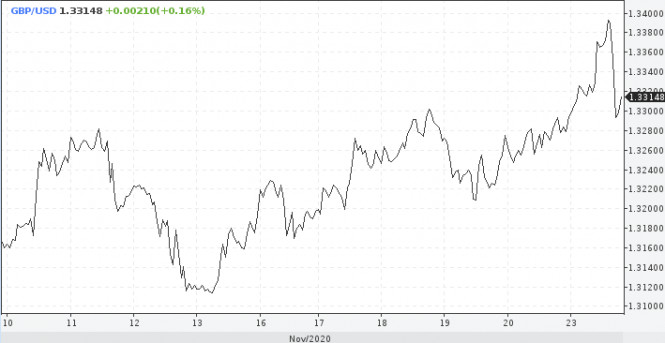

This week, the traders' attention will be set on the pound, which was tearing up on Monday, obsessed with hopes of a Brexit deal. Buyers of the GBP/USD pair managed to push the rate above 1.33. The EU's Chief negotiator said that fundamental differences remain, but both sides persist in concluding a trade pact.

According to European officials, the trade deal is 95% agreed. Meanwhile, it became known earlier that the parties temporarily suspended the dialogue, because one of the negotiators was diagnosed with coronavirus. Currently, work in this area is carried out in a remote format. The pound's growth was also favored by optimistic retail data and the weakness of the dollar, which faced another wave of sales on Monday. US Treasury Secretary Steven Mnuchin said that negotiations on a new package of stimulus measures will continue in the near future. The epidemiological situation in the United States is deteriorating and may lead to new restrictive measures and the inevitable recession of the country's economy.

So, the "buy on expectations, sell on facts" strategy will be fundamental until the Brexit situation becomes clearer. This means that the GBP/USD pair has a real chance to test the psychological resistance of 1.35.

The dollar weakened to a near 3-month low against a basket of currencies today. In addition to the above factors, this was helped by optimism about the next COVID-19 vaccine. AstraZeneca said that its drug showed an effectiveness of about 90%. The pharmaceutical company will be ready to provide data to authorities around the world who would like to use this vaccine. In any case, the news helps to overshadow concerns about economic growth. However, the continued threat of a slowdown may help slow the dollar's decline. In the US session, the dollar index bounced from the technical support level of 92 points, which in the event of a breakdown may signal further weakness of the US currency. The greenback rebound interrupted the growth of world currencies, including the pound.

Following the publication of strong statistics on business activity in the United States, the rate rose sharply. This state of affairs may force the Federal Reserve to postpone aggressive stimulus measures. Perhaps the regulator will prefer to wait until the updated composition of the Congress begins in January.

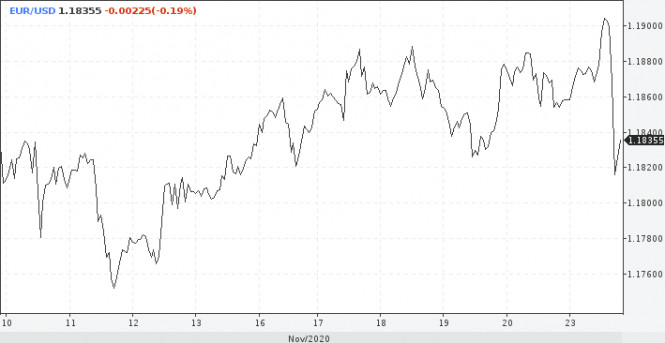

The euro strengthened on Monday, the exchange rate briefly broke through the 1.19 mark. It was impossible to stay on it, followed by a deeper pullback due to the behavior of the dollar. Part of the decline in the euro is due to weak macroeconomic data for the Euro area. Consumer confidence has fallen on a predictable trajectory. The index fell to minus 17.6 points (forecast minus 17.7 points). This is a kind of hint that the economy will still experience a shock from repeated coronavirus measures.

Meanwhile, market strategists continue to believe that the next target for the euro will be its September high around 1.2010, followed by the February 2018 peak of -1.25.