The EUR/USD currency pair managed to show high activity during the past day, which was caused by the publication of data on applications for unemployment benefits in the United States, which caused both joy and fear among traders.

So the number of repeated applications for benefits declined from 17,304,000 to 16,197,000, which led to the local growth of the US dollar at the time of publication of the data. In turn, the number of initial applications for unemployment benefits reflected an increase from 1,307,000 to 1,416,000 for the first time since March, with a forecast decline to 1,300,000, which shocked investors, worsening the situation in the US labor market. The growth of primary orders led to a sharp weakening of the US dollar from 13:00 [UTC+00 time on the trading terminal].

Today, in terms of the economic calendar, there are preliminary data on the index of business activity in the manufacturing sector and in the service sector for July for Europe and the United States, where the index is expected to grow everywhere, which may eventually lead to sideways movement in the market.

Regarding the technical picture, there is a sideways fluctuation, after a jump in the activity of the previous day at 1.1588/1.1625, where if the price consolidates below the level of 1.1585, the lower border can be extended to 1.1565. At the same time, the expansion of the upper border can be 1.1650.

The GBP/USD currency pair found a resistance point at the level of 1.2770 once again, where the quote immediately stopped and entered the pullback phase. Since the beginning of the trading week, this is the third touchdown of the level of 1.2770, which indicates that the upward interest remains, but the volume of buyers is not enough, which leads to a natural rebound in the price.

Considering the available analysis, it is worth continuing to work on two trading tactics, a rebound from the resistance area and work on its breakdown.

It is recommended to buy a pair if the price consolidates above the level of 1.2770 with the prospect of a move to 1.2810-1.2885

It is recommended to sell the pair using the method of rebounding from the resistance area, where in this case, the entry into the position can be made lower than 1.2720, in the direction of the values 1.2700-1.2685.

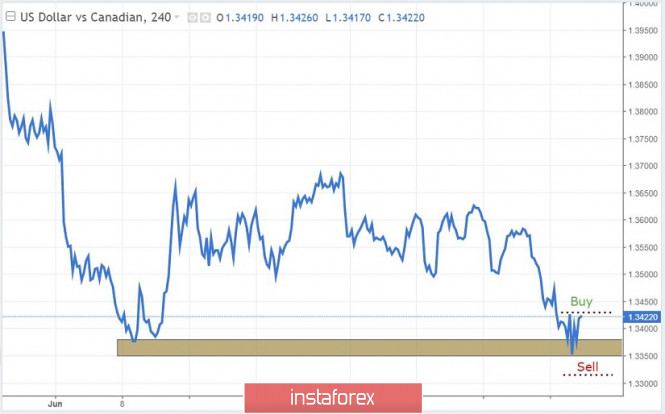

For the USD/CAD currency pair, there is a strong downward movement during which the quote managed to decline to the area of 1.3350/1.3380, which has repeatedly played the role of support in the market in history. A consistent rebound of the price from the same coordinates forms a natural basis in the market, which is used by traders.

Based on the analysis of the price area 1.3350/1.3380, it can be assumed that if the rebound pattern repeats, the price may reverse in the direction of the values 1.3465-1.3490. To minimize risks, it is advised to enter the market already at the moment of price movement, that is, above the level of 1.3430.

An alternative scenario, which every trader should have, considers a breakdown of the area of 1.3350/1.3380 in a downward direction. The signal for this step will be the price consolidation below 1.3315, which will indicate a breakdown of the support area and increase the chances of further decline in the direction of 1.3250-1.3200.