4-hour timeframe

Technical details:

Higher linear regression channel: direction - upward.

Lower linear regression channel: direction - upward.

Moving average (20; smoothed) - upward.

CCI: 81.6754

The EUR/USD currency pair starts on June 8 with a downward correction, which still started on the last trading day of the past week. We talked about the correction all last week, so it is very good that at least on Friday, traders decided to fix part of the profit on long positions. Now the main question is whether traders are going to resume buying the euro currency in the new week. As we have already seen in the "weekend" articles, there are no particularly good fundamental reasons for this. However, there were no good fundamental reasons for such strong growth in the euro. Thus, everything will depend, as always, on the mood of market participants, and technical analysis is designed to visualize it. Therefore, as long as the price is located above the moving average line, there are high chances of resuming the upward trend.

Meanwhile, protests and rallies in the US continue. On Saturday, June 6, major anti-racism rallies were held in Washington, as well as in some other major US cities. Again, there were pogroms. However, this time such inappropriate behavior was really an isolated case. Most of the meetings were held without any excesses. However, the police still had to block the approaches to the White House. Despite the fact that Saturday's rallies were the largest in all 12 days of protests, US President Donald Trump said that "the crowd was small, much smaller than expected". The US leader also thanked the National Guard, Secret Services, and police for "excellent work".

At the same time, Joseph Biden became the official presidential candidate of the Democratic Party, having secured the support of all the votes of the same party. "Together, we can win the battle for the soul of our nation," Biden wrote on Twitter. Recall that Biden was previously a Vice President in the administration of Barack Obama, and this is his third attempt to become President of the country.

Meanwhile, in the United States, of course, Donald Trump's party members have found something else to blame for China. According to Republican Senator Rick Scott, China is trying to "sabotage or slow down" the development of a vaccine against "coronavirus" in the United States. The Senator also said that he had proof of his words, but when asked what they were, he said that he could not discuss such topics. Thus, we continue to review the hit parade of unsubstantiated statements and accusations of American politicians against Beijing. Recall that earlier, Mike Pompeo and Donald Trump said that they have irrefutable evidence of China's guilt in the spread of the COVID-2019 virus, which they promised to present "a little later". "A little later" has long passed, and no one has seen the evidence. Now Senator Rick Scott claims that China is sabotaging the development of the vaccine. Also unsubstantiated. We are not saying that China is not doing anything like this, and is not to blame for anything, but without evidence, there is no faith in the words of Republican politicians. The Senator also said that if China creates a cure for the virus, they will not share it with the rest of the world. According to Scott, China "wants to dominate the rest of the world". "We have to make this vaccine. Unfortunately, we have evidence that Communist China is trying to sabotage or slow down its development in the West," the Senator said.

Well, US Secretary of State Mike Pompeo said this weekend that China's actions in Hong Kong are comparable to those of Nazi Germany during World War II. On the anniversary of the landing of American troops in Normandy (June 6, 1944), Pompeo said that Beijing's desire to establish total control over Hong Kong "is comparable to the actions of Nazi Germany". The Secretary of State echoes Rick Scott and says that China aims to "become the greatest country in the world". Pompeo also said that by seeking to establish control over Hong Kong, China is violating agreements with the UK, which is similar to Germany's actions against the rest of Europe.

At the same time, it is reported that the Chinese government is considering possible sanctions by Washington against China and Hong Kong. It is reported that if China is ready to cope with "normal" sanctions, then the possible disconnection of the Middle Kingdom from the SWIFT international payment system is very much a concern for the rulers. However, it is obvious that this is an extreme measure that Washington will not go to without unnecessary need. The fact is that disconnecting China from SWIFT promises huge losses to the United States themselves. As we said earlier, the world's two largest economies are so strongly linked to each other that in any case they have leverage over each other, and in any case, they will both suffer losses if the conflict escalates. Thus, most likely, if the United States resort to imposing sanctions, it will be more "calm measures", which Donald Trump has already mentioned more than once.

On the first trading day of the new week, only one report on industrial production in Germany is planned. The report is interesting but secondary. It is expected that by the end of April this indicator will decrease by 16.2-16.8% in monthly terms. However, traders do not have to expect anything else, and in the European Union and the United States, there will probably be no fewer volumes of industrial production falling. Although, for example, in the United States on Friday it became known that the official unemployment rate in April not only did not increase but also decreased. How this can be, if the country at this time was raging with the full force of the epidemic and the quarantine was in effect, is unclear. There may be a mistake or deliberate misrepresentation in order to create the appearance of an improvement in the situation in America because regular weekly reports on applications for unemployment benefits say exactly the opposite. Thus, on Monday, June 8, we expect that the euro/dollar pair will continue to adjust to the moving average. And already around the moving average, the future fate of the European currency will be decided, at least for this week. Of course, the markets will keep in mind the upcoming Fed meeting, which may make adjustments to the plans of market participants.

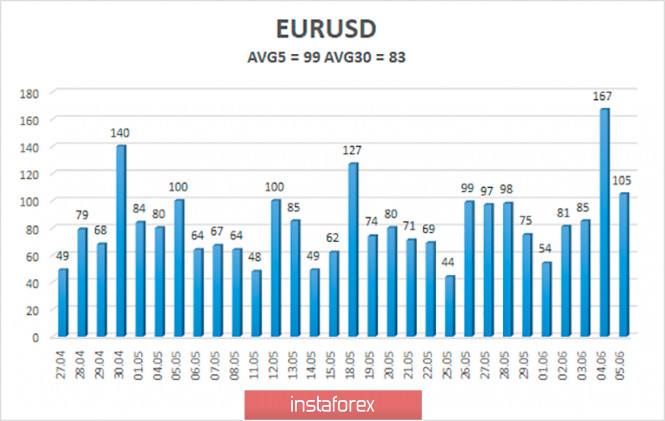

The average volatility of the euro/dollar currency pair as of June 8 is 99 points. Thus, the indicator value is already characterized as "high", thanks to the last two trading days. We expect the pair to move today between the levels of 1.1192 and 1.1390. The reversal of the Heiken Ashi indicator upwards may signal about a possible completion of a downward correction.

Nearest support levels:

S1 – 1.1230

S2 – 1.1108

S3 – 1.0986

Nearest resistance levels:

R1 – 1.1353

R2 – 1.1475

R3 – 1.1597

Trading recommendations:

The EUR/USD pair started to adjust. Thus, after overcoming the psychological level of 1.1000, buy orders remain relevant, at this time with the goals of 1.1353 and 1.1390, but now it is recommended to open them after the current correction is completed. It is recommended to return to selling the pair not before the price is re-anchored below the moving average line with the first goal of 1.1108.

The material has been provided by InstaForex Company - www.instaforex.com