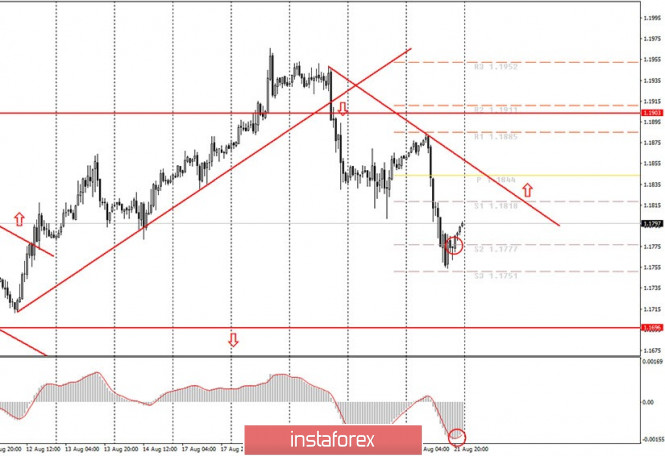

Hourly chart of the EUR/USD pair

The EUR/USD currency pair continued a strong downward movement for most of the day on Friday, August 21. Thus, as a result, we have even formed a downward trend. It looks very impressive on the hourly chart. If you look at a higher timeframe, novice traders may notice that all the current downward movement is just a tiny correction against a three-month upward trend. Moreover, the price has not been able to go below the 1.1700 level for almost a whole month, although there have been plenty of attempts to do so. Thus, it will not be surprising if the dollar starts to fall again (the growth of the euro/dollar pair) on Monday or Tuesday. However, we also have a downward trend line, which now makes it a little easier to determine the trend for this pair. As long as the price is below the trend line - we trade for a decrease, as soon as it settles above it – we begin to consider long positions.

Macroeconomic publications on Friday were quite interesting. Business activity indices in the European Union (Germany and France), as well as in the European Union as a whole, were the most surprising. Analysts expected that the deterioration in comparison with the previous period will not happen, since after the strongest decline in the second quarter, caused by the coronavirus epidemic and quarantine, a period of recovery has come. Fast or slow, it doesn't matter. The economy has started to recover. This means that business activity is the first indicator that should grow or reflect the recovery of the services and manufacturing sectors. However, in practice, it turned out that business activity in the European Union fell to critical values on the verge of a new decline in August. We remind novice traders that any value above 50 is considered positive and reflects the growth of the economy sector. Thus, in general, all three business activity indices in the EU (for the services sector, manufacturing sector, and the composite) were positive, but worse than a month earlier. And the main thing is that with this trend in September, they may go below the 50 mark again, which will again mean a reduction in one or another area of the economy.

No important publication in the European Union or the United States planned on August 24, Monday. Therefore, novice traders can only pay attention to the general fundamental background. We believe that at this time, technical factors and the mood of market participants are in first place. Thus, if there is no high-profile news and events on Monday, then the pair will most likely trade exclusively on the technique. And the technique at this time implies the continuation of the upward correction to the trend line. The MACD indicator has signaled its beginning, the signal is shown in the illustration with circles.

The following scenarios are possible on August 24:

1) Buying the pair at this time remains irrelevant, since the price has settled below the rising trend line. Thus, now buyers need to wait for a new upward trend to form. It is necessary to wait for the construction of new trend patterns or the cancellation of the corresponding downward patterns. Accordingly, it is not recommended to open purchases before breaking the descending trend line.

2) Selling the currency pair at this time is more relevant, since we already have a downward trend line at our disposal. Thus, we recommend waiting for the MACD indicator to turn down and after that open new sell orders with targets at 1.1777 and 1.1751 (these targets will be specified in tomorrow's morning review). The closer to the zero mark the MACD indicator turns downwards, the less the indicator will be late with its reaction.

What's on the chart:

Support and Resistance Levels are the levels that serve as targets when buying or selling the pair. You can place Take Profit near these levels.

Red lines are the channels or trend lines that display the current trend and show in which direction it is preferable to trade now.

Up/down arrows show where you should sell or buy after reaching or breaking through particular levels.

MACD indicator (10,20,3) consists of a histogram and a signal line. When they cross, this is a signal to enter the market. It is recommended to use this indicator in combination with trend lines (channels and trend lines).

Important announcements and economic reports (you can always find them in the news calendar) can seriously influence the trajectory of a currency pair. Therefore, at the time of their release, it is recommended to trade as carefully as possible or exit the market in order to avoid a sharp price reversal.

Beginners in the Forex market should remember that not every single trade should be profitable. The development of a clear strategy and money management are the key to success in trading over a long period of time.

The material has been provided by InstaForex Company - www.instaforex.com