Global stock indexes turned green on the wave of bullish sentiment, everything is as good as it may seem at first glance.

The pace of growth in the indices was set against the background of positive news from the United States, where Health Minister Alex Azar said that the first two American coronavirus vaccines will be available in the United States by December 25.

According to the Minister of Health during a CBS broadcast, "A week ago, Pfizer submitted an application to the US food and drug administration for emergency approval for the use of a vaccine developed by the company. Moderna, meanwhile, intends to submit a similar application on November 30. Approval will not take as long as we can see both vaccines coming out and getting into people's hands before Christmas."

In turn, US Vice President Mike Pence told governors on Monday that the spread of the coronavirus vaccine could begin by the third week of December, signaling that US regulators will quickly approve an emergency permit for the first vaccinations.

"We strongly believe that the vaccine distribution process can begin in the week of December 14," Pence told the governors.

The market reacted very positively to the news on the early launch of drugs to the masses, dollar positions instantly became relevant throughout the Forex market.

On Monday, Federal Reserve Chairman Jerome Powell spoke about the impact of the COVID-19 vaccine on the U.S. economy.

Powell believes that news about the development of a vaccine against the virus is quite positive for the United States economy in the medium term, since success in the fight against COVID-19 will largely determine growth.

The Head of the Federal Reserve also noted that the economic outlook is extremely uncertain and will largely depend on the success of efforts to contain the spread of the virus.

Chief Executive Powell stated that "A full economic recovery is unlikely until people are confident that resuming a wide range of activities is safe."

It is worth recalling that the daily increase in new cases of coronavirus infection in the United States has long exceeded the bar of 100 thousand. The other day, the daily growth has set an absolute record of more than 200 thousand people.

As a result, the market reaction to news on the launch of the vaccine to the masses is exclusively speculative noise, where the main reaction will come only in the medium term.

News has already emerged that Pfizer and BioNTech have requested regulatory approval for their COVID-19 vaccine in the European Union, with approval theoretically possible before the end of the year.

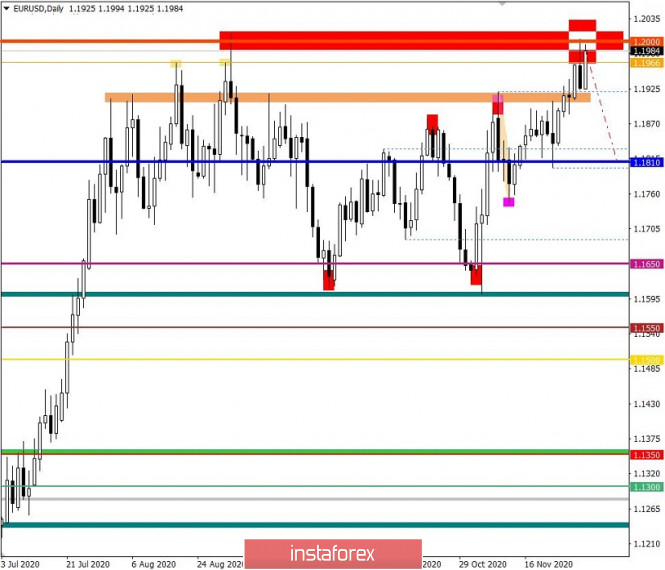

In terms of technical analysis, it can be noticed that the European currency was initially inclined to increase the rate, which led to the price touching the psychological level of 1.2000. The last time this indicator (1.2000) was seen on the market was on September 1. The natural basis associated with the level, as last time, played in favor of reducing the volume of positions in the euro. The lever for increasing the volume of positions in the US dollar was largely the news about the vaccine, as mentioned above. Technical analysis in this case reflected the starting point for euro sales.

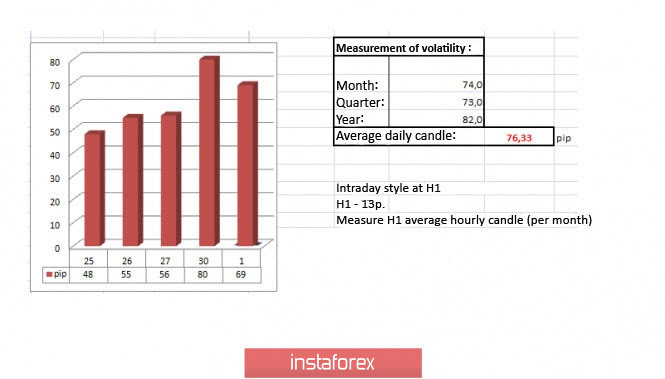

The market dynamics for November 30 was 80 points, which is the highest indicator of daily volatility in five trading days. The coefficient of speculative operations in this period had a high level, which is confirmed by the dynamics on the trading chart.

Analyzing the dynamics of volatility in November, it can be seen that the average daily indicator is 74 points, which is 2.5% lower than the average level. In comparison with the dynamics for October, there is an acceleration of daily volatility by 12%.

November: Monday-33 points; Tuesday-107 points; Wednesday -165 points; Thursday-148 points; Friday-96 points; Monday-125 points; Tuesday-63 points; Wednesday-87 points; Thursday-65 points; Friday-38 points; Monday – 54 points; Tuesday – 50 points; Wednesday – 41 points; Thursday – 66 points; Friday – 40 points; Monday – 105 points; Tuesday – 58 points; Wednesday – 48 points; Thursday – 55 points; Friday – 56 points; Monday-80 points.

On the trading chart in general terms (daily period), it can be seen that the European currency strengthened by 400 points (3.4%) in November, as a result of which the point of maximum deviation of the 18-week side channel of 1.1602/1.2000 was touched.

In terms of the economic calendar, the index of business activity in Europe's manufacturing sector was obtained, where a decrease was recorded from 54.8 points to 53.8 points. Perhaps the most important indicator that was published today is inflation in Europe, where the rate of decline slowed by one-tenth, from -0.3% to -0.2%, deflation persists for the fourth month in a row, which scares already frightened investors.

The current trading chart shows that the euro positions have almost completely recovered from the decline in the last trading day, but the psychological level of 1.2000 still puts pressure on market participants.

The natural basis associated with the 1.2000 coordinate will affect the volume of long positions, another price rebound should not be excluded from consideration.

A drastic change in the market will only be considered if the price is held higher than 1.2000 in the daily period. In this case, buyers will receive support, and the medium-term upward trend will take a new turn.

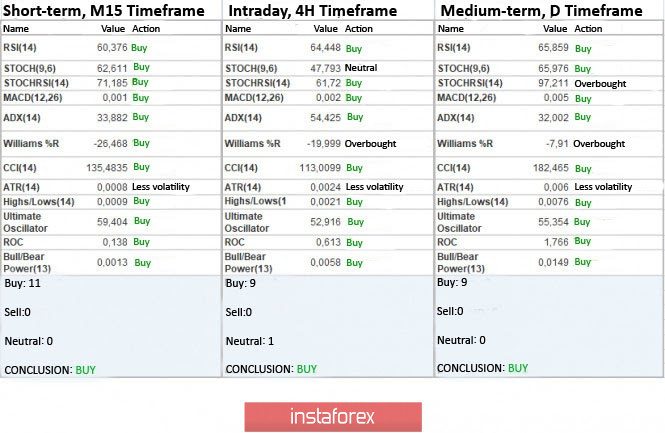

Indicator analysis

Analyzing different sectors of timeframes (TF), it can be seen that the indicators of technical instruments on the minute, hour, and day periods signal a purchase due to price movement within the local maximum.

Weekly volatility / Measurement of volatility: Month; Quarter; Year

The measurement of volatility reflects the average daily fluctuation, calculated per Month / Quarter / Year.

(December 1 was based on the time of the article's publication)

The dynamics of the current time is 69 points, which is quite good and only 9% below the average level. Volatility may still accelerate in the midst of a high speculative ratio.

Key levels

Resistance zones: 1.2000***; 1,2100*; 1,2450**; 1,2550; 1,2825.

Support areas: 1,1890-1,1900-1,1920**; 1,1810*; 1,1700; 1,1612*;1,1500; 1,1350; 1,1250*;1,1180**; 1,1080; 1,1000***.

*Periodic level

**Range level

***Psychological level

The material has been provided by InstaForex Company - www.instaforex.com