The released data on the number of applications for unemployment benefits in the US put pressure on the dollar, showing it its current place in the global financial system, the place of the funding currency, which provides for a rather prolonged period of weakness of its exchange rate against major currencies.

According to the data presented, the number of applications for unemployment benefits in the United States dropped significantly to 963,000 over the past week against the forecast of 1.120 million and revised upward to 1.191 million of the previous data. These figures, of course, can only show a local improvement in the situation on the labor market and not become a prologue to the upcoming positive dynamics, but they can be the first sign of an improvement in the picture in the US economy.

The published figures of the export and import price indices also added positivity. The indicators showed an increase in their growth rate last month by 0.8%, respectively, with the forecast of an increase of 0.4% and 0.7% against the expected growth of 0.6%.

Now, let's go back to the prospects for the dollar. Of course, the US economy is in dire need of a weak dollar. It needs it like air. In a situation of severe losses inflicted by the coronavirus infection on the country's economy, it is not enough to put pressure on economic opponents to successfully compete in world markets, which D. Trump is now actively engaged in both in Europe and in Asia. It is necessary to win at the cost of goods and services. And here, the relatively low exchange rate of the national currency will support the demand for American exports, which in turn, will stimulate domestic production and support the economic recovery.

Considering this need amid unprecedented stimulus measures from the Fed and the US Treasury, a prolonged period of weakness in the US currency should be expected. And yet, judging by the way the market reacts to positive economic statistics, we should expect only an increase in the dollar decline against the main currencies. Investors by their actions, and these are dollar sales, clearly indicate this.

As for the possible dynamics of the currencies of countries with developing economies, they are likely to suffer from a weakening dollar, as capital will flow from emerging markets (EM) to economically developed and invested in risky assets.

In general, assessing the emerging picture, we believe that the dollar will weaken in the future as new positive data on the US economy comes in.

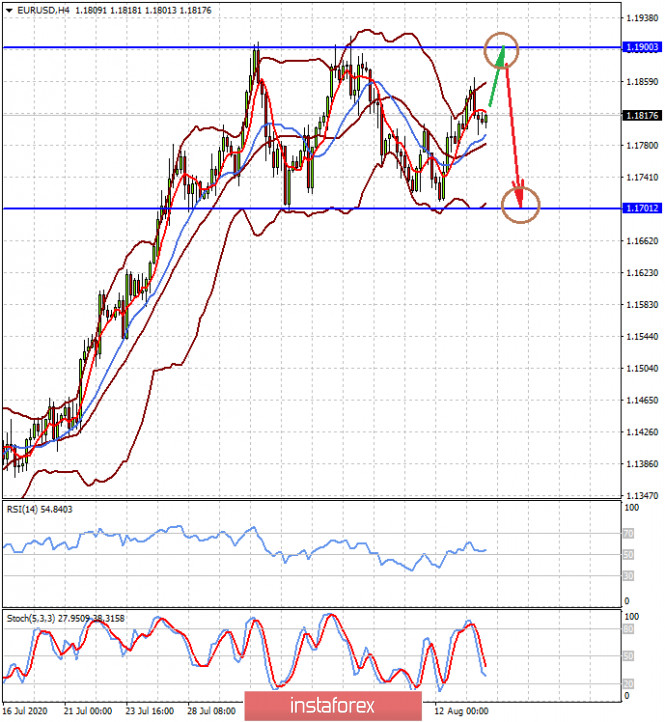

Forecast of the day:

The EUR/USD pair remains in the range of 1.1700-1.1900. We believe that this dynamics will continue throughout the day and we believe that the pair should be sold locally at a rise from 1.1900.

The USD/CAD pair remains in a short-term downward trend. In the wake of the limited recovery in oil prices, it may decline to the level of 1.3150 after falling below 1.3200.