States and the epidemic itself, which was not localized. Add to this the large-scale rallies and protests that have been going on for three weeks, caused by the racist scandal, and we get a very interesting picture, which is also unclear how it will affect the American economy and the US dollar in the future.

As a result of all the above, we continue to recommend that traders pay increased attention to technical factors that at this time best reflect what is happening in the market and forecast. However, we cannot completely ignore the macroeconomic statistics, so we will consider the most important and significant reports of the next week. On Monday, as is often the case, no important statistics will be published in either the US or the EU. There will only be a speech by ECB Vice-President Luis de Guindos, who from time to time makes really interesting statements. On Tuesday, business activity indices in the services, manufacturing and composite sectors in Germany, France, and the European Union will be released. All indices are expected to continue growing in June, however, they will all remain below the key level of 50.0, below which the industry itself is considered to be shrinking. Therefore, whatever the real values of business activity, we can only note a slowdown in the decline and not a recovery. No more news is planned for this week in the European Union. Thus, given the weak significance of the above reports (they are also just preliminary values), it is unlikely that market participants will pay any attention to them.

As a result, the whole week for the European currency promises to be quite boring. The next round of talks on the recovery fund will not take place until next month, and there are no other hot topics in the EU right now. Accordingly, traders will again closely monitor information from overseas, most of which, although it is insanely interesting and important, still does not affect the market "right here and now".

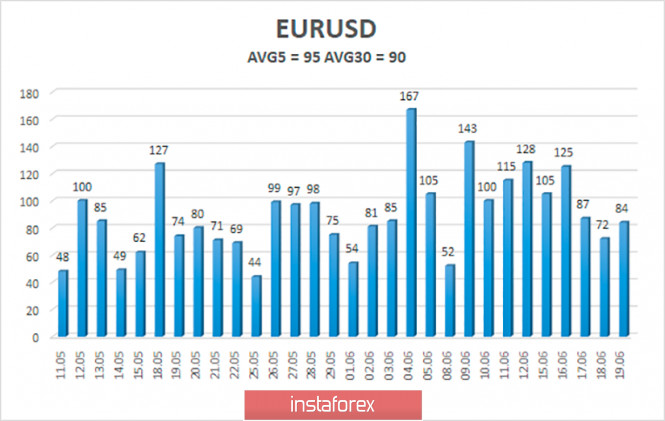

The average volatility of the euro/dollar currency pair as of June 22 is 95 points. Thus, the value of the indicator is still characterized as "high", but in general, volatility is decreasing. We expect the pair to move between the levels of 1.1081 and 1.1271 today. A reversal of the Heiken Ashi indicator upwards will signal a new round of upward correction.

Nearest support levels:

S1 – 1.1108

S2 – 1.0986

S3 – 1.0864

Nearest resistance levels:

R1 – 1.1230

R2 – 1.1353

R3 – 1.1475

Trading recommendations:

The EUR/USD pair continues its downward movement. Thus, at this time, sell orders with the goals of 1.1108 and 1.1081 remain relevant until the Heiken Ashi indicator turns up, which will indicate a correction. It is recommended to return to buying the pair not before fixing the price above the moving average with the first goals of 1.1353 and 1.1475.

The material has been provided by InstaForex Company - www.instaforex.com