4-hour timeframe

Technical details:

Higher linear regression channel: direction - upward.

Lower linear regression channel: direction - upward.

Moving average (20; smoothed) - upward.

CCI: -215.1910

While market participants are closely watching the EU summit, and the euro currency is trading in different directions, the British pound on Monday sharply and unexpectedly jumped up. In recent days, however, the pound/dollar pair has also been trading in completely different directions and it is also unclear whether it will continue its upward movement. However, one thing is absolutely certain. There is no positive news from the UK at this time, as well as from the European Union. Thus, either the reasons for today's strengthening of the British currency are purely technical, in other words, the market continues to "swing on a swing", or the reasons again need to be looked for in the US. And in the US, you don't need to look for reasons. They lie on the surface and are visible to the naked eye. We have already discussed the most obvious reason several times. It's a coronavirus. Traders fear that the second wave of the epidemic in the United States will lead, even if not to a new "lockdown", which Donald Trump flatly refused, to a new contraction of the economy, or at least to a weakened pace of economic recovery after the first "lockdown". We have repeatedly said that a situation in which half of the country will become infected with the "coronavirus", and the economy will continue to work in the usual, "pre-quarantine" mode, will not work. Thus, the more cases of the disease are registered in the United States, the more likely it is that the American economy will start experiencing serious problems again. But this time it will start experiencing problems not at the "pre-crisis", high levels, but at the "post-crisis", low levels. In the event of a new round of decline, the "coronavirus crisis" can really be called "depression". Therefore, we continue to believe that the overall strengthening of the euro and the pound is due to low market demand for the US dollar.

Meanwhile, British Prime Minister Boris Johnson said that even if the country begins the second wave of the pandemic, he is not going to launch a second "lockdown". The British Prime Minister said that British doctors continue to study the "coronavirus", constantly receive new information about it and now understand much better what social groups it affects, how it works and how it is transmitted. "Now we can quickly identify outbreaks and localize them," Johnson said. A similar rhetoric is shared by Boris Johnson's friend Donald Trump, who may be re-elected for such carelessness. Recall that most doctors in the world believe that with the arrival of autumn in many countries of the world will begin the second wave of the epidemic, which, in Britain, can be much worse than the first. Also, do not forget that if Europe managed to stop the spread of "coronavirus", then the world continues to establish and update anti-records almost every day. For example, over the past day, 260 thousand new cases of the disease were detected in the world, which is a record since the beginning of the pandemic. The total number of victims from the "coronavirus" is already about 600,000. And the vaccine against COVID-2019, according to the same doctors, should not be expected before 2021.

Meanwhile, Donald Trump continues to criticize his main opponent in the election, Joe Biden. Well, how to criticize. "Offend" is a more accurate expression of reality. This time, Trump said that "Biden can't connect the two proposals." "They are taking it out. He gets up, repeats, they ask him questions. He reads the text from the teleprompter, then returns to his basement. And you will tell me that Americans want to have this in an era when we have problems with other countries that want to mess with us?" Trump asked. "He is incompetent to be President. To be President, you need to be smart, tough, and a lot more. Joe does not know that he is alive," summed up Trump, who is only 3 years younger than his opponent and is currently the oldest US President in history. Meanwhile, the FOX TV channel (which supports the current President) conducted a poll, according to which 49% of voters are ready to support Biden in the election, and 41% are ready to support Trump. But opinion polls conducted by ABC News and The Washington Post indicate an even greater gap between Biden and Trump. At the moment, 55% of respondents are ready to vote for the Democrat, and only 40% give their vote to Trump. Thus, as practice shows, Americans do not care about Biden's age. It seems that in the United States there may be a situation that was already observed in December in the parliamentary elections in the UK, when people voted not for the Conservative Party, but for the fastest possible "divorce" from the European Union, which was promised by the conservatives led by Boris Johnson. In America, there may be a situation in which the vote will not be for Biden, but against Trump. After all, Joe Biden, in fact, is not doing anything at this time. He sits in his residence, rarely goes out, rarely gives interviews and comments. All the work is done for him by Trump himself, who does not seem to understand that almost every statement he makes only lowers his chances of re-election. Thus, Biden can become not only the oldest President, but also the President who most easily won the vote.

As for the technical picture of the GBP/USD pair, the quotes again returned to the Murray level of "6/8"-1.2634, from which they had previously bounced, and the Murray level of "7/8"-1.2665, from which the pair also bounced twice recently, is also located nearby. Thus, it is absolutely possible that in this area, the bulls will again ease their pressure and start another round of downward correction. Below the Murray level of "2/8"-1.2512, the pair also cannot escape, so we can even assume that the price is inside the side channel. Important macroeconomic statistics are not scheduled for Monday or Tuesday. Thus, market participants will again have to trade only on the basis of data on "coronavirus" in the United States. But even this topic can not constantly cause market pressure on the dollar.

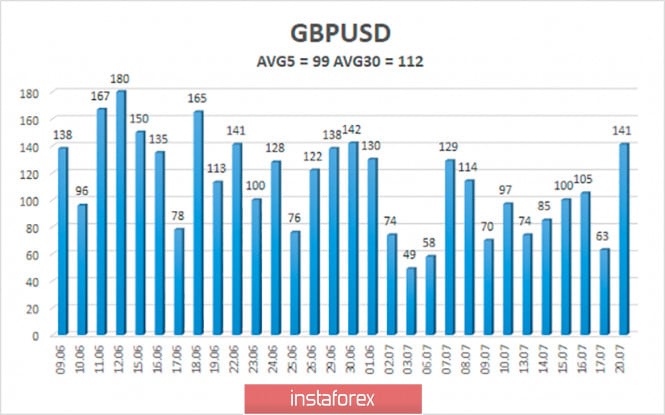

The average volatility of the GBP/USD pair continues to remain stable and is currently 99 points per day. For the pound/dollar pair, this value is "average". On Tuesday, July 21, thus, we expect movement within the channel, limited by the levels of 1.2551 and 1.2749. A reversal of the Heiken Ashi indicator downwards will indicate a downward movement, and the pair may re-establish itself below the moving average.

Nearest support levels:

S1 – 1.2634

S2 – 1.2604

S3 – 1.2573

Nearest resistance levels:

R1 – 1.2665

R2 – 1.2695

R3 – 1.2726

Trading recommendations:

The GBP/USD pair on the 4-hour timeframe continues to trade "up-down" near the moving average, then fixing above it, then below. Thus, now there is a kind of flat, and there is no trend as such. Thus, formally, buy orders with the goals of 1.2665, 1.2695 and 1.2726 are currently relevant. However, there is a high probability of another rebound from the Murray level of "7/8". Short positions can also be formally considered after fixing below the moving average with goals of 1.2512 and 1.2482, but there is also a high probability of a rebound from the Murray level of "2/8".

The material has been provided by InstaForex Company - www.instaforex.com