Wave pattern

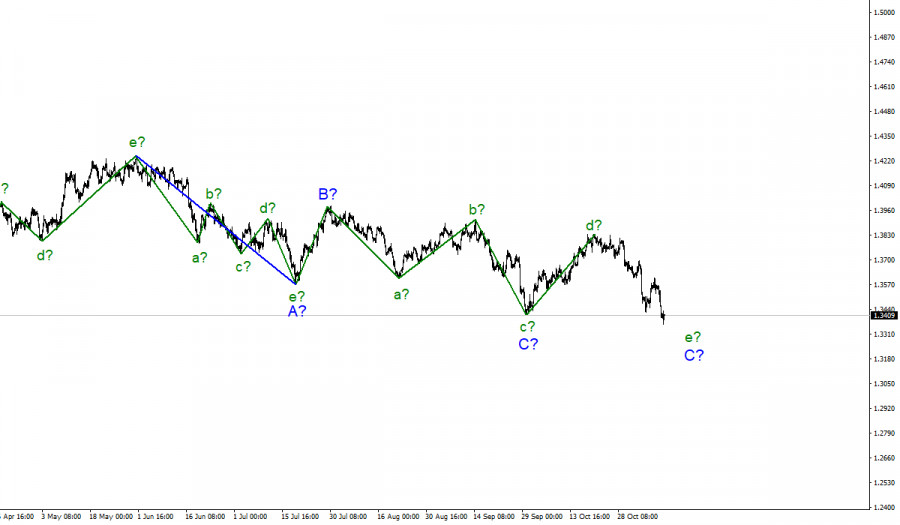

The wave counting for the Pound/Dollar instrument continues to look quite complicated due to deep corrective waves as part of the downward trend section, but at the same time, it is quite convincing.

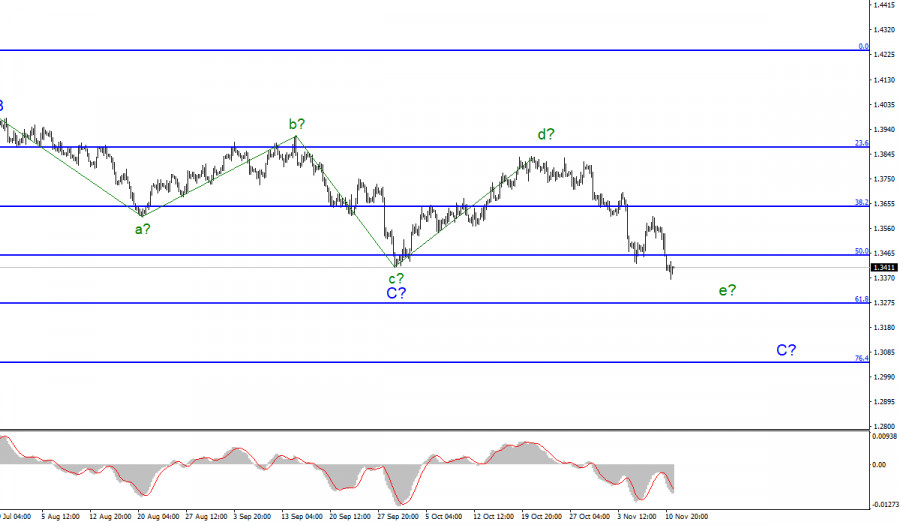

Presumably, five internal waves are visible inside the last wave C, and each subsequent one is approximately equal in size to the previous one. My assumption that wave C is complete has not yet been confirmed. A successful attempt to break through the low of the proposed wave c indicates the five-wave appearance of the last wave C.

However, all waves in the composition of C or A are almost equal in size. Thus, the minimum entry below the low of wave c in C may already mean that wave e is nearing its completion and may even fail to fall to the 61.8% Fibonacci level. Thus, to complete wave e and the entire wave C, you need to be ready. So far, I am not considering the option of complicating the proposed wave C.

Sterling stumbles again, but this time managed to avoid a strong decline.

The exchange rate of the Pound/Dollar instrument decreased by 160 basis points on Wednesday, and on Thursday it lost another 40, but by the middle of the day, it still managed to move away from the lows reached.

The news background for the British pound was still quite strong on Thursday. After Wednesday's inflation report, the markets managed to move away only after 12-15 hours, and immediately, data on GDP and industrial production were released in the UK, which could not but disappoint.

The UK economy showed growth of only 1.3% in the third quarter compared to the second quarter. This is not the final value of GDP, but it is still too low. In the second quarter, there was an increase of 5.5%. Note that the US GDP also failed earlier, but this does not make it easier for the sterling and the UK economy.

Industrial production in September was even worse than GDP, which saw a decrease of 0.4% MoM. The markets expected higher values in both cases. On Friday, the news background for the instrument will weaken, so the construction of a new upward wave may begin, which may become the starting point for a new upward section of the trend.

However, the markets may, at any moment, take into account one of the many topics that are currently pursuing the pound and the dollar. For example, the situation between Britain and the EU continues to heat up and a trade war is already beginning to smell, and new meetings on raising the government borrowing limit will soon begin in the United States. And the problem of the highest inflation in 30 years will now be very acute for the government and the Fed.

General conclusions

The wave pattern of the Pound/Dollar instrument looks quite convincing now. It has a downward form, but it is not impulsive. The expected wave e may be nearing its completion, so for now I advise you to stay in sales with targets located near the level of 1.3270, which equates to 61.8% Fibonacci level. But with the MACD signal "up," I advise you to exit the market and consider the possible construction of a new upward wave.

Starting from January 6, the construction of a new downward trend section began, which can turn out to be almost any size and any length. At this time, the proposed wave C may be nearing its completion, but there is no confirmation of this yet. The entire downward section of the trend may lengthen, but there are no signals about this yet either.

The material has been provided by InstaForex Company - www.instaforex.com