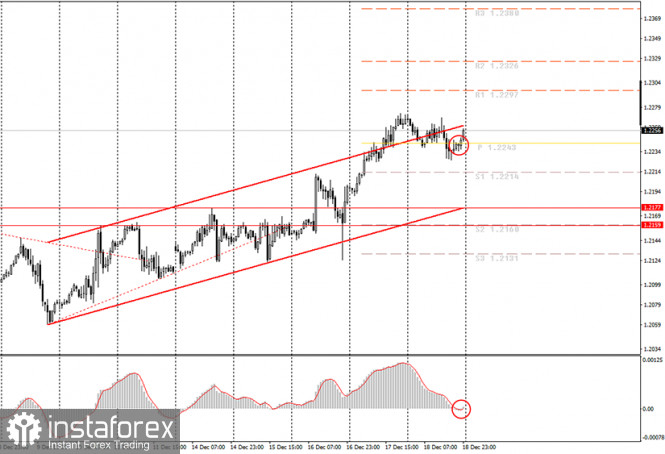

The hourly chart of the EUR/USD pair.

The EUR/USD currency pair started the weakest downward correction during the fifth trading day of the week. A little earlier, the pair's quotes went above the ascending channel. However, on Friday, they still returned to it. Thus, since the price was adjusted all day, novice traders were deprived of new buy signals. Recall that we have an ascending channel at our disposal, thus, we are considering buy orders. However, by the very end of the trading day, the MACD indicator still formed a buy signal, and novice traders could even work it out. That is, according to the reversal of the MACD indicator upward, traders could open new purchases and now wait for the opening of trading on Monday. Last Monday, the markets opened with a "gap". We hope that this will not happen tomorrow. Based on all of the above, the price has an excellent chance of continuing to move up. Now it is generally impossible to conclude that the upward trend is nearing completion. Sellers still refuse to enter the market.

On Friday, December 18, the European Union and the United States did not publish a single macroeconomic report. There was also other news. It should be understood that the matter is approaching first to the Catholic Christmas, and then to the New Year. Many politicians and deputies go on vacation, and in principle, events in the foreign exchange market are becoming much less. There's not much to say about the European Union right now. The ECB meeting is over, the economic recovery fund and the budget for 2021-2027 are unblocked, and vaccination against the "coronavirus" will soon begin. In the US, Donald Trump is losing time after time in attempts to turn the results of the presidential election. Democrats and Republicans continue to try to agree on a $ 900 billion aid package for the American economy, and vaccination against the "coronavirus" is also beginning in the United States. Thus, the fundamental background is now as neutral as possible, however, the euro currency continues to feel better than the US dollar.

No important publications are scheduled for the first trading day of the week in the EU and the US. However, an extremely small number of macroeconomic publications and other events are planned for this week. On the other hand, what difference does it make if the markets still don't work out the news and reports? We expect a drop in volatility this week, as some traders will already start to leave the markets ahead of the Christmas and New Year holidays.

On December 21, the following scenarios are possible:

1) Long positions remain relevant at the moment, as the upward trend continues. At the end of Friday, a new buy signal was even formed, according to which novice traders could open long positions with the targets of the resistance levels of 1.2297 and 1.2326. As for new purchases, until tomorrow morning, while maintaining the current signal, you can still try to have time to "jump on the train", however, it should be remembered that volatility may decrease.

2) Trading on the downside now looks impractical, as there is a clear upward trend. Thus, sellers need to wait for either the completion of this upward trend, or the formation of a downward one, and only then consider the possibility of opening sales. The most likely signal will be a consolidation below the current ascending channel.

What's on the chart:

Price support and resistance levels – target levels when opening purchases or sales. You can place Take Profit levels near them.

Red lines – channels or trend lines that display the current trend and show which direction is preferable to trade now.

Up/down arrows – show when you reach or overcome what obstacles you should trade for an increase or decrease.

MACD indicator (14,22,3) – a histogram and a signal line, the intersection of which is a signal to enter the market. it is recommended to use it in combination with trend lines (channels, trend lines).

Important speeches and reports (always contained in the news calendar) can greatly influence the movement of the currency pair. Therefore, during their exit, it is recommended to trade as carefully as possible or exit the market to avoid a sharp reversal of the price against the previous movement.

Beginners in the Forex market should remember that every trade cannot be profitable. The development of a clear strategy and money management is the key to success in trading over a long period.

The material has been provided by InstaForex Company - www.instaforex.com