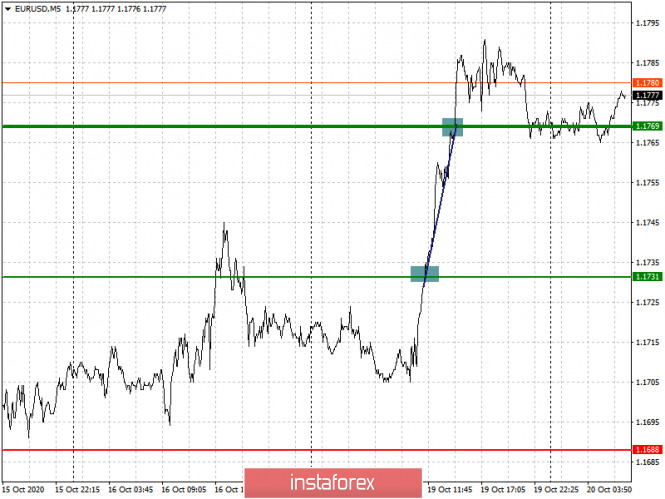

Analysis of transactions in the EUR / USD pair

The euro moved 40 pips up from the level of 1.1731 yesterday, bringing quite large profit to bullish traders in the market.

Trading recommendations for October 20

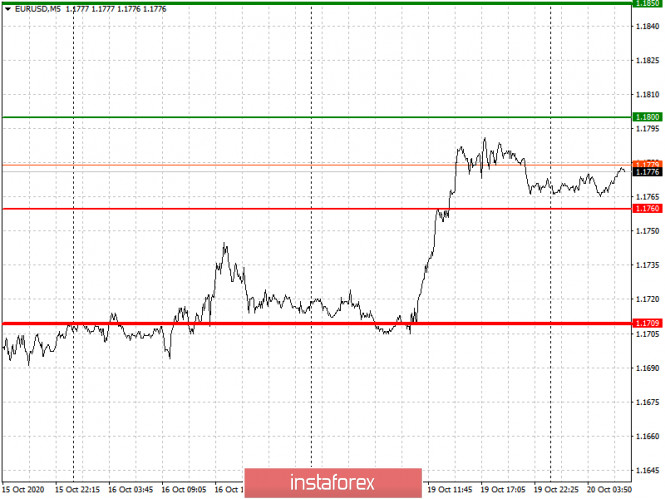

The most important event today is the scheduled speeches of Fed representatives. If such fails to support the euro in rising in the markets this morning, pressure could come back in the EUR / USD pair during the US trading session, which would quickly cover all the growth the pair had yesterday.

- Open a long position when the euro reaches a quote of 1.1800 (green line on the chart), and then take profit at the level of 1.1850. However, there is a low chance that demand will be at the same level today as it had yesterday.

- Open a short position when the euro reaches a quote of 1.1760 (red line on the chart), and then take profit at the level of 1.1709.

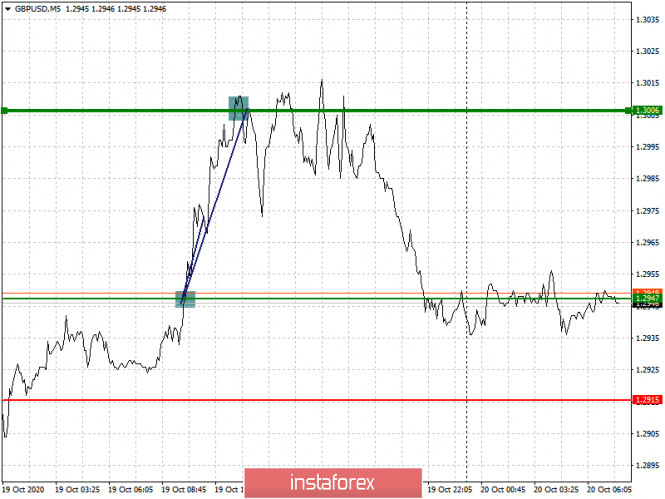

Analysis of transactions in the GBP / USD pair

The pound climbed up in the market again, rising 50 pips from the level of 1.2947. Then, afterwards, a correction began to emerge, and it started from the level of 1.2975.

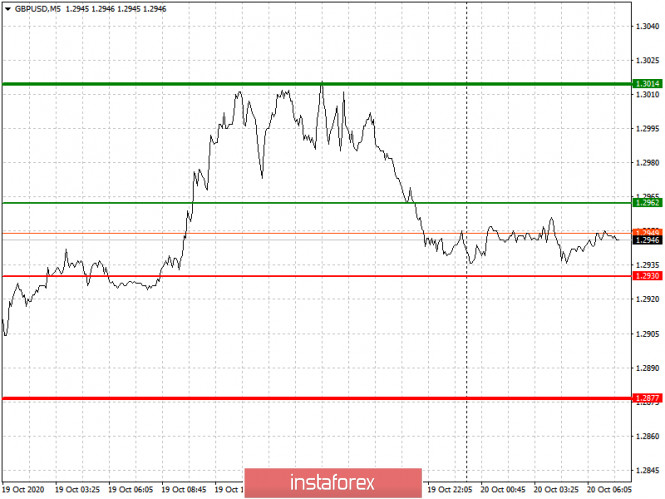

Trading recommendations for October 20

Since there are no important statistics scheduled for release today, the attention of traders will be focused on Brexit negotiations, which, until, has not been settled yet. A bad news will resume the downward trend in the pair, while a good news, or even lack of any at all, will raise the pound against the US dollar in the market.

- Open a long position when the pound reaches a quote of 1.2962 (green line on the chart), and then take profit around the level of 1.3014 (thicker green line on the chart).

- Open a short position when the pound reaches a quote of 1.2930 (red line on the chart), and then take profit at least at the level of 1.2877. Bad news on Brexit will resume the downward trend in the GBP/USD pair.