Overview :

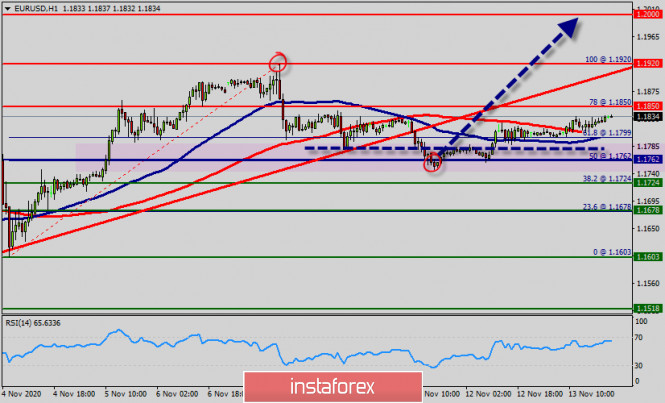

The EUR/USD pair is trading mainly with growth in the range of 1.1920, after falling to a last-week low (1.1762). The market closed at the price of 1.1834.

On the hourly chart, the pair remains above the MA (100) H1 moving average line (1.1850). The situation is similar on the four-hour chart.

The EUR/USD pair rebounded to 1.1762 last week but failed to extend gain and retreated sharply.

In this situation, it is probably worth continuing to stick to the uptrend direction in trade, and look for exit points to buy. The most likely range of price movement today may be hidden within the range of 1.1762 - 1.1920.

Initial bias is neutral this week first. On the upside, break of 1.1850 will reaffirm the case that consolidation from 1.1850 has completed at 1.1920. Further rise would be seen to retest 1.1920 high.

The EUR/USD pair will face resistance at the level of 1.1920, while minor resistance is seen at 1.1850. Support is found at the levels of 1.1762 and 1.1724.

Also, it should be noted that a daily pivot point has already set at the level of 1.1762.

Equally important, the EUR/USD pair is still moving around the key level at 1.1762, which represents a daily pivot in the H1 time frame at the moment.

Yesterday, the EUR/USD pair will be continued to move upwards from the level of 1.1762.

The level of 1.1762 is expected to act as major support today. From this point, we expect the EUR/USD pair to continue moving in the bullish trend from the support level of 1.1762 towards the target level of 1.1850.

If the pair succeeds in passing through the level of 1.1850, the market will indicate the bullish opportunity above the level of 1.1850 in order to reach the second target at 1.1920.

Consequently, the market is likely to show signs of a bullish trend. In other words, rebuy orders are recommended above 1.1920 with the third target at 1.2000.

Then, the pair is likely to begin an ascending movement to 1.1920 mark and further to 1.2000 levels. The level of 1.2000 will act as strong resistance, and the double top is already set at 1.1920.

However, break of 1.1724 support will turn bias to the downside to extend the consolidation with another falling leg.

if the pair fails to pass through the level of 1.1920, the market will indicate a bearish opportunity below the level of 1.1920.

So, the market will decline further to 1.1762 in order to return to the daily . Moreover, a breakout of that target will move the pair further downwards to 1.1724.

Conclusion :

- The EURUSD pair keeps its stability above 1.1762, which adds more support to the occasions of achieving more rise in the upcoming sessions and resume the main bullish trend, paving the way to head towards 1.1850 as a next main station, noting that holding above 1.1920 is important to continue the positive trades.

Technical levels for 16/11/2020

- Resistance 3 : 1.2000

- Resistance 2 : 1.1920

- Resistance 1 : 1.1850

- Pivot point : 1.1762

- Support 1 : 1.1724

- Support 2 : 1.1678

- Support 3 : 1.1603