The news that Pfizer is working with AstraZeneca and the University of Oxford to resume developing the COVID-19 vaccine has inspired financial markets with a surge of optimism, as demand for risky assets rises while the US dollar is weakening.

At the moment, there is a clear correlation between the demand for risky assets – company shares and the dynamics of the US dollar. If demand grows, then the dollar will be under pressure, which will be clearly reflected in the currency market.

Another factor that exerts downward pressure on the dollar is the Fed's policy aimed at largely stimulating the national economy by targeting inflation. Considering this, we believe that a general decline in market tensions, either in line with the resumption of trials of a vaccine against coronavirus infection, or a general decline in the degree of tension in the markets, will contribute to an increase in demand for company shares with a simultaneous weakening of the dollar.

A two-day meeting of the US regulator begins today. Tomorrow, his decision on the monetary rate will become known, and a press conference by J. Powell will be held. Markets are not expecting not only any changes in monetary policy, but also in the rhetoric of the head of the Central Bank. We believe that without changes and personal confirmation of maintaining the current rate of monetary policy will be favorably received by investors, which will lead to a continued recovery in demand in the stock markets and to a further weakening of the US currency.

The ZEW Economic Sentiment Index for the Eurozone is due today, along with industrial production, export and import price indices, as well as NY Empire State Manufacturing Index and American Industrial Production.

The focus will be on the NY Empire State Manufacturing Index. If the indicator shows growth in the expected 6 points in September or even higher, then this will be regarded by the markets as a positive signal and will push up the demand for shares of companies. However, it seems that these dynamics will be supported by investors only in the case of good values for industrial production, which should come out less worse than the forecast of monthly growth of 1.0%.

In general, assessing the situation on the markets, we believe that the restoration of investor interest in buying shares of companies will negatively affect the rate of the US currency.

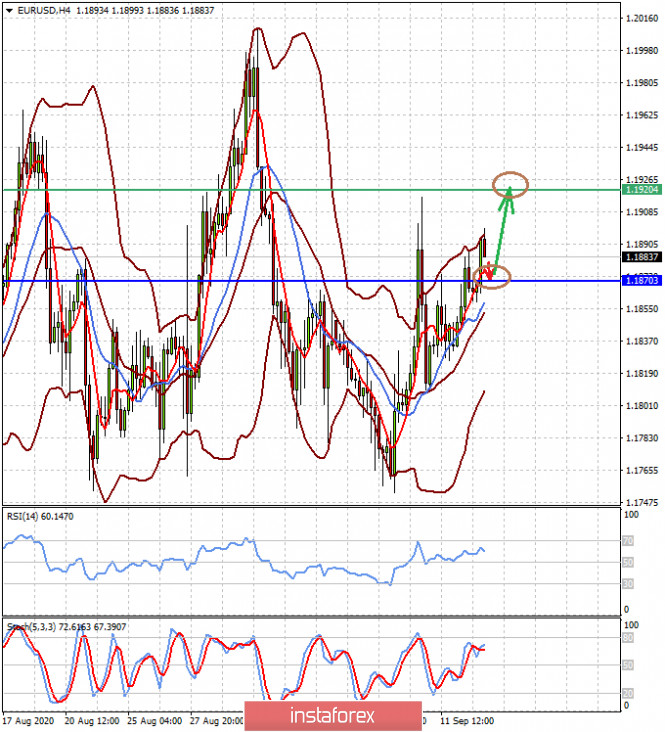

Forecast of the day:

The EUR/USD pair is correcting downward. Thus, we consider it possible to buy it from the level of 1.1870 with a likely rise to 1.1920.

The USD/CHF pair found support at 0.9060. We believe that the pair will resume its decline to the level of 0.9020, but it needs to drop below 0.9060 first for this to happen.