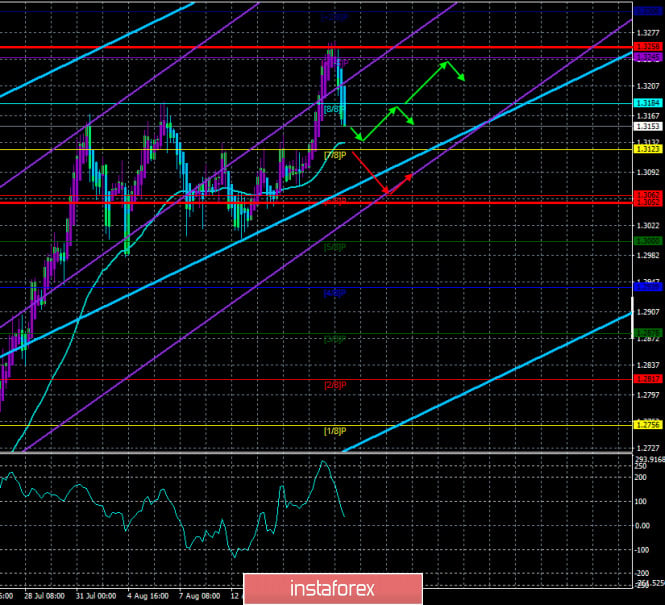

4-hour timeframe

Technical details:

Higher linear regression channel: direction - upward.

Lower linear regression channel: direction - upward.

Moving average (20; smoothed) - sideways.

CCI: 35.8597

The British pound stayed in one place for most of the past day, and in the second half of the day – started a downward movement, so far a correction. As in the case of the euro currency, we believe that the pound is overbought very much, but the dollar is oversold. Therefore, we continue to insist on the option that the US dollar should start growing again, at least within the framework of a corrective movement. Yesterday, the pound/dollar pair, having worked out the area of 1.3250-1.3260, began to adjust to the moving average line and only fixing the price below it will change the current trend to a downward one.

By the way, yesterday, the British currency could well continue to move up. On August 19, in the morning, the UK inflation report was published and it turned out that the main CPI indicator accelerated to 1% with a forecast of 0.6% y/y, and core inflation accelerated to 1.8%, while experts expected it to slow from 1.4% to 1.3% y/y. Thus, it was a pleasant surprise for buyers of the pound. So pleasant that they were even confused and began to reduce long positions. However, we have repeatedly noted in recent months that macroeconomic statistics are ignored by market participants. Thus, we are not surprised by the fact that the next report did not have any impact on the movement of the currency pair. Plus, we have already noted several times that inflation is not the most significant indicator at this time. This leads to the conclusion that it is better to keep track of all macroeconomic reports, but now we need to pay more attention to the overall fundamental background. This is what traders focus on when opening any positions, and especially large, professional traders who drive the market.

Unfortunately, at this time, currency market participants do not pay any attention even to the general fundamental background from the UK. For example, the latest GDP data showed that the British economy is the leader in losses among all the countries of the European Union, which it will no longer be a member of at the end of the year. In addition, in Northern Ireland and Scotland, as many journalists and political analysts note, separatist sentiments have begun to mature and strengthen. It is no secret that Scotland wants to leave the United Kingdom and return to the EU. And Northern Ireland is completely unimpressed by the prospect that the island will now have a physical border with Ireland, which will remain in the EU. Moreover, the economic crisis can only worsen the mood of the left that the UK should leave the same way as Britain itself left the Alliance. After all, if the EU countries now have every right to rely on free aid from other countries of the bloc (the 750 billion euro economic recovery fund), then Britain can now only rely on itself. Negotiations with Brussels on a trade agreement that would take effect on January 1, 2021, are still in place, and all reports of the beginning of the seventh, unplanned round of negotiations between Michel Barnier and David Frost sound like an anecdote. Just like reports that London expects to conclude an agreement in September. Recall that according to Michel Barnier, London is absolutely not eager to make concessions. In other words, London is just waiting and hoping that the EU will give in to everything and the parties will sign a deal. Moreover, Bloomberg economists conducted a vote among top managers and bankers, which shows that few of them expect the economy to fully recover by the end of 2021, as promised by the Bank of England. Most likely, by the end of 2021, the British economy will be 5% smaller than before the pandemic. Moreover, this figure reflects the most optimistic scenario, in which the second "wave" of the epidemic will not occur. However, doctors as one declare that with the arrival of autumn and, moreover, winter, the second "wave" of COVID-2019 will begin. Thus, potentially, the economy of almost any country in the world with the arrival of the cold season can again begin to slow down or even shrink. We have repeatedly said that even if the government of a country does not impose strict quarantines, people will not be forced to work or lead an active social life if an epidemic is raging outside the window. Especially in developed countries, where it is quite possible to live on unemployment benefits. In general, all forecasts of the Central Bank of England are regarded by investors as "surprisingly optimistic". Moreover, most economists expect that the Bank of England will once again expand the asset purchase program by 50 or 100 billion pounds. All these factors are now simply ignored by traders, so in general, it is the US dollar that continues to fall.

Interesting information at the same time comes from overseas. On August 19, Donald Trump said in a conversation with reporters that trade talks with China were put on pause. "I don't want to talk to him at this time," Trump said. "What they did to this country and the world is unthinkable." The US President did not forget to once again prick his opponent Joe Biden: "If sleepy Joe worked with them, they would already own America. Biden would give them everything. He is not very smart and is frankly weak." In addition to the war we have already mentioned against the Chinese company Huawei, Trump seriously intends to work against other Chinese giants, forcing them out of the American market. Just the other day, Trump said that he is studying the possibility of banning the Chinese giant Alibaba in the United States. Earlier, we wrote that Trump requires the sale of the social network TikTok to any American company, or this network will be banned in the States. Any such aggression against a Chinese company is explained by national security interests. In addition to all this,Trump seriously intended to return American companies from China to the States. He promised to do this during the 2016 election campaign, and now, a few months before the end of his first presidential term, he recalled this issue. It is not known whether Trump will have time to solve this problem, but it is expected that all companies with production facilities in China will receive tax benefits when returning to America and, conversely, will be punished and fined if they refuse to do so. Thus, relations between the United States and China will continue to deteriorate with a 90% probability. And especially if Trump wins the 2020 election.

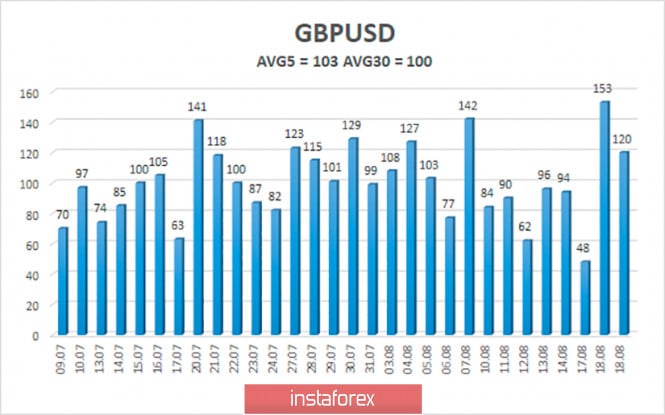

The average volatility of the GBP/USD pair is currently 103 points per day. For the pound/dollar pair, this value is "high". On Thursday, August 20, thus, we expect movement within the channel, limited by the levels of 1.3052 and 1.3258. Turning the Heiken Ashi indicator upward will indicate the possible completion of the downward correction.

Nearest support levels:

S1 – 1.3123

S2 – 1.3062

S3 – 1.3000

Nearest resistance levels:

R1 – 1.3184

R2 – 1.3245

R3 – 1.3306

Trading recommendations:

The GBP/USD pair started a strong correction on the 4-hour timeframe. Thus, today it is recommended to consider new longs with the goals of 1.3245 and 1.3258 if the Heiken Ashi indicator turns upward or the price rebounds from the moving average. It is recommended to open sell orders no earlier than fixing the price below the moving average with the goals of 1.3062 - 1.3052.

The material has been provided by InstaForex Company - www.instaforex.com