4-hour timeframe

Technical details:

Higher linear regression channel: direction - upward.

Lower linear regression channel: direction - upward.

Moving average (20; smoothed) - upward.

CCI: 40.9864

Well, here comes the "Hour X" for the Eurozone and the euro currency. Today is July 17, which means that the EU summit will begin today, during which the fate of the economic recovery fund will be decided, which involves the accumulation and further distribution of 750 billion euros to the most affected countries and sectors of the economy. In short, all EU member states support the formation of such a fund, and all agree that the amount should be at least 750 billion and that funds should be raised from foreign markets, which will then be repaid for many years. However, the European Commission proposed to distribute about 500 billion euros in the form of grants, that is, on a free basis, and only 250 - in the form of loans. This proposal is strongly opposed by Austria, Sweden, Denmark, and the Netherlands, which believe that all 750 billion euros should be provided in the form of loans. For this, they were already tacitly given the name "stingy four". However, "buying up" or "not buying up" is the second question. The first question is that these countries have the right to refuse such an offer if they do not want to share several tens of billions of euros with a conditional Italy or Spain. In principle, they can be understood. They have their budget and the more money they spend on aid, the less they will spend on their own needs. Italy, Spain, and other EU countries most affected by the pandemic and crisis are now the first floors of a high-rise building where there was a fire. For the entire house to stand and not collapse, all floors must help the most affected. However, if there is nowhere to go in a high-rise building, then in the case of the EU, some countries may well refuse the offer of the European Commission, may leave the bloc, or try to personally get more acceptable conditions for participation in this program. One way or another, all 27 member countries of the alliance should come to a common opinion. As long as they do not come to him, the financial assistance of the European economy will not be granted. And the problem here is precisely in Italy, Spain, Portugal, and Greece. Recall that Greece received huge help from the EU during the crisis of 2008-2009. Even then, the country declared a technical default. Now a similar fate may befall, for example, Italy. However, an even greater threat is that Rome may initiate the country's second exit from the EU in the last 5 years. The logic of Rome is very simple: if the EU is not helping us amid an economic crisis, then why do we need to stay in it at all? Moreover, it is in Italy that openly "anti-European" political views have been maturing recently, so if the European Union does not help, then Italians will vote for those political forces that are opposed to European integration in the next elections. And this can turn into "Itexit" ("Italy exit"). In general, the issue on the agenda is extremely important.

On the eve of the first face-to-face EU summit since the beginning of the pandemic, European Council President Charles Michel called on governments to show solidarity and will to adopt the EU budget for 2021-2027 and a plan for economic recovery after the crisis. "The COVID-19 pandemic has claimed many lives across Europe and has been a major blow to our economy and society. All our efforts must be directed towards ensuring sustainable recovery. To this end, our meeting this week will focus on the long-term budget and recovery plan," said Charles Michel. Regarding the differences of opinion between the "North" and "South" of the European Union, Michel said: "It is not surprising that there are different opinions in the EU. I assure you that we have taken into account all opinions, all differences. My task is to do everything possible to reach an agreement, and this is done unanimously by all 27 countries." Meanwhile, Italian President Sergio Mattarella said on Thursday that the EU summit on July 17-18 will be "decisive". However, the Italian President did not say why or who was "decisive". Either for Italy itself, or for its future in the EU, or for the entire alliance. However, in a conversation with Italian Prime Minister Giuseppe Conte, politicians again agreed that most of Italy's aid should be provided in the form of grants. But an adviser to the President of Lithuania Asta Skaisgiryte believes that it may take much longer to reach an agreement on the formation and distribution of the recovery fund and the EU budget for the next 7 years. The presidential adviser suggested that the EU countries will not be able to come to a common denominator again over the next two days. Skaisgiryte believes that it may need a second meeting of representatives of all EU member states, which will take place until the autumn. At the same time, Spanish Prime Minister Pedro Sanchez called on all EU countries to make some concessions to reach an agreement, and said that "the European Union is facing very difficult times".

On Thursday, July 16, there was a bit of interesting news in the European Union. Not a single macroeconomic report and the ECB meeting turned out to be passable and did not provoke strong movements in the currency market. The European Central Bank left its key interest rates on loans and deposits unchanged at 0% and -0.5% and left the volume of the PEPP program unchanged at 1.350 trillion euros. This is what market participants were preparing for, so they were not surprised. In the United States on this day, a report was published on applications for unemployment benefits, which for the reporting week added 1.3 million, if we talk about the primary. 17.3 million secondary cases were recorded. Retail sales in June increased by 7.5% mom instead of the forecast +5%. Thus, in the American trading session, the US dollar could even begin to strengthen, but in general, the euro/dollar pair conducted a rather vague trading all day.

On the last trading day of the week, in addition to the planned EU summit, the results of which will be known only at the weekend, the publication of the June inflation report in the European Union, and the University of Michigan consumer confidence index for July is also planned. We consider both of these reports very secondary. It is unlikely that they will cause any strong reaction from market participants.

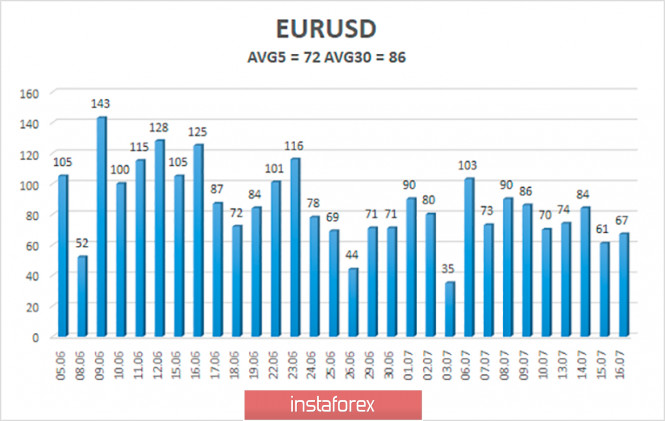

The volatility of the euro/dollar currency pair as of July 17 is 72 points and is characterized as "average". We expect the pair to move today between the levels of 1.1308 and 1.1452. Turning the Heiken Ashi indicator upward will signal the end of the downward correction cycle.

Nearest support levels:

S1 – 1.1353

S2 – 1.1292

S3 – 1.1230

Nearest resistance levels:

R1 – 1.1414

R2 – 1.1475

R3 – 1.1536

Trading recommendations:

The EUR/USD pair has started a new round of corrective movement. Thus, it is now recommended to open buy orders with the goals of 1.1414 and 1.1452, but after the price rebounds from the moving average. It is recommended to open sell orders no earlier than when the pair is fixed below the moving average line with the first targets of 1.1308 and 1.1230.

The material has been provided by InstaForex Company - www.instaforex.com