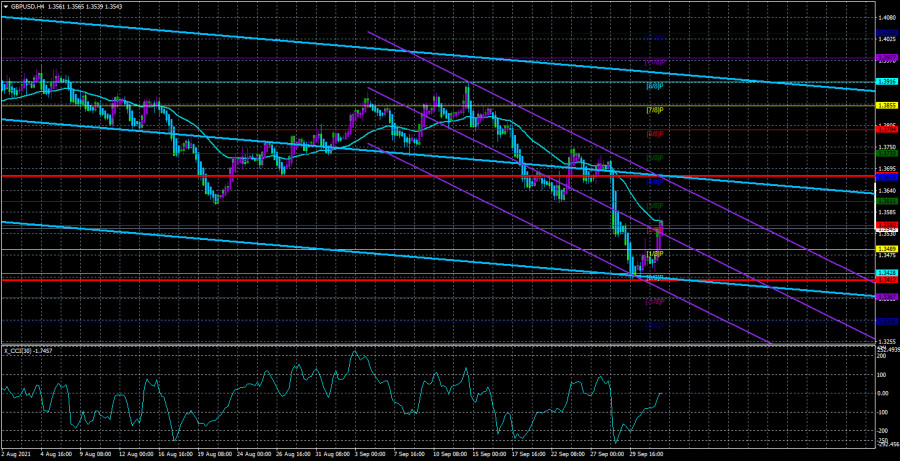

4-hour timeframe

Technical details:

Higher linear regression channel: direction - downward.

Lower linear regression channel: direction - downward.

Moving average (20; smoothed) - sideways.

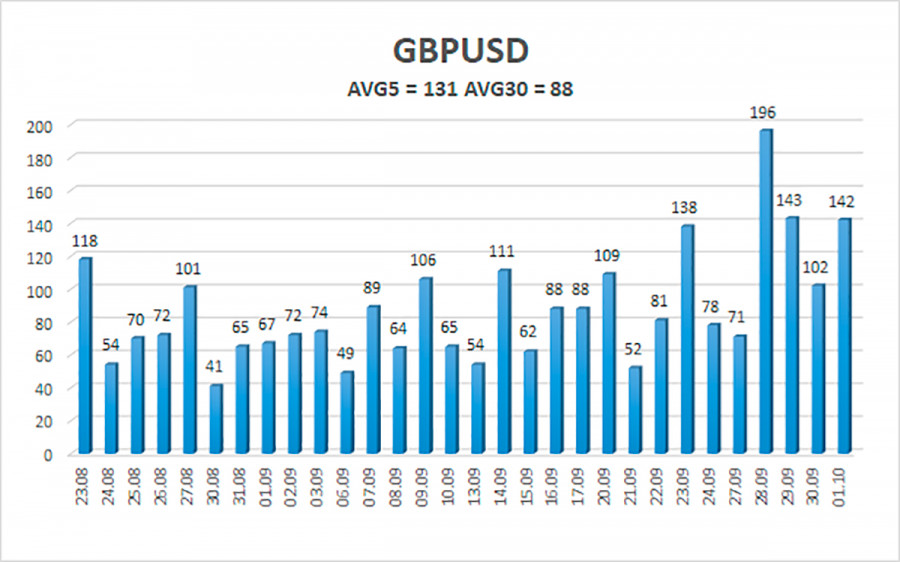

This week, the British pound paired with the US dollar showed just excellent volatility, moving like in the good old days. Recall that the normal volatility for the pound/dollar pair is 100-130 points per day. It is the value of the indicator we see now in the context of the last five days. We continue to believe that the main reason for the powerful fall of the pound and the growth of the dollar is the "logistical crisis," part of which is the "fuel crisis" that Britain faced just last week. We have already drawn traders' attention to the fact that the lack of gasoline at the gas station means its lack of ordinary drivers and the lack of the most significant services in the state plan (for example, ambulance). So far, there have been no reports from the UK that one or another state structure has stopped its work due to lack of gasoline, but still, this event has no analogs. Thus, the pound could fall by 300 points due to this factor. However, the pair's recovery began on Thursday and Friday, and the price has returned to the moving average line. Therefore, on Monday and Tuesday, the future fate of the pound will be decided. If there is a consolidation over the moving, it will be possible to talk about the resumption of the upward movement and a new upward trend. If not, then the movement to the south is likely to continue. It should also be noted that the pair overcame the most important level of 1.3600 for itself, which it could not "take" for six months. But at the same time, the pair have still adjusted by only 24% about the entire upward trend, which began a year and a half ago. Thus, the latest fall of the pound/dollar pair is practically nothing in global terms.

Next week, traders will have almost nothing to turn their attention to in macroeconomic terms. For the whole week, only two not the most significant reports will be published in the UK – business activity indices for the services sector and the construction sector. We can hardly expect a strong reaction to these reports. It should also be noted that if the chairmen of central banks spoke almost every day last week, then no important speeches are planned for the next week. Thus, market participants will have to pay attention only to statistics from overseas, where the most important report will be Nonfarm Payrolls, which will be published on Friday.

However, in addition to this, you should pay attention to non-economic news. For example, the same "fuel crisis." So far, Boris Johnson's government has decided to involve the military in the case, who have become truckers and issue temporary visas to drivers from other countries. It cannot be said that the problem has already been solved since, according to media assurances, truck drivers from other countries are not eager to go to the UK for a couple of months and then be deported. Drivers are interested in permanent and stable work, so to speak, in relation to labor migration.

Moreover, after Brexit was completed at the beginning of the year, many drivers made a choice in favor of other EU countries, where prosperity and working conditions are no worse than in Britain. Thus, for the time being, the problem will be solved by the military. However, the country may face not only a "fuel crisis." Some respected news agencies reported last week that there may be a shortage in other sectors of the economy. In particular, there may be a shortage of some products in stores. Thus, Boris Johnson needs to solve the global problem of labor shortage in places where the British themselves are not used to working and do not want to do it.

Consequently, next week, any news about the "logistical crisis" aggravation may provoke a new fall in the British currency. In general, we suggest traders observe the pair's behavior in the first four days of the trading week. Especially if there are no new reports regarding the shortage of gasoline from Britain. If this condition is met, it will be possible to understand whether the markets are set up for further pair sales, which can be justified by the high probability of curtailing the QE program in the United States? If the pound continues to fall anyway, then the downward trend will no longer be just an assumption. It will become an expectation.

The average volatility of the GBP/USD pair is currently 131 points per day. For the pound/dollar pair, this value is "high." On Monday, October 4, we expect movement inside the channel, limited by the levels of 1.3412 and 1.3677. The upward reversal of the Heiken Ashi indicator signals a round of corrective movement.

Nearest support levels:

S1 – 1.3489

S2 – 1.3428

S3 – 1.3367

Nearest resistance levels:

R1 – 1.3550

R2 – 1.3611

R3 – 1.3672

Trading recommendations:

The GBP/USD pair has started a corrective movement on the 4-hour timeframe but has not yet overcome the moving average. Thus, at this time, it is still necessary to consider sell orders with targets of 1.3489 and 1.3428 levels in the event of a price rebound from the moving average line. Buy orders should be considered again if the price is fixed above the moving average with targets of 1.3611 and 1.3672 and keep them open until the Heiken Ashi turns down.

The material has been provided by InstaForex Company - www.instaforex.com