4-hour timeframe

Technical details:

Higher linear regression channel: direction - upward.

Lower linear regression channel: direction - sideways.

Moving average (20; smoothed) - sideways.

CCI: 25.0417

The euro/dollar pair again spent the second trading day of the week in fairly calm trading with a slight upward bias. Thus, the pair's quotes again approached the upper line of the side channel of 1.17-1.19, which we have been writing about for several weeks in a row. The upper border of this channel is quite blurry. The pair was at least twice as high as it was, which means it was ready to resume the formation of an upward trend. However, both times I returned to this channel. Thus, this time it can again overcome the level of 1.1900, however, this does not mean that the upward movement will continue. So far, the local maximum remains the level of 1.2011, and in recent weeks, the bulls do not find grounds for new purchases of the European currency. However, the problem is that traders do not find any reason to buy the US currency either. For more than a month and a half spent in the flat, sellers were not able to correct the pair by more than 200 points.

At the beginning of the new trading week, the fundamental background for the euro/dollar pair did not change in any way, and all the key topics remained the same. For example, the topics of the presidential election, which is only a month and a half away. Donald Trump recently said that "Joe Biden's mental abilities are clearly not enough and he simply will not be able to stand up to other world leaders - Vladimir Putin and Xi Jinping." "I'm sorry, but we need very smart people, and Joe is not suitable for this post," said Donald Trump. Of course, it would be strange if Trump said that Biden is an excellent candidate for the US presidency. The US leader also recalled the "coronavirus" and the main culprit of the epidemic - China: "I want to tell you that China is now a real problem because of what they did to us. We will never forget it. We made a great deal, but before the ink was dry on the contract, the disease came from China." Thus, the US President only indirectly confirmed once again that the trade standoff with China will continue and there may even be a full-fledged "cold war". Meanwhile, the latest results of sociological research have shown that the gap between Biden and Trump has been reduced to just 5%. It is difficult to say how accurate these studies are. In the same way as to understand why Biden's popularity began to decline, and Trump's - to grow. Over the past few weeks, the current US President did not have time to distinguish himself, so what is the reason for the growth of his popularity? We believe that in general, the political ratings of both candidates remain the same or changes are minimal.

Meanwhile, the problems in the American economy remain great. First, there is complete uncertainty with the government for the next four years. And since it is not clear who will be at the helm of the country, the US economy is not popular with investors right now. Moreover, many investors fear that the election will be won again by Donald Trump, which may be fraught with consequences. For example, during the second presidential term, Trump may start hunting for companies that have production outside the United States and especially in China. Duties may be imposed on the products of such companies, and taxes may be significantly increased for the companies themselves. Also, Democrats and Republicans can not agree on a new package of assistance to the US economy. The latest Republican legislative proposal called for $ 300 billion and failed to pass a vote in the Senate. Thus, the American economy may begin to slow down in its recovery after the "coronavirus crisis".

Today, a very important event will take place in the US that can greatly affect the movement of the euro/dollar pair, as well as the position of the US currency. Summing up the results of the next Fed meeting. Jerome Powell recently said at a symposium in Jackson Hole that the Fed is changing its approach to analyzing inflation. Now the consumer price index will be allowed to go above the 2% mark, and when adjusting monetary policy, the Federal Reserve will rely on the average inflation rate. In other words, periods of low inflation will be offset by periods of high inflation without adjusting monetary policy. In the second quarter, the US economy lost almost 32%. The Fed does not want to lower the rate to the negative zone, especially since negative rates greatly reduce the income of banks and create additional risks for the financial system. Thus, the most interesting thing awaits us at the performance of Jerome Powell. The head of the Federal Reserve will summarize the results of recent months, provide updated information on forecasts for inflation, GDP, and unemployment in the coming years, and also outline his vision for the growth rate of the US economic recovery. Recall that in one of the last articles, we were just wondering which of the economies (European or American) is recovering more quickly? The answer to this question determines how the euro/dollar pair will behave in the coming months. Thus, at least a hint of the answer to this question can be given by the Fed Chairman. Also, Powell can not ignore the topic of "coronavirus", which has recently eased the pressure on the American population, but has not retreated and has not yet been completely suppressed. Moreover, with the arrival of autumn and generally colder seasons, the third "wave" of the epidemic may begin in America. Of course, we hope that this will not happen, however, this is a very real picture of the possible future. Most likely, Powell will again note the high risks that the "coronavirus" creates for the American economy. In general, the more "dovish" Powell's speech is, the more likely it is that the US currency will again begin to depreciate against the euro.

Thus, the pair can trade in a very calm direction until the evening results of the Fed meeting are summed up. However, recently it often happens that market participants are trying to win back all the decisions of the Central Bank and the statements of its head. Thus, the volatility may increase tomorrow morning.

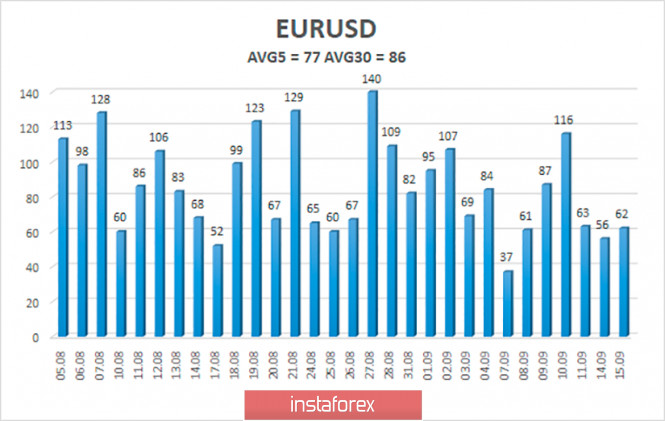

The volatility of the euro/dollar currency pair as of September 16 is 77 points and is characterized as "average". Thus, we expect the pair to move today between the levels of 1.1770 and 1.1924. The reversal of the Heiken Ashi indicator back to the top signals a possible resumption of the upward movement in the remaining side channel of $ 1.17 - $ 1.19.

Nearest support levels:

S1 – 1.1841

S2 – 1.1719

S3 – 1.1597

Nearest resistance levels:

R1 – 1.1963

R2 – 1.2085

R3 – 1.2207

Trading recommendations:

The EUR/USD pair continues to trade above the moving average line and retains the chances of growth to the area of 1.1924-1.1963. Thus, the price rebound from the moving average will allow you to open new longs with these goals. It is recommended to consider again options for opening short positions if the pair is fixed below the moving average, with targets of 1.1770-1.1719.

The material has been provided by InstaForex Company - www.instaforex.com