To open long positions on GBP/USD, you need:

A fairly good signal to sell the British pound appeared last Friday afternoon. And it seemed like it went down, the movement gained 20 points three times, but then it stopped. The bad data on the deterioration of consumer sentiment in the US surprised with its numbers and also disappointed buyers of the US dollar. This is primarily due to the lack of a compromise between Republicans and Democrats on a new package of measures to help the economy and the Americans, as well as because of the new wave of the coronavirus pandemic, which forces them to resort to measures of social distancing and isolation. Let's take a look at the deal. If you look at the 5-minute chart, you will see how the bears formed a false breakout in the resistance area of 1.3172 and the pair returns to the area under this range, above which the bulls can no longer climb. Testing this level from the bottom up led to producing a signal to sell the pound, which I drew attention to in my Friday review.

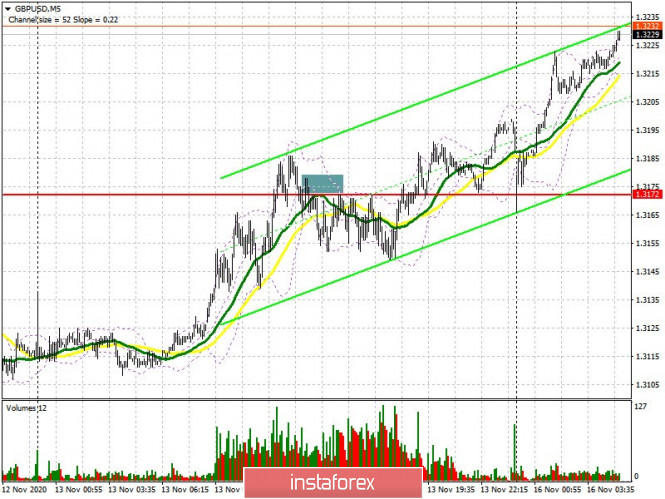

The situation for buyers of the pound has not changed much. It just changed the goals that the bulls will stick to at the beginning of this week. The initial challenge for the first half of the day is to defend support at 1.3172, which will only be tested if the bullish Asian momentum wanes. Forming a false breakout there will stop the bears, which will give confidence to buyers and return GBP/USD to the resistance area of 1.3248, which they are striving for. Speeches by representatives of the Bank of England, which are scheduled for today, can support the pound, provided that they do not mention negative interest rates, which, obviously, will be introduced early next year. In the meantime, getting the pair to settle above the resistance of 1.3248 forms a new entry point into long positions in hopes for GBP/USD to continue rising and reach the high of 1.3310, where I recommend taking profits. The next target will be resistance at 1.3378, but it will require a good reason for an update. In case bulls are not active in the 1.3172 area, it is best not to rush and hold off from long positions until a new low of 1.3106 has been tested, where you can buy the pound immediately on a rebound, counting on a correction of 20-30 points within the day.

To open short positions on GBP/USD, you need:

The bears have taken a wait-and-see attitude and the main focus is on protecting the resistance of 1.3248. How sellers behave at this level today will determine the pair's succeeding direction. If buyers are not active, then a false breakout in the 1.3248 area will be the first signal to open short positions in the pound, in hopes for it to fall to support 1.3172, which is now the middle of the horizontal channel. It will be possible to say that the bears have taken the market under their control only when they have successfully settled below 1.3172, which will quickly pull the pound to the lower border of this channel at 1.3106. Only its breakout will show that the bearish trend has returned, which could pull down the pound to new lows of 1.3034 and 1.2976, which is where I recommend taking profits. In case bears are not active at 1.3248, it is best to postpone short positions until the test of the monthly high of 1.3310, or sell the pound immediately on a rebound from resistance at 1.3378, counting on a correction of 20-30 points within the day.

Let me remind you that the Commitment of Traders (COT) report for November 3 showed a reduction in long positions and a slight increase in short positions. Long non-commercial positions fell from 31,799 to 27,701. At the same time, short non-commercial positions slightly rose from 38,459 to 38,928. As a result, the negative non-commercial net position was 11,227 against 6,660 a week earlier, which indicates that the sellers of the British pound retain control and also shows their minimal advantage in the current situation.

Indicator signals:

Moving averages

Trading is carried out above 30 and 50 moving averages, which indicates the likelihood of maintaining the bullish momentum formed during the Asian session.

Note: The period and prices of moving averages are considered by the author on the H1 hourly chart and differs from the general definition of the classic daily moving averages on the daily D1 chart.

Bollinger Bands

In case the pair falls, support will be provided by the lower border of the indicator in the 1.3145 area.

Description of indicators

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 50. It is marked in yellow on the chart.

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 30. It is marked in green on the chart.

- MACD indicator (Moving Average Convergence/Divergence — convergence/divergence of moving averages) Quick EMA period 12. Slow EMA period to 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-commercial speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between short and long positions of non-commercial traders.