Outlook on November 9:

Analytical overview of major pairs on the H1 TF:

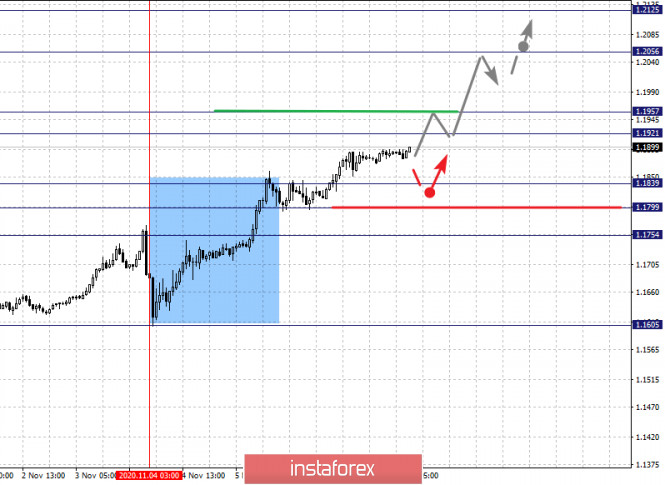

The key levels for the euro/dollar pair are 1.2125, 1.2056, 1.1957, 1.1921, 1.1839, 1.1799 and 1.1754. The development of the upward pattern from November 4 is being followed here. Now, a short-term growth is expected in the range of 1.1921 - 1.1957. If the last value breaks down, it will lead to the development of a strong movement. In this case, the potential goal is 1.2056. For the potential value for the top, we consider the level of 1.2125. Upon reaching which, we expect consolidation and downward pullback.

A short-term decline, in turn, is expected in the range of 1.1839 - 1.1799. If the last value breaks down, it will lead to a deep correction. Here, the target is 1.1754, which is the support for the top.

The main trend is the upward structure from November 4

Trading recommendations:

Buy: 1.1921 Take profit: 1.1955

Buy: 1.1958 Take profit: 1.2055

Sell: 1.1839 Take profit: 1.1800

Sell: 1.1795 Take profit: 1.1755

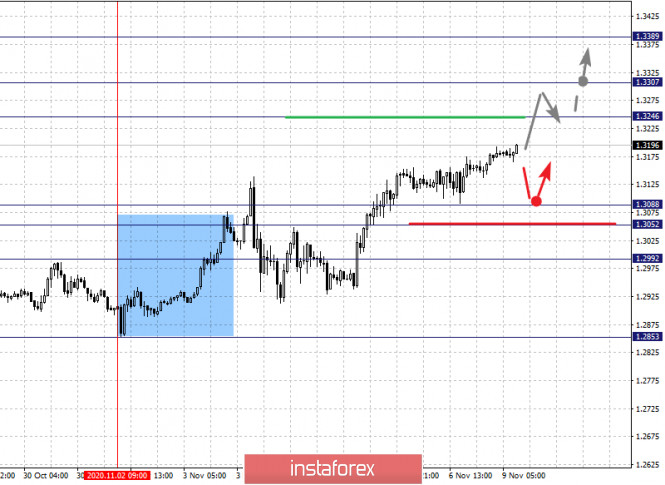

The key levels for the pound/dollar pair are 1.3389, 1.3307, 1.3246, 1.3088, 1.3052 and 1.2992. Here, we are following the formation of the rising pattern from November 2. At the moment, we expect to reach the level of 1.3246. On the other hand, there is a short-term growth and consolidation in the range of 1.3246 - 1.3307. For the potential value for the top, we consider the level of 1.3389. Upon reaching which, a downward pullback can be expected.

Meanwhile, a short-term decline is expected in the range of 1.3088 - 1.3052. In case of breaking through the last value, it will lead to a deep correction. The goal here is 1.2992, which is a key support for the top.

The main trend is the formation of an upward potential from November 2

Trading recommendations:

Buy: 1.3247 Take profit: 1.3306

Buy: 1.3308 Take profit: 1.3387

Sell: 1.3088 Take profit: 1.3053

Sell: 1.3050 Take profit: 1.2994

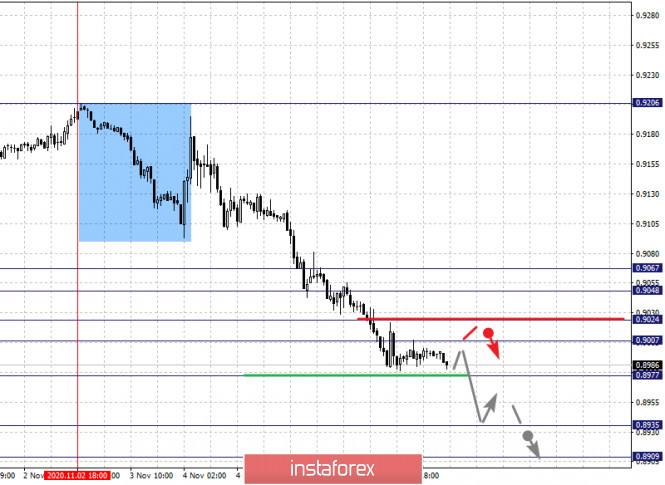

The key levels for the dollar/franc pair are 0.9067, 0.9048, 0.9024, 0.9007, 0.8977, 0.8935 and 0.8909. The formation of the descending structure from November 2 is being followed here. The pair is expected to decline further after the level of 0.8977 breaks down. In this case, the goal is 0.8935. For the potential value for the bottom, we consider the level of 0.8909. Upon reaching which, price consolidation and upward pullback is expected.

A short-term upward movement is possible in the range of 0.9007 - 0.9024. If the last value breaks down, it will lead to a deep correction. The goal here is 0.9048, which is the key support for the downward structure. Meanwhile, we expect the formation of the top of the initial conditions for the upward cycle in the range of 0.9048 - 0.9067.

The main trend is the descending structure from November 2

Trading recommendations:

Buy : 0.9007 Take profit: 0.9023

Buy : 0.9025 Take profit: 0.9048

Sell: 0.9075 Take profit: 0.8937

Sell: 0.8933 Take profit: 0.8910

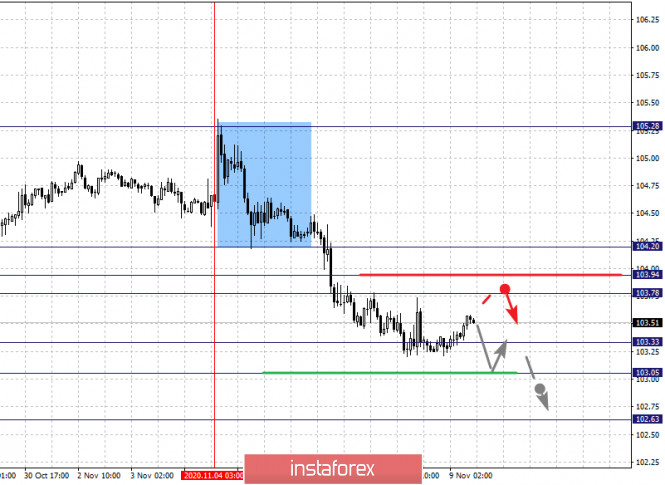

The key levels for the dollar/yen are 104.20, 103.94, 103.78, 103.33, 103.05 and 102.63. The development of the descending pattern from November 4 is being followed here. Now, the decline is expected to continue after breaking through the level of 103.33. In this case, the goal is 103.05. Price consolidation, in turn, is near this level. If the goal breaks down, it will lead to a strong decline. Here, the potential target is 102.63.

A short-term rise is likely in the range of 103.78 - 103.94. In case that the last value breaks down, it will lead to a deep correction. The goal is 104.20, which is the key support for the downward structure.

The main trend is the downward trend from November 4

Trading recommendations:

Buy: 103.78 Take profit: 103.93

Buy : 103.96 Take profit: 104.20

Sell: 103.33 Take profit: 103.07

Sell: 103.03 Take profit: 102.65

The key levels for the USD/CAD pair are 1.3166, 1.3107, 1.3062, 1.2997, 1.2901 and 1.2828. Here, we are following the development of the descending structure from November 2. The decline is expected to continue after breaking through the level of 1.2997. In this case, the goal is 1.2901 and price consolidation is near this level. For the potential value for the bottom, we consider the level of 1.2828. Upon reaching which, consolidation and a pullback into correction is expected.

A short-term growth, on the other hand, is possible in the range of 1.3062 - 1.3107. If the last value breaks down, it will lead to a deep correction. The goal here is 1.3166, which is the key support for the downward structure.

The main trend is the descending structure from November 2

Trading recommendations:

Buy: 1.3062 Take profit: 1.3106

Buy : 1.3109 Take profit: 1.3165

Sell: 1.2995 Take profit: 1.2903

Sell: 1.2900 Take profit: 1.2830

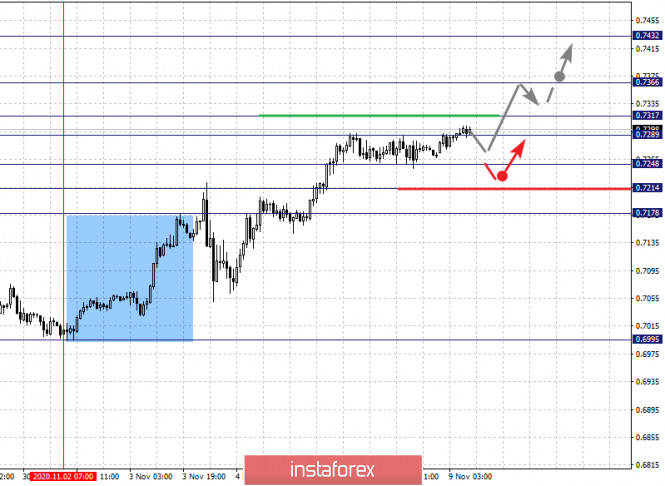

The key levels for the AUD/USD pair are 0.7432, 0.7366, 0.7317, 0.7289, 0.7248, 0.7214 and 0.7178. We continue to monitor the formation of the rising pattern from November 2. Now, a short-term rise is expected in the range of 0.7289 - 0.7317. If the last value breaks down, it will lead to a strong rise. Here, the target is 0.7366 and price consolidation is near this level. For the potential value for the top, we consider the level 0.7432. A downward pullback is likely upon reaching this level.

In turn, a short-term decline is expected in the range of 0.7248 - 0.7214. If the last value breaks down, a deep correction will occur. Here, the target is 0.7178, which is the key support for the top.

The main trend is the upward cycle from November 2

Trading recommendations:

Buy: 0.7319 Take profit: 0.7365

Buy: 0.7368 Take profit: 0.7431

Sell : 0.7246 Take profit : 0.7216

Sell: 0.7212 Take profit: 0.7180

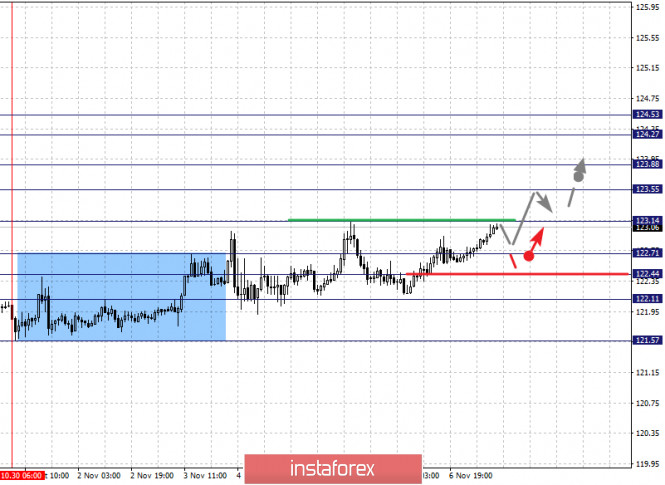

The key levels for the euro/yen pair are 124.53, 124.27, 123.88, 123.55, 123.14, 122.71, 122.44, 122.11 and 121.57. The rising pattern from October 30 which is considered as the main structure is being followed here. At the moment, growth is expected to continue after breaking through the level of 123.14. In this case, the goal is 123.55. Meanwhile, there is a short-term growth and consolidation in the range of 123.55 - 123.88. Now, if the level of 123.90 breaks down, it will lead to a strong movement. Here, the target is 124.27. For the potential value for the top, we consider the level of 124.53. Upon reaching which, price consolidation and downward pullback is expected.

A short-term downward movement, possibly in the corridor 122.71 - 122.44, a breakdown of the last value will lead to a deep correction, here the target is 122.11, this level is a key support for the top.

The main trend is the upward structure from October 30

Trading recommendations:

Buy: 123.16 Take profit: 123.53

Buy: 123.56 Take profit: 123.86

Sell: 122.70 Take profit: 122.45

Sell: 122.42 Take profit: 122.11

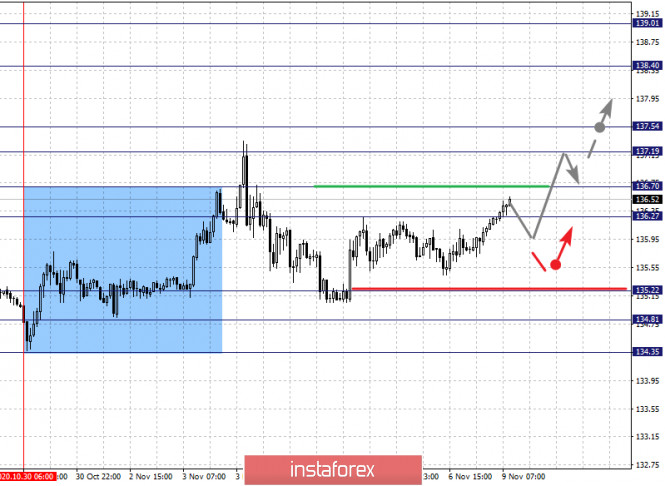

The key levels for the pound/yen pair are 139.01, 138.40. 137.54, 137.19, 136.70, 136.27, 135.22, 134.81 and 134.35. Here, we follow the formation of the potential for the top from October 30. A short-term growth is possible in the range of 136.27 - 136.70. Now, we expect the upward trend to continue after the level of 136.70 breakdown. In this case, the target is 137.19. On the other hand, there is a short-term rise and consolidation in the range of 137.19 - 137.54. If the level of 137.55 breaks down, it will lead to a strong growth. The target here is 138.40. As a potential value for the top, we consider the level of 139.01. Upon reaching which, price consolidation and downward pullback is possible.

A short-term decline is possible in the range of 135.22 - 134.81. If the last value breaks down, it will lead to the development of a downward trend. In this case, the goal is 134.35.

The main trend is the upward structure from October 30

Trading recommendations:

Buy: 136.27 Take profit: 136.68

Buy: 136.72 Take profit: 137.19

Sell: 135.20 Take profit: 134.81

Sell: 134.78 Take profit: 134.35

The material has been provided by InstaForex Company - www.instaforex.com