Over the weekend, Bitcoin grew and managed to reach the level of $ 48,682, but failed to break through it. Therefore, if a rebound occurs from this level, a downward correction can begin. The quotes have begun to decline now and are moving towards the support level of $ 46,600. But after breaking through the trend line, the trend has already formed an upward trend. We are talking about the current correction of the crypto asset, and once this is done, the upward movement should resume. In turn, we continue to rely on the fact that Bitcoin will continue to correct and decline to the level of $ 30,000 per coin for the next few months. However, there are no sell signals at the moment, except for the local, corrective one.

Meanwhile, China's central bank did not have time to completely ban cryptocurrencies, and the Fed did not have time to declare that it was not going to completely ban bitcoin, as representatives of the IMF made an official statement, calling on the Central Bank to strengthen regulation of the cryptocurrency sphere. According to IMF analysts, the growing popularity of bitcoin and its price pose risks to financial stability. "The pseudo-anonymity of cryptocurrencies creates data gaps for regulators and can open undesirable avenues for money laundering, as well as terrorist financing. In addition, the cryptocurrency segment falls under different legal norms in different countries, which complicates the coordination of interaction between regulatory authorities around the world," the IMF said in a statement. It can be seen that the reasons for the need to tighten cryptocurrency control remain unchanged: money laundering, tax evasion, terrorist financing. In this matter, we also remain with our original opinion: the leading countries of the world will continue to tighten control over cryptocurrencies.

At the same time, the CEO of the Galaxy Digital cryptocurrency bank, Mike Novogratz, said that most of the cryptocurrencies that have been created over the past decade will not survive until the next one. However, Novogratz is full of optimism about bitcoin and believes that it will change the entire current financial system. He urges market participants not to pay attention to the volatility of bitcoin and tries to look at the whole picture. "Decentralized systems will fundamentally change finance," Novogratz said. In addition, he stated that Bitcoin investors are interested not only in profit, they believe in fundamental changes in the financial system. A rather controversial statement, which is very similar to another attempt by an interested person to increase the demand for bitcoin in order to provoke its further growth. It was repeatedly mentioned that forecasts from the level of "$ 100,000 by the end of the year" can really come true, but their main target is to assure the market that the growth of bitcoin is almost inevitable. In this case, market participants will invest more in the main digital asset, which will continue its growth, bringing profit primarily to those billionaires who distribute these forecasts.

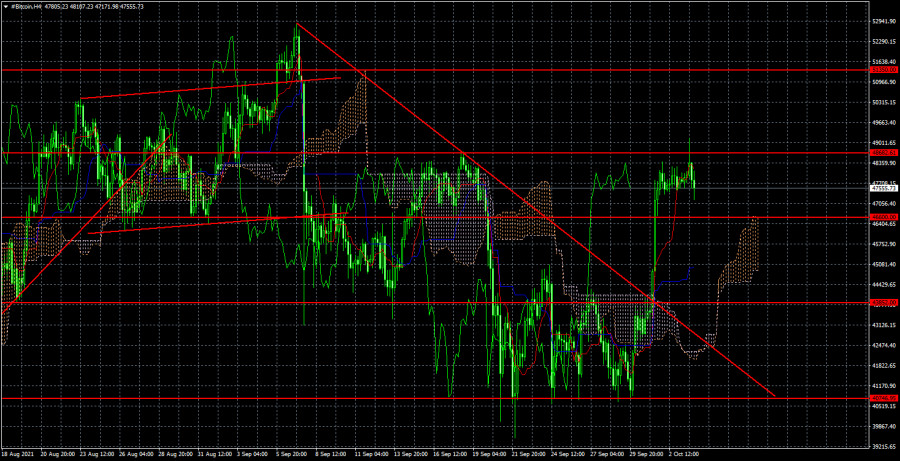

On the four-hour timeframe, the trend changed into an upward one after the price consolidated above the downward trend line and above the Ichimoku cloud. A rebound from the level of $ 48,682 has occurred, thus, a correction with the targets of $ 46,600, $ 43,852, and $ 40,746 is possible. The breakdown of each level will open the way to the next. If the level of $ 48,682 is broken, then one should further buy with the target of $ 51,350.

The material has been provided by InstaForex Company - www.instaforex.com