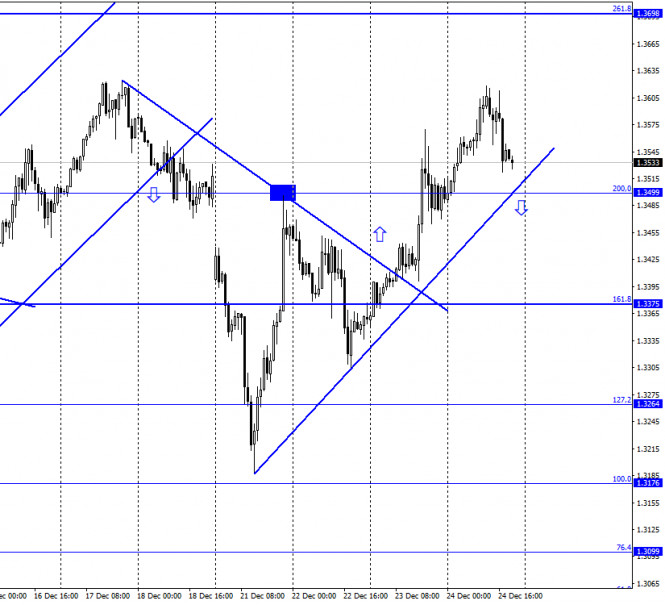

GBP/USD – 1H.

According to the hourly chart, the quotes of the GBP/USD pair continued for some time on December 24, the process of growth over the ascending trend line, which still characterizes the current mood of traders as "bullish". In the afternoon, a reversal was made in favor of the US currency, and the process of falling in the direction of the upward trend line began. The rebound of quotes from this line will work in favor of the British and the resumption of growth in the direction of the corrective level of 261.8% (1.3698). Fixing under it will increase the chances of a further fall in the direction of the Fibo level of 161.8% (1.3375). "The deal is done," Boris Johnson said. The trade deal between the UK and the European Union is fully agreed upon, although few people believed it. Nevertheless, London and Brussels still managed to settle all the disputed issues. Now the case remains small: the agreement must be approved by the parliaments of the UK and the EU. I believe that there will be no special problems with this, even though the time remains until the end of Brexit is catastrophically short. It is already known that if the parliaments do not have time to ratify, the European Council will recognize the agreement as valid, using the corresponding article in EU legislation. This will make it possible to continue trading with Britain without duties and commission from January 1, and parliaments will be able to vote on this agreement later. Today, the foreign exchange market is closed and trading will resume on Monday.

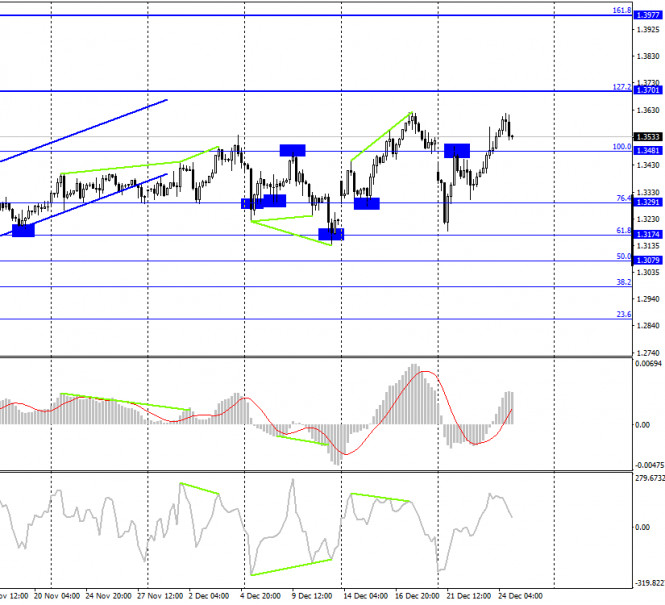

GBP/USD – 4H.

On the 4-hour chart, the GBP/USD pair performed a reversal in favor of the US dollar and also began the process of falling in the direction of the corrective level of 100.0% (1.3481). The rebound of quotes from this level will work in favor of resuming the growth process, and fixing under it will increase the probability of continuing the fall.

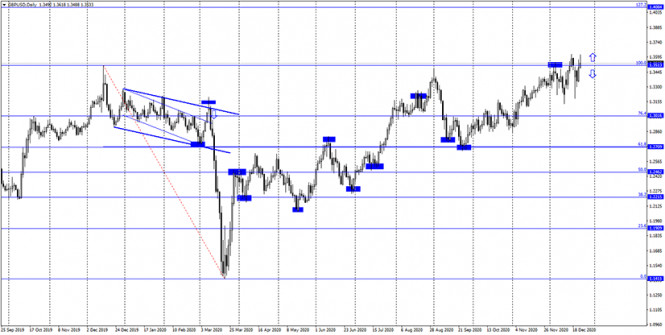

GBP/USD – Daily.

On the daily chart, the pair's quotes returned to the corrective level of 100.0% (1.3513). A new rebound from this level will again work in favor of the US dollar and the beginning of a new fall in the direction of the Fibo level of 76.4% (1.3016).

GBP/USD – Weekly.

On the weekly chart, the pound/dollar pair performed an increase to the second downward trend line. A rebound from it in the long term will mean a reversal in favor of the US dollar and a long fall in the British dollar's quotes.

Overview of fundamentals:

On Thursday, there were no economic reports in the UK, however, the British pound was still trading quite actively.

The economic calendar for the US and the UK:

On December 25, the calendar of economic events in the UK and the US is empty. Markets are closed today.

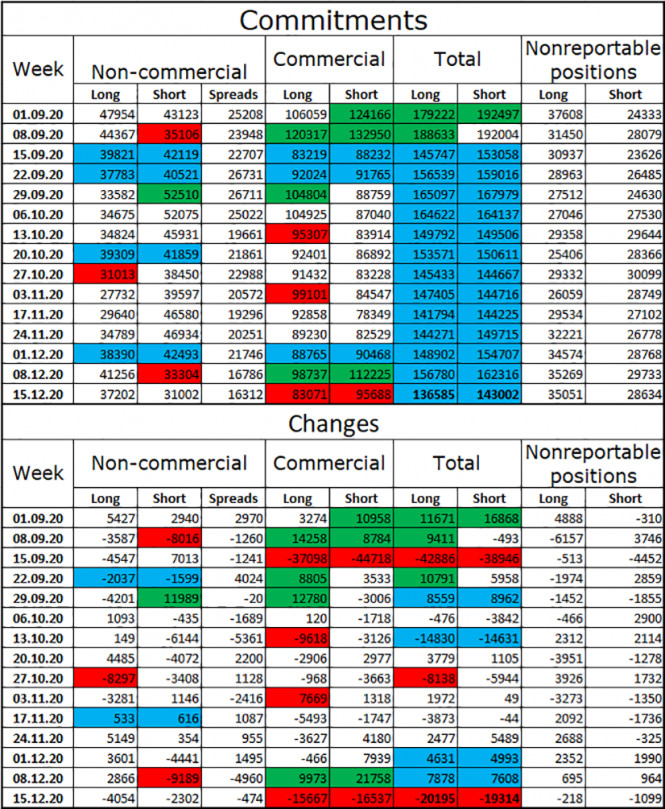

COT (Commitments of Traders) report:

The latest COT report showed that speculators were getting rid of both long and short contracts. This again suggests that traders are afraid of the British and the information background. It is extremely difficult to predict what will happen to the UK economy in 2021. Therefore, the "Non-commercial" category of traders prefers to close trades rather than open new ones. This time, speculators closed 4 thousand long contracts and 2.5 thousand short contracts. Thus, the mood of speculators has become much less "bullish". At the same time, the British continued the growth process, thus, I can draw the same conclusion as for the euro. Major traders are preparing for a new fall in the pound sterling.

GBP/USD forecast and recommendations for traders:

It is recommended to open new purchases of the British dollar on Monday in case of a rebound from the ascending trend line on the hourly chart with the target level of 261.8% (1.3698). I recommend selling the pound sterling when it is fixed under the ascending trend line on the hourly chart with a target of 1.3375.

Terms:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy currency, not for speculative profit, but to ensure current activities or export-import operations.

"Non-reportable positions" - small traders who do not have a significant impact on the price.

The material has been provided by InstaForex Company - www.instaforex.com