Finally, we have seen a noticeable appreciation of the dollar, and all thanks to the content of the report of the United States Department of Labor. Of course, it is too early to talk about the beginning of a full-fledged correction, but the tension in the market has slightly decreased. Indeed, the market still remains significantly overheated, and the dollar is still oversold.

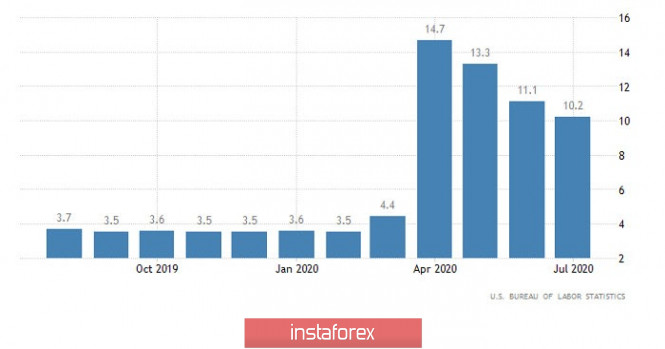

The content of the report of the United States Department of Labor itself turned out to be significantly better than even rather optimistic forecasts. Most importantly, the unemployment rate fell from 11.1% to 10.2%. A decrease to 10.5% was expected. This became possible due to the fact that outside agriculture, 1,763,000 new jobs were created, instead of the projected 1,620,000. And even if this is still an incredibly high level of unemployment. The fact of its steady decline is in itself an extremely positive factor. And it is clear that investors only looked at these two indicators, but other parameters turned out to be quite nothing. In particular, the growth rate of average hourly wages slowed down from 4.9% to 4.8%, which is also quite good. After all, they expected a slowdown in growth rates to 4.5%. And in general, there were fears that the growth rate of the average hourly wage would drop to 4.2%. That is, it was expected that the labor market would recover amid a significant decrease in wages. But, apparently, so far this has been avoided. In addition, the average working week has been reduced from 34.6 hours, not to 34.4 hours, but to 34.5 hours. And the only indicator that was somehow disappointing was the level of economic activity, which should have remained unchanged, but it dropped from 61.5% to 61.4%. The reduction is not important, and the indicator itself is probably the most insignificant among all other indicators of the labor market.

Unemployment rate (United States):

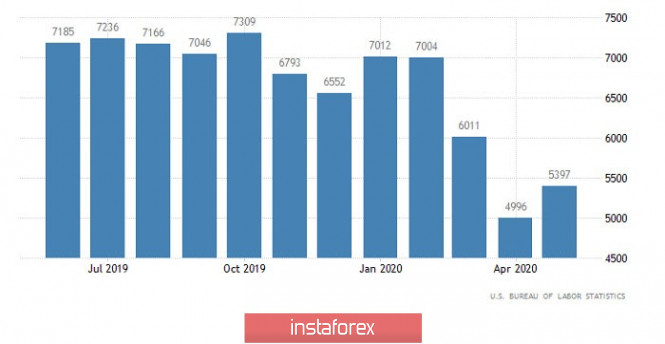

The only thing that is of any interest today is open vacancies in the United States, the number of which should be reduced from 5,397,000 to 4,900,000. indicating that the rate of decline in unemployment will only slow down. Thus, exacerbating the already difficult situation in the economy. However, after Friday's report from the Ministry of Labor, this will be seen as a consequence of a more dynamic reduction in the unemployment rate. So from the point of view of investors, such a decrease in the number of open vacancies is just another confirmation of the recovery of the US labor market. Which, without any doubt, will help strengthen the dollar.

JOLTS Open Jobs (United States):

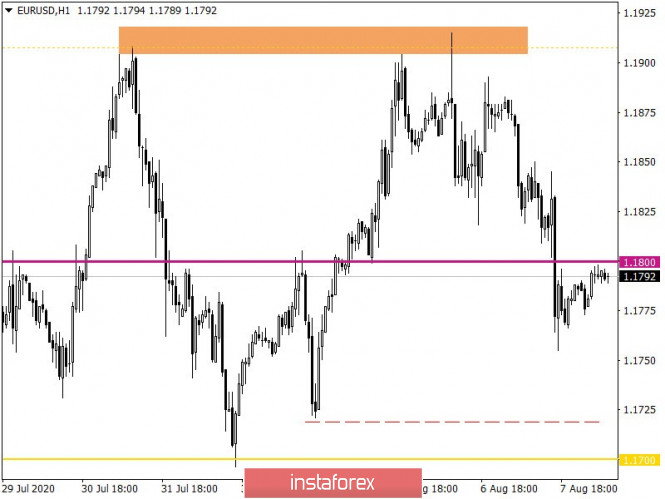

The euro/dollar pair managed to form a downward move last Friday, where the 1.1900 area played a role of resistance in the market. The outlines of the correction course were obtained, but the scale of the price change is extremely small when taking into account such a high value of the European currency. If we proceed from the dynamics of the period earlier, there is a chance for a further decline in the value of the euro. Relative to market volatility, there is a high dynamic that exceeds the average, which indicates speculative interest in the market.

Looking at the trading chart in general terms (the daily period), you can see that the current movement is a price fluctuation at the peak of the inertia course.

We can assume that if the price rebounds from the value of 1.1800 and consolidates lower than 1.1780, we will open a path in the direction of 1.1755-1.1720. An alternative scenario considers the absence of further adjustment to the euro's value, where consolidating the price higher than 1.1820 may lead to a reverse course.

From the point of view of complex indicator analysis, we see that the indicators of technical instruments at minute and hour intervals signal a sale due to Friday's rally. The daily indicator still signals a purchase against the background of the main inertia.