Bitcoin managed to stabilize the situation near the $58.5k mark, after which the price began to move up and as of 12:00 UTC, it is trading around $61k. At the same time, the technical charts of the coin continue to signal local bearish signals. However, such a rapid recovery of the fall suggests that investors are ready to start a bullish rally of the cryptocurrency. In order to assess the market position in relation to BTC, it is necessary to conduct an on-chain analysis of the coin's indicators.

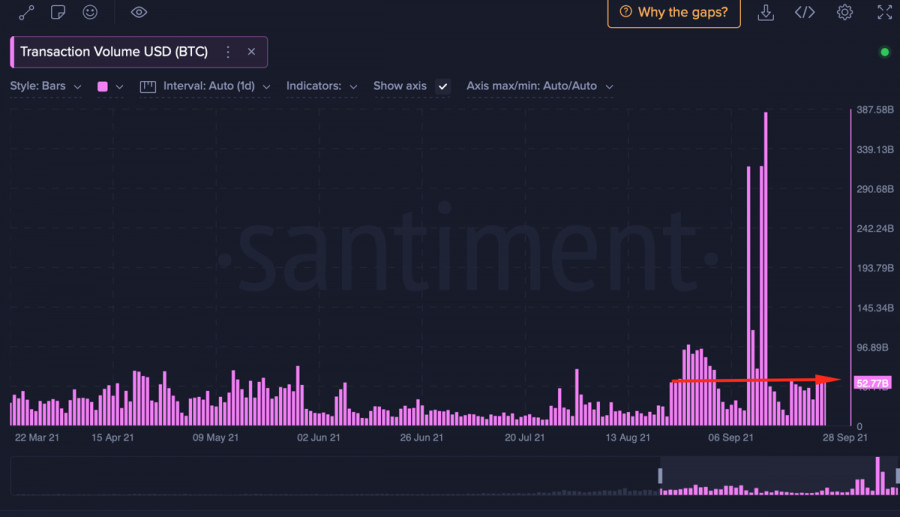

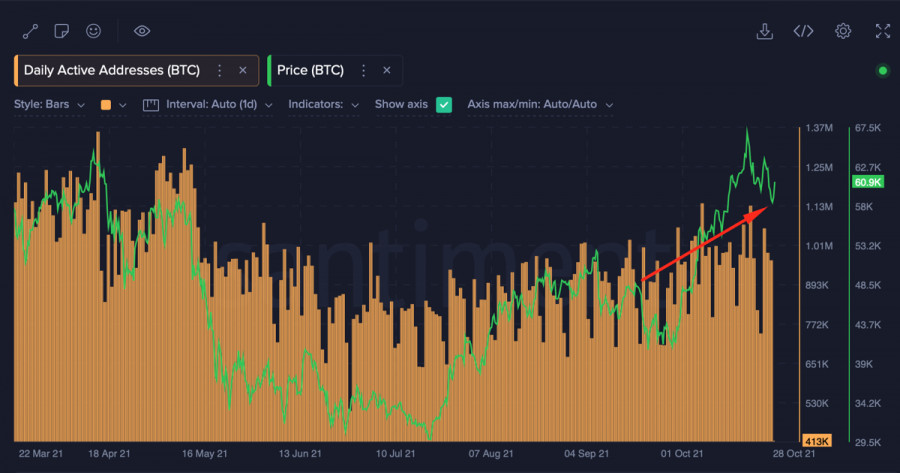

First of all, it is worth starting with the main metrics that reflect the audience's interest in bitcoin. To do this, it is worth using indicators of the number of unique addresses and total transaction volumes. Analyzing Daily Active Addresses, it can be concluded that the BTC audience retains bullish sentiments and conducts transactions in the cryptocurrency network. The number of unique addresses continues to remain in the region of 900,000, at the level of a week ago, during the update of the historical record. This indicates that the market continues to count on the resumption of cryptocurrency growth. Similar dynamics are maintained by the volume of transactions in the Bitcoin network, which also remain at the level of indicators of the period of reaching a new maximum. In general, this confirms the high degree of on-chain activity of the audience and readiness for a bullish rally.

*Learn and analyze

Daily Active Addresses is a metric that determines the number of unique addresses in the cryptocurrency network.

On-chain activity is the actions of cryptocurrency market players who independently manage their crypto assets, which is why the recording goes directly to the main blockchain. These statistics include both private investors and large companies.

MVRV (Market Value to Realized Value) indicator displays the ratio of the market and realized value of a particular cryptocurrency. This metric gives a more objective view of the current value of the coin and the period of the market. The indicator also displays the results of the movement of coins: if the value is below 0, then the players moved coins with a loss, and if it is above 0, then investors have made a profit from operations with coins.

Price consolidation is the period when a certain cryptocurrency is within a narrow horizontal price channel. Usually, this process indicates price stabilization or weakness of market participants (buyers and sellers).

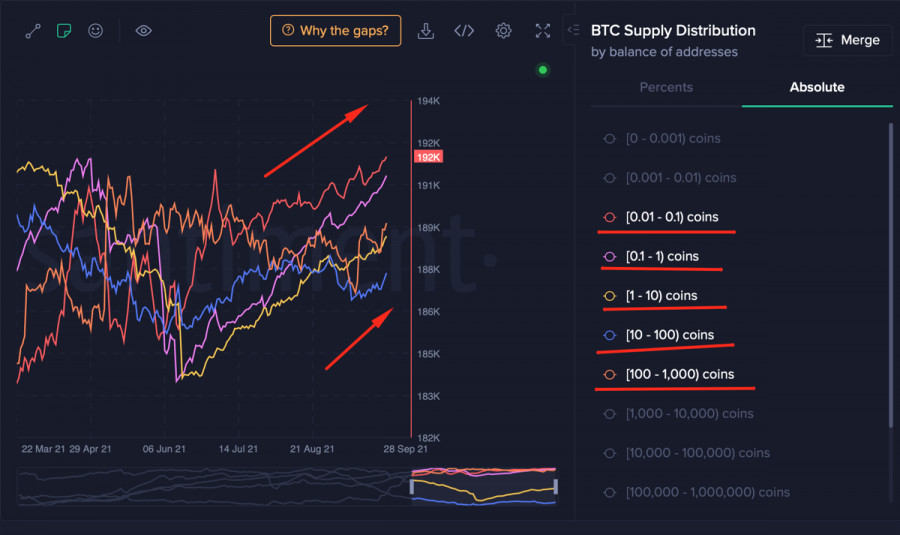

By balance of addresses is an on-chain metric that allows you to see the growth/decline in the number of addresses with certain wallet balances, as well as track the accumulation trend.

Volume of transactions is an indicator that displays the total volumes of transactions performed in the bitcoin network by market participants.

Another important metric that reflects the degree of overbought Bitcoin market is the ratio of the market value to the realized value of the coin. According to this metric, the majority of investors are in the red in the coin buying campaign. The 30-day reading is at -9% and continues to decline, which may be a consequence of the recent sell-off due to a sharp drop in prices. Such a low mark of this metric indicates that the market is in the stage of accumulation and recovery. By tracking this indicator, you can determine the beginning of a bull market: the value will cross the zero mark and continue to grow, which will mean an increase in prices and investors' profits.

Another important point for determining the current and next stage of the market is the analysis of certain categories of addresses and changes in the balances of their wallets. It is worth noting that, based on on-chain metrics, most of the Bitcoin audience is engaged in the accumulation of coins. Addresses with balances from 0.1 to 10k BTC continue to purchase coins, which is also reflected in the metric of the ratio of the sold to market value of assets. This is a positive and important signal for the market, as it demonstrates traders' faith in further growth. The absence of an impulse sell-off during Wednesday's sharp drop in prices testifies to the maturity of the market and the readiness to resume growth.

Taking into account the fact that the market is completing the stage of accumulation and is gradually moving to the recovery of quotes, it is worthwhile to closely monitor the technical indicators. It is the daily and narrower timeframes that will be the first to signal the start of a full-fledged upward trend. On-chain analysis proves the desire of investors to wait for the growth of bitcoin quotes, and therefore it becomes especially risky to play on a decline. As of 15:00 UTC, entering the asset looks dangerous, but generally a justified undertaking, since there is no doubt about further price growth. The market has proven to be resistant to impulse decisions, which is a defining component of growth.