GBP/USD 1H

The GBP/USD currency pair, in contrast to EUR/USD, was trading very reluctantly and frankly sluggish on Monday. After the pair left the downward channel and overcame the resistance area of 1.2404–1.2424, buyers got a certain carte blanche, but they can't take full advantage of it yet. Thus, in the current conditions, the upward trend continues as long as the pair's quotes continue to remain above the area of 1.2404–1.2424 and the Senkou span B and Kijun-sen lines. Bears will only be able to return to the market below these three supports. There is also a fairly strong resistance line around the 1.2530 level, from which the quotes have rebounded several times.

GBP/USD 15M

Both linear regression channels continue to be directed upwards on a 15-minute timeframe, so the overall trend remains upward in the short term. However, the lack of overcoming the 1.2530 level can push the pair down by 250 points.

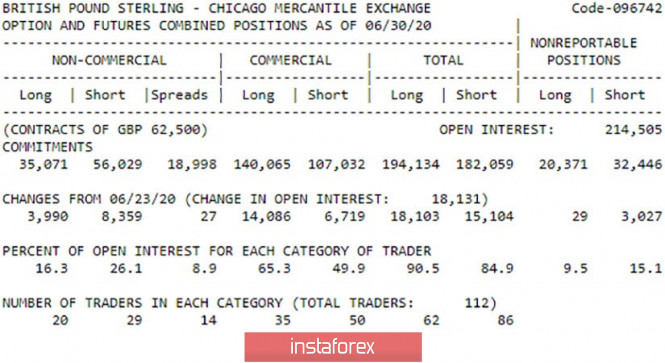

The COT report

The latest COT report, which covers the dates of June 24-30, shows that the pound was traded by large traders very actively at this time. Major market participants basically reduced contracts in the euro currency, but then they increased it in the pound. Professional market participants increased the number of contracts for the purchase by 4,000 and by 8,400 for sale. Thus, the net position decreased by 4,400 contracts only in the non-commercial category. It is logical that the pound has become cheaper during this period. The Commercial group, which does not set itself the goal of making a profit from foreign exchange transactions, naturally bought the pound more. If someone sells the currency, then who buys it. In total, the total net position for the pound even increased during the reporting week (18,000-15,000 = +3,000). The pound only grew after the report expired, thus, it can be assumed that professional market participants are already looking in the direction of purchases of the British currency.

The fundamental background for the GBP/USD pair on Monday did not change much compared to the previous week. The next stage of negotiations on the terms of the Brexit agreement has failed, so the UK does not have good news for the pound. The British pound continues to rely on negative news from overseas, which helps this currency grow from time to time. As for the UK itself, Great Britain's economy in 2020 will continue to sink in any case. Yes, there will be a recovery by the end of the year, but it will not be as rapid as, for example, in the EU. In 2021, new shocks are also possible for the British economy, since this year the country can start trading with the European Union under the rules of the World Trade Organization, that is, with quotas, duties and other charms of non-EU membership. From our point of view, British Prime Minister Boris Johnson has not achieved anything positive for his country in almost a year of his rule. The only thing that can be credited to him is the completion of Brexit. And even then, not to him, but to the British people, who for the second time expressed their will to leave the EU as soon as possible, when they gave the majority of votes to the Conservatives. Based on this, we believe that the pound can continue to grow, but for this, traders will need to constantly feed on the negative from overseas. In this case, market participants will have reasons to continue to get rid of the dollar. However, new portions of negativity from Britain may return the desire of traders to get rid of the pound.

There are two main scenarios as of July 7:

1) Since the resistance area of 1.2404-1.2424 has been passed, the upward movement has more prospects now . However, at the same time, the pound/dollar pair stopped near the past local high (about 1.2530) and the bulls still can not overcome it. Therefore, we recommend buying the pair after overcoming this level with targets at resistance levels of 1.2589 and 1.2698. Potential Take Profit in this case will be from 40 to 150 points.

2) Sellers are advised to wait until the pair has been pinned below the support area of 1.2404-1.2424, and at the same time the Kijun-sen and Senkou Span B lines. In this case, the downward trend will take place, and the first targets for sell orders will be 1.2311 and the support area of 1.2196-1.2216. Potential Take Profit in this case will be from 70 to 170 points.

The material has been provided by InstaForex Company - www.instaforex.com