To open long positions on GBP/USD, you need:

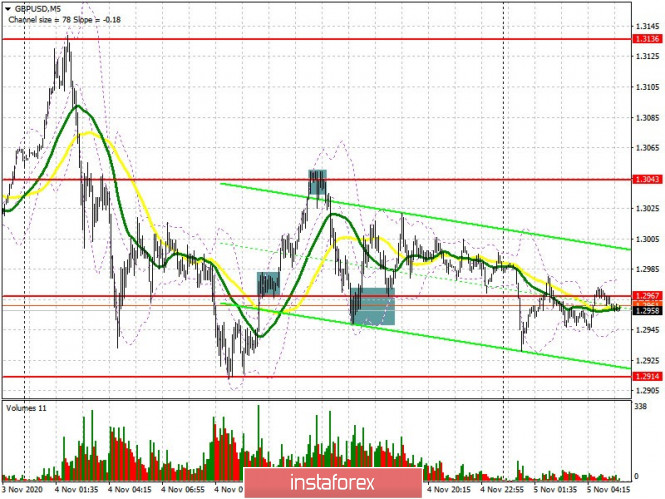

The British pound drew quite a lot of entry points yesterday, both in buying and selling. Let's try to deal with them all. The bears began to actively defend support at 1.2914 after the pair fell in the first half of the day, where a false breakout produced a fairly good signal to buy the pound, which was fully implemented. Towards lunchtime, the bulls regained resistance at 1.2967 and settled on it, which produced another signal to buy the pound in order to continue the upward trend. And this signal worked and brought about 70 points of profit, as the price reached the target level of 1.3043. Forming a false breakout on it brought back sellers to the market and quickly dumped the pound back to the support of 1.2967, testing it from top to bottom, after the bears' unsuccessful attempt to go even lower, led to producing a buy signal. However, it was less successful, although the upward movement was more than 40 points. I marked all entry points on the chart.

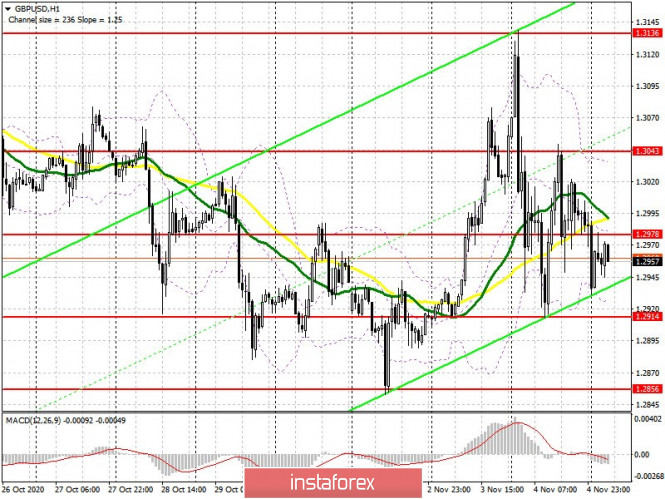

The picture has slightly changed at the moment, although the key levels have remained in place. Bulls are focused on getting control of resistance at 1.2978, which is also the middle of the horizontal channel. Moving averages also pass above this level, playing on the side of the pound sellers. A confident breakout and being able to test this level from top to bottom forms a good entry point into long positions in hopes to continue the upward movement and updating the 1.3043 high, where I recommend taking profits. You can count on going beyond this range following the Bank of England meeting on monetary policy. If the rate is shifted towards stimulating the economy, it will support the pound and lead to updating a new high of 1.3136. In case the pair falls in the first half of the day, it is best to wait for a false breakout near the lower border of the horizontal channel at 1.2914, similar to yesterday, and buy the pound afterwards, in hopes to bring back the pair's growth. Lack of activity in this area could pull down GBP/USD to a low of 1.2856, on which the further major upward movement of the pair depends. You can open long positions from it, counting on a rebound of 30-40 points within the day.

To open short positions on GBP/USD, you need:

Pound sellers are aiming for support at 1.2914. A breakout and getting the pair to settle below this range will form a new entry point for short positions, which will cause the pound to fall to a low of 1.2856, on which the current bull market depends. A breakout and being able to settle below this range will lead to removing a number of buy stop orders, which will pull down the pound to the 1.2807 and 1.2749 areas, where you can observe a slight upward correction. However, such a scenario will only be realized if Donald Trump wins the US presidential election, or if the Bank of England announces the introduction of negative interest rates. In case bears are not active and the pair grows in the first half of the day, it is best to think about selling only when a false breakout forms in the resistance area of 1.2978. You can open short positions in GBP/USD immediately for a rebound only from a high of 1.3043, counting on a correction of 20-30 points within the day.

The Commitment of Traders (COT) reports for October 27 showed a reduction in both short and long positions. Long non-commercial positions fell from 39,836 to 31,799. At the same time, short non-commercial positions fell from 41,836 to 38,459. As a result, the negative non-commercial net position was at -6,660, against -2,000 a week earlier, which indicates that the sellers of the British pound retained control and also shows their minimal advantage in the current situation.

Indicator signals:

Moving averages

Trading is carried out below 30 and 50 moving averages, which indicates an attempt by the bears to control the market.

Note: The period and prices of moving averages are considered by the author on the H1 hourly chart and differs from the general definition of the classic daily moving averages on the D1 daily chart.

Bollinger Bands

A break of the lower border of the indicator in the 1.2935 area will increase the pressure on the pound. Growth will be limited in the area of the upper level of the indicator at 1.3040.

Description of indicators

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 50. It is marked in yellow on the chart.

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 30. It is marked in green on the chart.

- MACD indicator (Moving Average Convergence/Divergence — convergence/divergence of moving averages) Quick EMA period 12. Slow EMA period to 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-commercial speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between short and long positions of non-commercial traders.