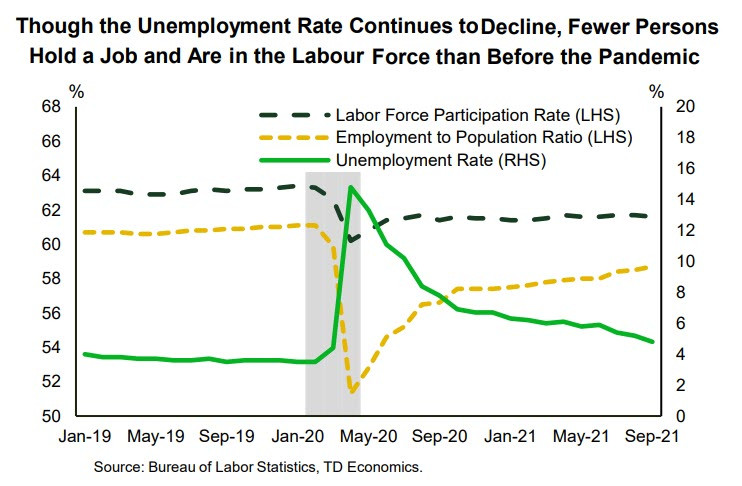

The US employment report for September was disappointing, but the market reacted with restraint, for which there are several reasons. Despite the fact that only 194 thousand new jobs were created over the previous two months, the figure amounted to +169 thousand, which partially offset the negative. Another positivity is that the unemployment rate has fallen from 5.2% to 4.8%, the average working week has increased from 34.6 to 34.8 hours, and most importantly, there is an in average wages from 4.0% to 4.6%. The latter circumstance increases concerns about the approaching stagflation. In any case, inflationary pressure is not decreasing, which is an argument for the Fed to start curtailing incentives even without strong Nonfarm figures.

A sign that the markets interpret the results of the employment report as moderately hawkish is the fact that there was an increase in US Treasures yields during Friday's close, which supported the US dollar. The latter circumstance is probably the key in assessing the market prospects of the dollar – the markets are waiting for its strengthening no matter what.

So, despite the seemingly weak employment report, a number of additional indicators imply that these figures will be enough for the Fed to announce the beginning of a reduction in QE in November. In favor of this scenario, there is also a general reduction in tension associated with an increase in the US debt limit, which allows financing the government at least until December.

Low volatility was expected on Monday since the US markets are closed due to the celebration of Columbus Day. Therefore, the main movements currency market will begin on Tuesday.

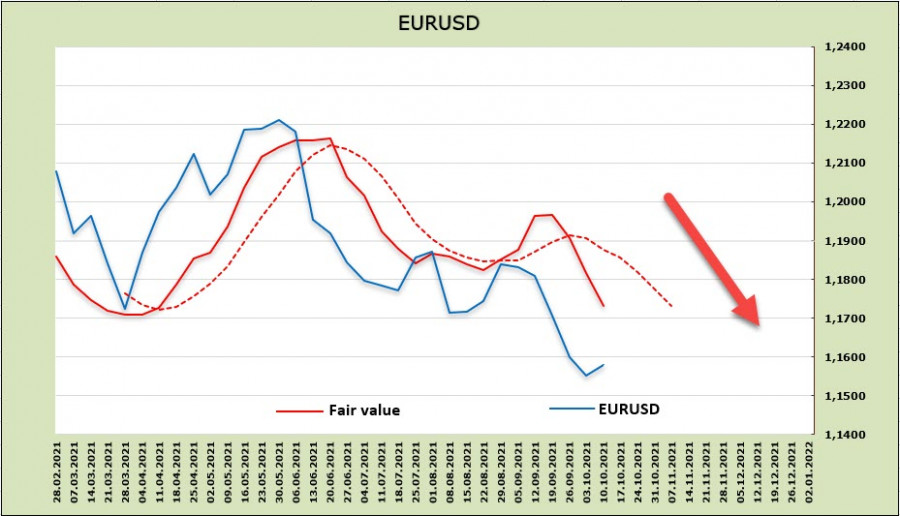

EUR/USD

The prospects for the euro are deteriorating. The CFTC report showed that a net short position on the euro was formed on the futures market for the first time in 18 months. The estimated price is steadily falling, and speculators do not see a bullish reversal for European prospects.

It can be assumed that the bearish pressure will increase. The nearest target is 1.15, which represents a 50% pullback from the 2020 highs. The resistance zone is 1.1660/80, but there is practically no reason why the euro can make a correction in this zone.

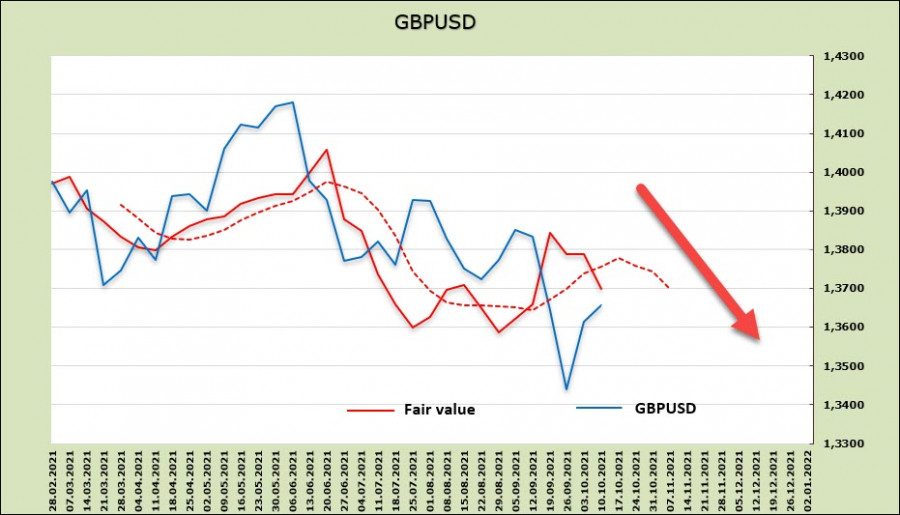

GBP/USD

The pound looks slightly stronger than the euro, but this impression is deceptive – the situation in the UK looks tense for a number of fundamental factors. The FT reports that the EU has rejected the UK's demand to rewrite the Brexit protocol on Northern Ireland. This demand looked a little ultimatum. Britain scares the EU with the use of an article on unilateral withdrawal from the agreement if the EU does not show flexibility, but the EU does not want to show flexibility the way the UK wants.

As for the policy of the Bank of England, a fairly clear hawkish signal appeared over the weekend – Committee member Sanders said that market expectations for rate hikes were "appropriate," and BoE head Bailey added that inflation was a growing threat and needed to be brought under control. Apart from raising the rate, there are no other ways to bring inflation under control if one does not consider the very exotic ways of killing the economy by sharply reducing the money supply and limiting lending.

Despite the fact that the pound rose slightly at the opening on Monday, the settlement price rushed down. The CFTC report turned out to be negative for the pound, and a net short position was formed.

The pound managed to slightly rise above the resistance zone 1.3580/3600, which is facilitated by rising energy prices. Despite the fact that British consumers suffer from high prices, the UK corporate sector, which has a strong raw material component, receives high profits. However, there are practically no long-term factors for continued growth. Thus, we expect the pound to start declining from the current levels. The nearest technical resistance is the level of 1.3720, the long-term target is the support of 1.3170/80.

The material has been provided by InstaForex Company - www.instaforex.com