4-hour timeframe

Technical details:

Higher linear regression channel: direction - upward.

Lower linear regression channel: direction - upward.

Moving average (20; smoothed) - sideways.

CCI: -1.6055

A new trading week begins for the euro/dollar pair with the same vague movement that has been observed in the last month. On the one hand, the side channel with the borders 1.1200 and 1.1350 is preserved. On the other hand, there is a slight upward bias in the movement of quotes. However, corrections against the main movement are very frequent, and before overcoming the Murray level of "5/8"-1.1353, it makes no sense to talk about a full-fledged upward trend. Thus, in general, the current situation is not the most favorable for trade. Buyers remain uncertain, and sellers do not have enough strength to overcome the moving average line. Most of the macroeconomic reports continue to be ignored by traders, and the general fundamental background allows for various scenarios in the coming week.

Naturally, we will start the review of the most interesting events with the American President, who on Sunday, July 12, for the first time in public during the pandemic, put on a medical mask. Yes, this message can be considered the news of the day, because Trump managed to contradict himself again. Earlier, Trump said that he does not imagine how he will communicate with world leaders while wearing a mask. Yesterday, the US leader said that "wearing a mask is great". "I made the decision to wear a mask because of a visit to the hospital. During this event, I will communicate with many military personnel, people who conduct operations. I think it's a great idea to wear a mask on these occasions. I have never opposed wearing a protective mask. Just everything has its time and place," said Donald Trump.

In addition, the American President commented on the desire of American musician Kanye West to run for President of the United States. However, Trump does not believe that a black musician can compete with him, but said that "West will easily take away some of the votes from Joe Biden, who did nothing good for black people". This is a very interesting statement, especially against the background of the fact that in the course of the racist scandal, it was Trump who was accused of racism, and it was Trump who wanted to disperse the protesters and people with the help of the US national army. After these actions and intentions of Trump, Trump's political ratings again rushed down, and many sociologists said that the majority of the black population of the United States will vote for Biden.

Meanwhile, the Eurogroup meeting was held in the European Union last week, where, however, the issue of creating a recovery fund was not discussed, although traders are waiting for information on this topic. However, on Friday, the head of the European Council, Charles Michel, spoke and shared interesting information with the markets. The head of the European Council said that he updated the proposal to the EU member states on the budget for 2021-2027, as well as on the economic recovery fund. The new proposal is to fix 1.7 trillion euros, as well as an additional 750 billion euros for economic recovery. The balance between loans, subsidies and guarantees will be maintained, "in order to avoid overloading the country's budgets due to too high debt". 70% of the fund can be used in 2021-2022, where and to whom the funds will be sent, the European Commission will determine. 30% can be used in 2023, depending on the macroeconomic indicators. "During the discussions between the governments of the states, it became clear that there are serious objections to the fund. After that, I held a series of bilateral talks with European leaders, following which I will present a revised draft of the multi-year budget plan and the recovery fund," Michel said. "If we still want to see Europe on the map in 10-15 years, we must now do everything to prevent an economic collapse," Michel concluded. On July 17-18, a new EU summit will be held in Brussels, which will focus on the fund for recovery from the pandemic crisis. There are still no agreements between the countries, as Austria, Sweden, Denmark and the Netherlands do not consider it necessary to provide 500 billion euros to the affected countries on free terms.

At the same time, there was quite interesting information that a former virologist of the Institute of Public Health of Hong Kong fled from China to the United States. Li Meng Yan accused the Chinese authorities in an interview with Fox News of deliberately hiding information related to the "coronavirus" epidemic. According to Li Meng Yan, she was one of the first to study the COVID-2019 virus. She is confident that the Chinese government was aware of the true extent of the threat posed by the virus. Li Meng Yan said that the Chinese government knew about the ability of the virus to be transmitted from person to person as early as December 2019, but did not allow foreign scientists, even from Hong Kong, to start studying the virus. At the same time, the virologist notes that "coronavirus" was previously discussed quite freely in scientific circles, but at a certain point all conversations about it stopped. The fleeing virologist also said that "she knows about corruption in the WHO, the Chinese government and the Chinese Communist Party, so she is not at all surprised by what happened". The Chinese Embassy in the United States has already rejected everything that Li Meng Yan said, saying that they do not know such a person, she has never worked in the health sector in Hong Kong, and Beijing responded to the outbreak in a timely and effective manner.

On the first trading day of the new week, no macroeconomic reports or events are planned in the European Union and the United States. Thus, it is unlikely that traders will find grounds on Monday to overcome the important Murray level of "5/8"-1.1353. More or less important news will begin to arrive on Tuesday, when America will release a report on inflation, and the EU – on industrial production. However, traders will closely monitor the topics of "coronavirus" in the US and the EU summit on July 17-18. Of course, we should not forget about the topic of the China-US confrontation, which continues to escalate.

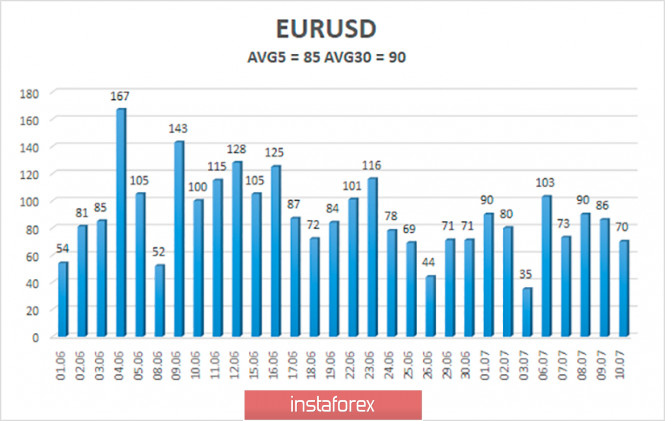

The volatility of the euro/dollar currency pair as of July 13 is 85 points and is characterized as "average". We expect the pair to move between the levels of 1.1214 and 1.1384 today. A new reversal of the Heiken Ashi indicator downwards will signal a new round of downward movement within the side channel.

Nearest support levels:

S1 – 1.1230

S2 – 1.1108

S3 – 1.0986

Nearest resistance levels:

R1 – 1.1353

R2 – 1.1475

R3 – 1.1597

Trading recommendations:

The EUR/USD pair continues to trade near the moving average line, inside a side channel with a slight upward slope. Thus, it is recommended to open long positions if traders manage to overcome the level of 1.1353, which is the approximate upper limit of the channel, with the goal of 1.1475. It is recommended to open sell orders no earlier than the 1.1200 level with the goal of 1.1108.

The material has been provided by InstaForex Company - www.instaforex.com