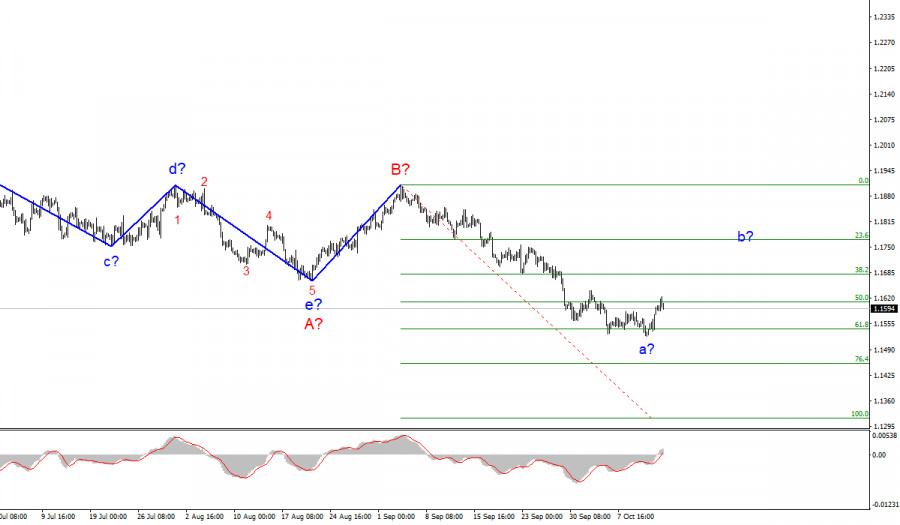

Wave pattern

The wave counting of the 4-hour chart for the Euro/Dollar instrument suffered certain changes after the quotes fell below the low of the previous wave. The construction of the downward trend section has resumed, so now the trend section a-b-c-d-e, which was formed from the very beginning of the year, is interpreted as wave A, and the subsequent increase of the instrument is interpreted as wave B. If this assumption is correct, then the construction of the proposed wave C has now begun and is continuing, which can take a very extended form. Even if it takes a three-wave form, then given the size of its first wave, it will still turn out to be very long. If so, the decline in the quotes of the European currency will resume in a week or two or three. If not, then the entire wave pattern, which still looks quite complicated and not impulsive, may require additional adjustments. This is the problem with corrective structures – they can change very often.

Inflation in the US is accelerating, Bullard and Bostic are talking about tapering

There was practically no news background for the euro and the dollar on Thursday. There was nothing interesting during the day. In America, the producer price index and the number of applications for unemployment benefits were released, but the first report generally met expectations, and the second one caused only a slight increase in demand for the dollar, as it turned out to be better than market expectations. However, both reports are not important, so today's amplitude is only 20 basis points. At the same time, several important speeches by Fed members have already taken place this week, but have practically no effect on the dollar.

Atlanta Fed President Rafael Bostic and St. Louis Fed President James Bullard said they support the idea of reducing the stimulus program as early as November. Bullard stated that high inflation may not necessarily be due to temporary factors, which Fed Chairman Jerome Powell has repeatedly stated. In this regard, the Fed should be ready to take decisive action.

The Fed minutes released Wednesday partly confirm the possible announcement of the completion of QE at the November meeting. Fed members have already started discussing possible volumes of reduction of the bond repurchase program. It is assumed that the first step will be a reduction of $15 billion per month from the current 120 billion. However, many analysts still doubt that this will happen in November. The Fed also has a "dovish" wing, which includes Chair Powell, who clearly does not want to rush to complete the stimulus when the labor market has not fully recovered.

General conclusions

Based on the analysis, I conclude that the construction of the downward wave C will continue, but at this time the corrective wave has begun. Therefore, now I advise you to wait for the completion of this wave, and after that - the sale of the instrument for each downward signal from the MACD, with targets located near the calculated marks of 1.1454 and 1.1314, which corresponds to 76.4% and 100.0% Fibonacci levels.

The wave counting of the higher scale looks quite convincing. The decline in quotes continues and now the downward section of the trend, which originates on May 25, takes the form of a three-wave corrective structure A-B-C. Thus, the decline may continue for several more months until wave C is fully completed.

The material has been provided by InstaForex Company - www.instaforex.com