4-hour timeframe

Technical details:

Higher linear regression channel: direction - upward.

Lower linear regression channel: direction - upward.

Moving average (20; smoothed) - sideways.

CCI: -85.9271

On August 18, the British pound gained about 150 points, then fell by 200 points, gained 200 points and fell again by 200 points. These last three days have been fun. The most interesting thing is that it is impossible to give an unambiguous explanation of what is happening. If the pound was growing almost unreasonably before, now it is just tossing from side to side. "Groundless" - because the factors that pushed the US dollar down have already been worked out by the market many times. But for some reason, traders have forgotten about all the problems in the UK and do not want to remember them. But we once again recall that the last 4 years, since the referendum on leaving the EU, have been black for the pound, as well as for the whole of the UK. The British currency has been falling for most of this period against all its competitors, and the UK economy first began to slow, then contract, then, thanks to the "coronavirus", collapsed and lost 20% in the second quarter. Moreover, this is not all that the pound expects in the near future. Recall that from January 1, 2021, Brussels and London will trade with each other under the WTO rules, which are much less profitable for both sides than the free trade that operates between EU member states. But Britain will officially cease to be a member of the EU on January 1, 2021. And if this is only a small "minus" for the economy of 27 countries, then it will be another big "minus" for the UK economy. More than 50% of exports were sent from Britain to the European Union. Now trade turnover will decrease, duties will increase, so trade between the Alliance and the Kingdom will become much less profitable. And if Boris Johnson had managed to sign a trade agreement with the US during this time, he would have been forgiven for completely severing ties with the European Union. But there is no agreement with the States either. And if Donald Trump fails to get re-elected for a second term, then this agreement may not be. Or it may be signed in a few years.

Therefore, the hopes of many experts were still connected with the European Union and the trade agreement with it. There were seven rounds of negotiations between the parties and it became clear that there would be no agreement in the second or third round. But no. It was obvious that there would be no agreement even before the start of negotiations, as Boris Johnson's position on Brexit was initially "hard Brexit". He did not hesitate to declare this, and only the Parliament fought against his destructive initiative. However, the British decided that severing ties with the EU is a good option and gave all the power to Boris Johnson's party in the parliamentary elections. So now you don't even need to vote for a particular conservative bill in Parliament. Only their party has enough votes to make any decision. Despite the fact that from the very beginning it was clear that the "deal" will either not happen, or it will be as Boris Johnson sees it, it was clear for a long time, since the British Prime Minister is negotiating on the principle of his "Big Brother" Donald Trump – "either everything will be my way, or nothing". However, if Trump can afford such a luxury, since he is the President of a country with the strongest economy in the world, then Boris Johnson is not. Thus, it is quite expected that the European Union does not make concessions, provocations and blackmail of Boris Johnson are not conducted. At the end of the seventh round of talks last week, Michel Barnier said that "the parties will probably not be able to conclude an agreement on the relationship after Brexit" and that, "instead of getting closer, the parties have started to move away from each other". "In general, it is unlikely that the EU and the UK will be able to conclude an agreement before the end of the year. I do not understand why we should continue to waste time on these negotiations with this attitude of the British side," said the chief negotiator from the European Union. Moreover, Michel Barnier noted that London has begun to put forward new requirements that do not meet the principle of common sense and are devoid of logic. For example, Barnier said that London wants to maintain access to the European transport market, while refusing to comply with EU transport regulations. "However, it was the UK that decided to leave the EU, not the EU that denied it access to the European market," Barnier says. Thus, at this time, Barnier sees only one way to avoid a complete break in ties between the EU and Britain – to conclude an agreement that concerns exclusively free trade. Barnier's colleague David Frost also believes that there was progress in the seventh round of negotiations, but very little. Frost believes that an agreement can still be made, but "it will not be easy".

We can only say one thing. London and Brussels, in fact, stand in the same place. Negotiations are not progressing. On key issues (fisheries, competition, the judicial system and compliance with standards), there is no progress at all and no one wants to give in. On Friday, the UK also published a report on retail sales, which increased in volume in July by 3.6% compared to June and exceeded forecasts, as well as business activity indices in the manufacturing and services sectors. The first index rose to 55.3, the second to 60.1. All macro-economic reports exceeded forecasts and the pound sterling fell down. And indeed, it could be clearly stated that the problem is information about the failed negotiations, but before that, for two days, the pound was also tossed from side to side, and previously there was already information about the failed six rounds of negotiations, so this was not such an unexpected and important news.

As a result, while the pound/dollar pair is fixed back below the moving average line, whether the bears can continue to move the pair down is a big question. Despite the fact that the pair has twice passed the distance of 200 points down in recent days, the previous local lows were not passed. Therefore, the further fall in quotes is a great question.

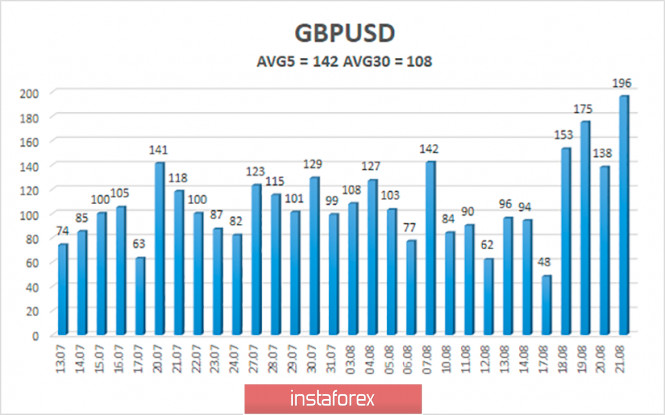

The average volatility of the GBP/USD pair is currently 142 points per day. For the pound/dollar pair, this value is "high". On Monday, August 24, thus, we expect movement within the channel, limited by the levels of 1.2947 and 1.3231. Turning the Heiken Ashi indicator upward will indicate a possible new round of upward correction.

Nearest support levels:

S1 – 1.3062

S2 – 1.3000

S3 – 1.2939

Nearest resistance levels:

R1 – 1.3123

R2 – 1.3184

R3 – 1.3245

Trading recommendations:

The GBP/USD pair is trying to start a new downward trend on a 4-hour timeframe. Thus, today it is recommended to consider new short positions with the goals of 1.3000 and 1.2939 and hold them until the MACD indicator turns upward. It is recommended to open buy orders again before fixing the price above the moving average with the goals of 1.3231 – 1.3245.

The material has been provided by InstaForex Company - www.instaforex.com