Buyers of the EUR/USD pair have been trying to develop corrective growth for several days, but the results leave much to be desired. Each conquered point is given with difficulty, and almost every rising wave is replaced by a downside pullback. One step forward– two steps back. Nevertheless, traders were able to approach the first price barrier of 1.1630, which corresponds to the average line of the Bollinger Bands indicator on the daily chart. EUR/USD buyers have been besieging this target for the second day. But as soon as they approach this resistance level, sellers seize the initiative, extinguishing another upside surge. The report published today on the volume of retail sales in the United States only strengthened the position of the greenback, although in general, it continues to be in a vulnerable state.

Based on the results of the past week, it is possible to draw an obvious conclusion that the US currency took a pause and allowed its opponents to organize a corrective counteroffensive in almost all pairs. This behavior of the greenback looks quite logical, given the multi-week period of consistent strengthening. Based on the weekly EUR/USD chart, the pair has been diving down since the beginning of September, and almost recoilless. Having reached the lower line of the Bollinger Bands indicator on W1 (1.1530 mark), the bears moderated their ardor and recorded a profit. The changed fundamental background contributed to this. First of all, the greenback has lost an important trump card in the form of an increase in the Treasury yields. In particular, the yield of 10-year government bonds at the beginning of the week reached its local peak of 1.628 (a 4-month high), after which the indicator turned 180 degrees. The US dollar index, by and large, repeated this trajectory, as it has been repeating it since the beginning of autumn, when the yield of securities was just beginning to grow.

However, the greenback has been strengthening its position all this time not only due to the growth of the Treasury yields. The hawkish attitude of the American regulator is the main locomotive of the USD revaluation. However, this fundamental factor does not "work" in all pairs of the "major" group. For example, when paired with the pound or the New Zealand dollar, the greenback plays the role of an outsider, since the Bank of England and (especially) the Reserve Bank of New Zealand allows the implementation of a "hawkish scenario." RBNZ was the first of the central banks of the leading countries of the world to raise the interest rate at the October meeting, while the English regulator does not rule out such a scenario next year. Therefore, it is much more difficult for dollar bulls to restrain the onslaught of the above-mentioned currencies, since they have the same fundamental trump cards.

Meanwhile, the dollar feels more than comfortable against the yen, "holding and dominating" for several weeks in a row. The Bank of Japan, as you know, assured the markets that it will continue to implement a soft monetary policy. Actually, as does the European Central Bank, whose representatives also take a "dovish" position, stating that the tapering of the PEPP program "will not be the end of the accommodative policy."

All this suggests that the US currency should not be written off, despite the fact that the past five days were not in favor of dollar bulls. The higher timeframes tell us that the EUR/USD pair has been within the downside trend for several months. If over the past 5 weeks the price has decreased by 300 points (from 1.1880 to 1.1530-1.1590), then over the past five and a half months (i.e. since the beginning of June) the pair has "marched" down 700 points, steadily declining from the June maximum of 1.2254. At the same time, the main support level is not located on the lower line of the Bollinger Bands indicator on the daily chart (1.1510), but at 1.1450 - this is the upper limit of the Kumo cloud on the monthly timeframe.

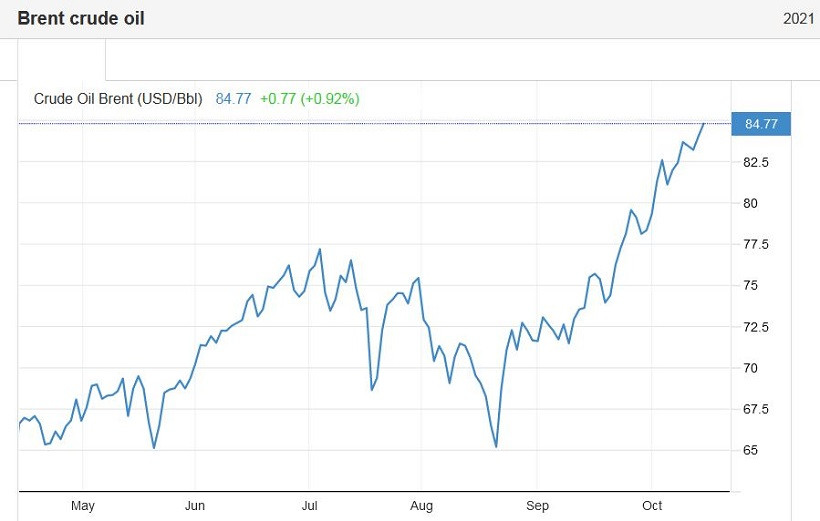

The key problem of dollar bulls is the lack of a powerful information driver capable of giving a new impetus to the downward movement. The minutes of the last meeting of the Fed did not present any surprises – all the announced theses have already been "won back" and taken into account in prices. But American inflation, which showed a very good result in September, may still play a role in the fate of the greenback. The fact that inflation indicators continue to be at high levels suggests that the American regulator may be mistaken in its assumptions about "temporary growth." Especially if we take into account the situation on the oil market – a barrel of Brent crude oil is holding above the $80 mark, and, according to TD Securities forecasts, it may rise to $100 in the next 6 months.

In his speech in Congress at the end of September, Federal Reserve Chairman Jerome Powell said that the Fed "may need to consider raising rates if it sees evidence that rising prices are forcing households and companies to expect higher prices to take root, creating more stable inflation." If this idea is voiced more often by members of the Fed, the dollar will regain self-confidence - at least for a breakthrough to the base of the 15th figure. And here it should be noted that the European currency is deprived of support from the ECB. This fact suggests that any increase in EUR/USD is temporary, corrective in nature.

Thus, if the buyers of the pair in the coming days do not overcome and (most importantly) do not consolidate above the resistance level of 1.1630 (the average line of the Bollinger Bands indicator on D1), then traders should consider the option of short positions with a target of 1.1570 (the Tenkan-sen line on the same timeframe) and 1.1530 (the annual minimum). It is too early to talk about lower values, although in my opinion, in the context of the long-term perspective, the outlines of the 14th figure will become clearer - especially on the eve of the November Fed meeting.

The material has been provided by InstaForex Company - www.instaforex.com