Hello, dear colleagues!

Yesterday's publication of Nonfarm Payrolls and unemployment data showed that the US labor market is recovering at a faster pace than economists had expected.

In June, unemployment in the United States fell to the level of 11.1%, although forecasts were reduced to 12.4%. And if memory serves, this trend has been observed for the third month in a row. That is, the actual value of the unemployment rate is lower than the forecast values for the third time in a row. Is this not an indicator of the recovery of the US labor market?

Nonfarm Payroll reports are another important factor for the US labor market. The creation of new jobs in the non-agricultural sectors of the American economy in June grew much stronger than forecasts, which were reduced to the appearance of three million new vacancies, but the number of employed increased by 4.8 million. This is a record since statistics were started in 1939! And if you look at these statistics, but only for the last three months, you can find that the actual figures for non-farms exceed the forecasts, and quite significantly. This is another good reason to believe that the labor market in the United States is actively recovering, which, unfortunately, can not be said about the situation with the spread of COVID-19.

The United States still holds a sad lead in the daily number of people infected with the coronavirus. According to the latest data, the daily increase in infected COVID-19 was 52,000 people in the United States. A surge in the pandemic could undo the economic recovery that has begun in the United States.

In addition to good data on the US labor market, the dollar was in demand as a safe asset in connection with the COVID-19 outbreak and showed growth in yesterday's trading across a wide range of the market. However, this growth was very small. Here it is appropriate to say that the US currency has stopped its fall, which was observed before.

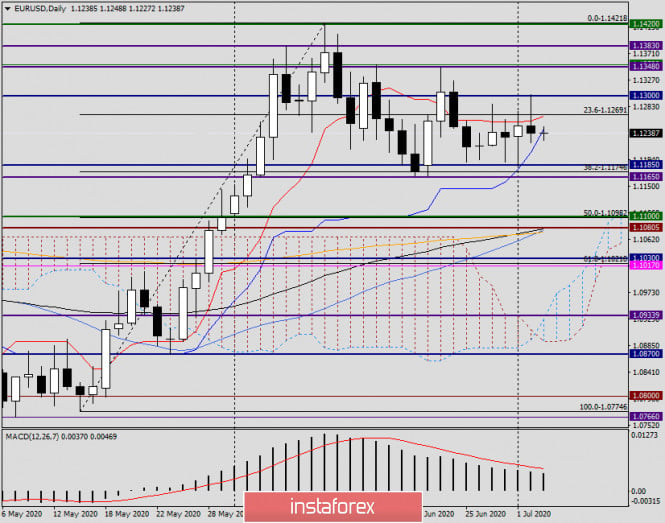

Daily

The Tenkan line of the Ichimoku indicator and the mark of 1.1300 has become a real Achilles' heel for euro bulls. Even after the release of very positive labor reports from the US, the players on the increase did not stop trying to continue the rise of the rate. The pair hovered around 1.1287 for a long time, and the market's desire to move up was evident, but strong statistics from the US, as well as the demand for the USD as a safe-haven currency, played a dominant role. As a result, the pair still turned down and ended Thursday's trading at 1.1239. At the same time, yesterday's daily candle may well be perceived by market participants as a reversal model of the "shooting star" candle analysis.

However, in the absence of American players, the market today will be thin, and therefore any possible scenarios are possible.

The bullish mood will return only if Tenkan (1.1266) breaks, and then the mark of 1.1300. That is, players need to rewrite or update yesterday's highs, which are at the level of 1.1302, and end the trading session above this mark. But is such a mission possible today?

Bears on EUR/USD have an equally difficult task. They need to lower the exchange rate to a strong support zone of 1.1185-1.1165, the breakdown of the level of 1.1165, in my opinion, will finally indicate the superiority of sellers of the single European currency.

Turning to trading recommendations, I would like to draw your attention to the fact that today is not the best day to open new positions. First of all, this is the last trading day of the week and the weekend is ahead. Secondly, on the occasion of the US Independence Day, American trading platforms will be closed, which means a thin market.

For those who still decide to trade today, I recommend considering both scenarios. In my personal opinion, sales will become relevant after the corresponding candle signals appear on H4 and (or) H1, in the price zone of 1.1280-1.1300. It is riskier to sell the pair near 1.1250. At the same time, I do not recommend setting large goals, 20-35 points for such a day is quite sufficient and reasonable profit.

Purchases should be considered after the appearance of bullish models of Japanese candlesticks in the price zones of 1.1210-1.1190 and 1.1185-1.1165. The goals are the same as when opening short positions. I assume that the main struggle of the warring parties today will unfold around the level of 1.1200 and the final closing price of the day and week relative to this mark. However, this is just an assumption. We will talk about how events will develop and how the weekly trading will end on Monday.

Good luck!

The material has been provided by InstaForex Company - www.instaforex.com