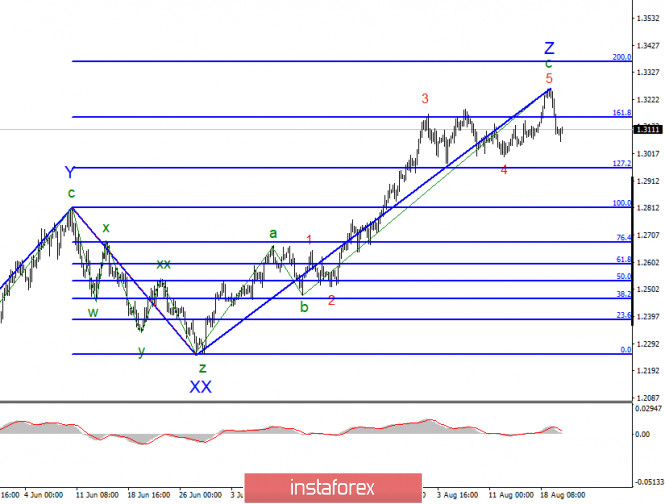

The wave pattern of the upward trend, which was formed on March 20, has almost fully completed its formation. A successful attempt to break through the previous high resulted in the complication of the internal structure of Z wave. At the moment, this wave looks fully completed. Thus, the price may continue to fall to the targets located at 27 and 28 levels while forming a new descending trend pattern.

The current wave pattern shows that the uptrend and, in particular, the Z wave, can be fully completed soon, especially after the price moved away from yesterday's highs. However, in the past few months, the demand for the US currency has been extremely low. If this tendency continues, then wave 5 in c and in Z may take an even more complex and extended form.

The last few days were extremely difficult for the British pound. At first, the pound sterling dropped 200 pips. After that, it managed to win back almost all its losses. On Friday, however, it slumped again by 200 pips. It is quite difficult to explain what is happening with the pound now. At first glance, the news background may be the reason for the pound's decline. Surprisingly, the British pound was losing its value exactly when upbeat data on inflation rate was released in the UK. Besides, positive data on retail sales for July was published this morning, as well as excellent PMI figures in manufacturing and services for August. The latter has significantly exceeded market expectations. But still the pound was not in demand. Therefore, the background is not the main reason. In the US, the situation with the news background is also confusing. It is difficult to say what kind of effect the news and reports will have on the markets. Some new is simply ignored by investors. Throughout the week, it has been speculated that Democrats and Republicans had resumed their talks on the next stimulus package to assist the US economy. For some reason, this was said to be insider information. Then it was reported that the US was also conducting covert negotiations with China on a new trade deal. And again, it is difficult to say which news attracted investors' attention. The US PMI in the services and manufacturing sectors also exceeded markets' expectations. However, by the time of the release, the US dollar had already been rising for several hours. Therefore, I can say that statistics from Britain and the US were not the main factors that caused the drop in the pair.

Conclusion and recommendations:

The pound/dollar pair resumed the formation of the upward Z wave and could have completed it right there. Thus, I would recommend buying the instrument with the targets near the level of 1.3368, which corresponds to 200% Fibonacci for each MACD buy signal. At the same time I think that the entire ascending pattern is about to complete its formation or has already completed it. If this scenario is true, then opening long positons may be too risky now.

The material has been provided by InstaForex Company - www.instaforex.com