Trading recommendations for EUR / USD on August 26.

Analysis of transactions

Dollar remains trading in the market even amid disastrous US consumer sentiment report. This suggests that the market is playing in the hands of the bulls at the moment, so a rise in dollar and plunge in euro may well occur in the near future.

At the same time, data on US durable goods orders is scheduled to be released today, which will very much indicate the confidence of consumers on their financial positions in the future. Good data will certainly help raise demand for the dollar, but reduced orders will negatively affect the currency's position in the market.

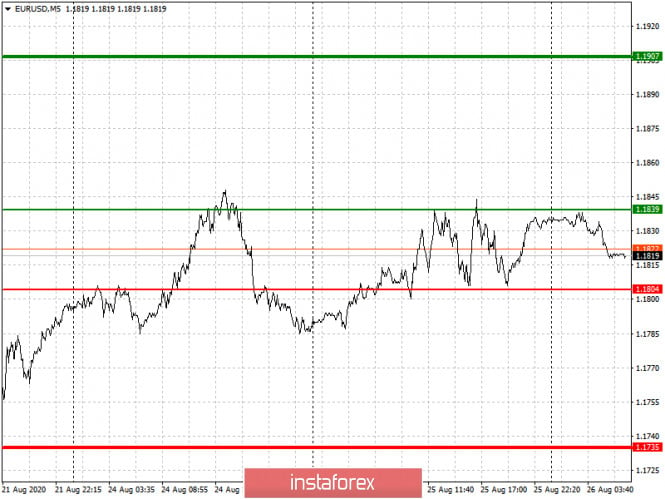

- Set long positions from a price level of 1.1839 (green line on the chart) to a price level of 1.1907, but only if data on US durable goods orders turn out worse than expected. This is because such weak report will inevitably help the euro rise in price in the daily chart. Take profit at the level of 1.1907.

- Meanwhile, short positions may be set up from the level of 1.1804 (red line on the chart) to the level of 1.1735, especially if demand for dollar increases, as such will lead to a sure downturn in the EUR/USD pair. Take profit at the level of 1.1735.