4-hour timeframe

Technical details:

Higher linear regression channel: direction - upward.

Lower linear regression channel: direction - upward.

Moving average (20; smoothed) - sideways.

CCI: -29.7360

The EUR/USD currency pair, after rebounding yesterday from the Murray level of "6/8" - 1.1963, continued to move down for most of Thursday, August 20. And as a result, it was fixed below the moving average line. However, despite the fact that we have been waiting for the pair's quotes to fall for a long time, and despite the fact that the price has fixed below the moving average, and despite the fact that the dollar has finally risen in price, we do not believe that the upward trend is definitely over. Yes, the pair is fixed below the moving average, however, look at the illustration: over the past two weeks, the price overcame the moving average three times and each time could not start forming a downward trend. Thus, it is absolutely possible that this time the bears will fail and the upward movement will resume, although we have repeatedly said that the euro/dollar pair, from our point of view, is strongly overbought. But market participants are not interested in this. Major traders do not seem to leave the market, and yesterday recorded only a part of the profit on long positions. Thus, in order for the downward movement to continue, it is necessary that professional traders continue to reduce longs. At the same time, sellers should start opening short positions. Only in this case, the US currency can count on further strengthening. In fundamental terms, nothing has changed for the euro/dollar pair. There was no positive news from America. The overall fundamental background has not changed.

Last night, the minutes of the last Fed meeting were published in the States. And this document could well send the US dollar into another "knockout". However, we warned traders that market participants rarely pay attention to this publication, so the reaction is unlikely to follow. In reality, there was no reaction, and the US dollar was actively rising in price at this time, which clearly does not correspond to what was stated in the document. The first thing to note is that the Fed leaders consider it necessary to further support the US economy through various types of stimulus measures. Representatives of the Monetary Committee note that the uncertainty in the future of the economy is extremely high and will depend on how the fight against the "coronavirus" epidemic will take place and what its results will be. Members of the Monetary Committee agreed that the economy will need additional incentives, but have not yet decided what tools and when to use them. Two key factors that will affect the economy in the future are government actions and the scale of the pandemic. The greatest concerns are related to the economic activity of Americans, which may remain at a low level for a long period of time if the COVID-2019 virus can not be curbed or a vaccine against it is created soon. However, not everyone supports additional monetary stimulus. Opinions differ. Some members of the FOMC believe that serious fiscal stimulus will be needed to improve labor market conditions, and some believe that new monetary injections will be needed to return inflation to the 2% level. The minutes also said that at the next meeting, representatives of the Federal Reserve may re-evaluate monetary policy, which will lead to a significant change in the text of the final communique.

Thus, there was nothing optimistic about this protocol. By and large, everything really depends on how strong the "coronavirus" epidemic will be in America in a month, two, three or six months. Now we all see that the United States continues to lead in the number of cases, in the number of deaths from the pandemic. Of course, the United States is also one of the most numerous countries in the world, so the large number of diseases and deaths is partly due to this. Moreover, many countries clearly falsify real data, hiding the real scale of the epidemic. In particular, this is China, which, according to the Johns Hopkins Institute, currently recorded a total of 90,000 cases of diseases and 4,707 deaths. Obviously, this information is not true.

Meanwhile, US President Donald Trump once again "rode the roller" on his main opponent in the presidential election, Joe Biden. Recall that for America and, accordingly, the US dollar, now the topic of elections is one of the most important. After all, the entire international policy of the country depends on who will become the next President. "Putin, President Xi Jinping, Kim Jong Un, Turkish President Erdogan, all of them are world-class grandmasters. We can't let a man who can't think straight deal with them. He was not very good at his best," Trump said. The US leader also said that Biden is "a puppet of the ultra-left political forces and does not understand what is happening". However, the Americans will choose a new President clearly not based on how well the new leader will stand up to Xi, Erdogan, Kim Jong-Un and Putin. After all, everyone knows that people are primarily interested in their own standard of living, and not in foreign economic policy. It is Trump who is interested in the struggle and confrontation with other countries. 90% of the inhabitants of any country are interested in going to work, getting a salary, starting a family and living well, and not the political course of Syria or Turkey. Trump has shown himself to be a leader in 2020 who cannot effectively lead the country at a difficult moment. Another question is, can Biden be a better President than Trump?

If Trump becomes President for the second time, there is no doubt that he will launch an even greater campaign against China. There is no doubt that Trump will impose new duties, require all American companies to return their production to the United States, impose duties on those who refuse, and give benefits to those who agree. Thus, by and large, all the industrial and technological giants of America do not benefit from Trump becoming President for the second time. Well, a new trade war with Beijing or an escalation of the old one does not benefit anyone at all, but the US President is unlikely to stop these judgments. He set a goal to eradicate the injustice in China's attitude to America and will go to it to the end. The US dollar remains in the high-risk zone. Yes, technical factors speak in favor of the fact that this currency should have started strengthening long ago, however, it is not technical factors that rule the currency market, but traders. If traders continue to find reasons to get rid of the US currency, it will continue to fall in price.

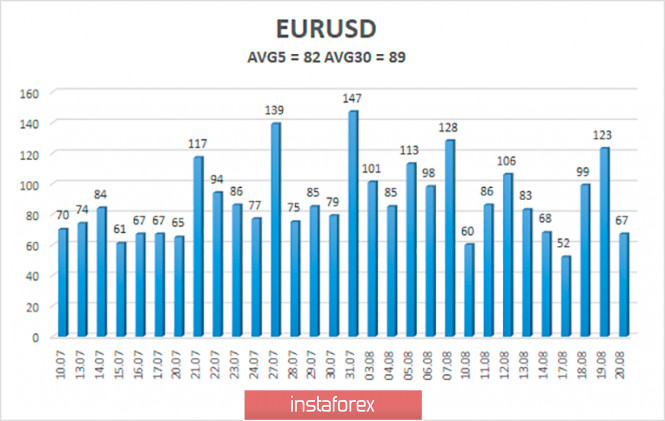

The volatility of the euro/dollar currency pair as of August 21 is 82 points and is characterized as "average". Thus, we expect the pair to move today between the levels of 1.1771 and 1.1935. A reversal of the Heiken Ashi indicator to the top will signal a possible resumption of the upward trend.

Nearest support levels:

S1 – 1.1841

S2 – 1.1719

S3 – 1.1597

Nearest resistance levels:

R1 – 1.1963

R2 – 1.2085

R3 – 1.2207

Trading recommendations:

The EUR/USD pair has started to adjust and is located just below the moving average. Thus, today it is recommended to open new long positions with targets of 1.1935 and 1.2085, if the pair returns to the area above the moving average line. It is recommended to consider short positions only after a more confident fixing of the price below the moving average with the first goals of 1.1771 and 1.1719.

The material has been provided by InstaForex Company - www.instaforex.com