4-hour timeframe

Technical details:

Higher linear regression channel: direction - upward.

Lower linear regression channel: direction - upward.

Moving average (20; smoothed) - upward.

CCI: 157.5025

The British pound started the second trading day of the week quite pessimistic, with a downward movement. However, this so-called correction ended very quickly, and the pound soared up again. Market participants continue to ignore the negative news background from the UK, but at the same time, they are very attentive to everything that is happening in the US. Thus, the next local highs were updated, and the upward trend continued. The pound/dollar pair did not even manage to adjust normally.

In the article on the euro/dollar, we have already questioned whether everything that is happening in America at this time is happening by itself. The war with Donald Trump continues on the sidelines of the US Congress. For example, the issue of providing a new package of assistance to the economy in the face of a severe pandemic crisis is now on the agenda. Republicans and Trump are proposing to allocate another $ 1 trillion for this, as well as cut federal unemployment allowances by three times. In America, the current situation is that unemployment benefits, together with "coronavirus" allowances, often exceed the wages of certain categories of American workers. In fact, many Americans do not want to go to work, because their wages do not differ much from the amount of unemployment benefits. And given how much the "coronavirus" is raging in the country, not every American is ready to lead an active social life. Democrats also propose to allocate another three trillion dollars to support the economy and thus increase the national debt to 29-30 trillion dollars. Naturally, in the run-up to the election, this proposal from the Democrats is a very strong step for Joe Biden. Of course, many people want to stay out of work as long as possible and still get the same money. Well, Donald Trump needs Americans to go back to work and restore the economy, and not just sit at home and fear the "coronavirus". That is why the president proposes to reduce unemployment benefits, which naturally further reduces his political ratings.

Meanwhile, unexpectedly, the British pound has found fundamental support. Just the kind that the pound likes. That is, rumors, speculation, assumptions, and so on. And on this news, the pound continued to strengthen against the dollar on July 28. Quite unexpectedly, Michel Barnier, the chief Brexit negotiator with London, said at a closed meeting with the ambassadors of EU member states that an agreement with the UK is possible to conclude. "I remain confident that a balanced and sustainable agreement remains possible, even if it is less ambitious," Barnier said, also adding that London does not seem too interested in a quality agreement. According to Barnier, his recent meeting with Boris Johnson showed that London really wants to conclude an agreement, despite the fact that it is ready to reject any agreements with the EU.

At the same time, British Prime Minister Boris Johnson said that the first signs of the second "wave" of "coronavirus" are being observed in Europe. The UK has introduced a mandatory two-week quarantine for all those who arrived from Spain since July 26, some countries again note serious increases in the number of infected people. If Europe and the UK are overwhelmed by the second "wave" of the pandemic, the pound and euro may very quickly lose their advantage over the US dollar.

Well, the leader of the United States Donald Trump, meanwhile, continues to delight the audience with their allegations. This time, the US president said that the victory over the "coronavirus" will soon be won, after which the country will enter the "Golden age". "It will be much better than ever," Trump said, politely keeping silent about the fact that this "Golden age" can be associated, in his opinion, only with his name, and not with the name of Joe Biden. All that America will get if Biden becomes the new president, Trump believes, is destroyed cities and collapsed markets. In addition, the president once again criticized the media, which "represent the protesters in Portland and Seattle as innocent people, although in fact they are agitators and provocateurs who should be kept under the control of law enforcement agencies".

As a result, the British currency continues to grow, and again at a very high rate. What can stop buyers in the current conditions, it is even difficult to guess. The most interesting thing is that almost no important and interesting macroeconomic reports are planned for this trading week in the UK. But in the US, a report on GDP will be released, which can finally finish off the US currency. Recall that according to experts' forecasts, the US economy may lose from 33% to 34% in the second quarter. We also remind you that initially in the first quarter, GDP was expected to fall by 4%, but after that it came out by 5%. So, this time there may be something similar. Well, it is unlikely that traders will be happy to reduce the economy by more than 34%. Also, today we plan to summarize the results of the Fed meeting, which can be both absolutely "passing" and quite interesting. Simply put, we don't know what to expect from the Fed's monetary committee in such a difficult economic situation.

From a technical point of view, nothing changes at all for the pound/dollar pair. The pound continues to grow even when the euro currency takes a pause. Thus, it seems that buyers really aimed at the level of 1.3200, which is the maximum from March 9, from which the panic fall of the pair and the growth of the dollar began. Both channels of linear regression are still directed upwards, and the price is located far enough from the moving average line, which indicates the strength of the current trend. Thus, short positions are not recommended to be considered at all, since there is no single prerequisite for changing the trend. The future of the US dollar still depends on currency market traders, not least the major players. However, despite the fact that the latest COT report showed a reduction in the net position (weakening of the bullish mood), the pound, as we see, still continues to grow. Therefore, we need to wait for the time when market participants "remember" that everything in the UK is also not very good, the economy of this country is also experiencing serious problems, and in the autumn, Britain may face its second "wave" of the pandemic.

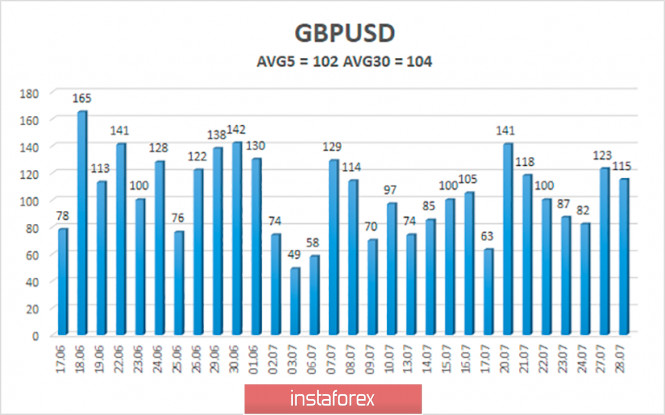

The average volatility of the GBP/USD pair continues to remain stable and is currently 102 points per day. For the pound/dollar pair, this value is "average". On Wednesday, July 29, thus, we expect movement within the channel, limited by the levels of 1.2842 and 1.3046. Turning the Heiken Ashi indicator downward will indicate a new round of downward correction.

Nearest support levels:

S1 – 1.2878

S2 – 1.2817

S3 – 1.2756

Nearest resistance levels:

R1 – 1.2939

R2 – 1.3000

R3 – 1.3062

Trading recommendations:

The GBP/USD pair continues to move up on the 4-hour timeframe. Thus, it is recommended to stay in purchases of the British currency with the goals of 1.3000 and 1.3046 (the level of volatility on Wednesday), until the Heiken Ashi indicator turns down. Short positions can be considered after fixing the price below the moving average with the first goal of 1.2695.

The material has been provided by InstaForex Company - www.instaforex.com