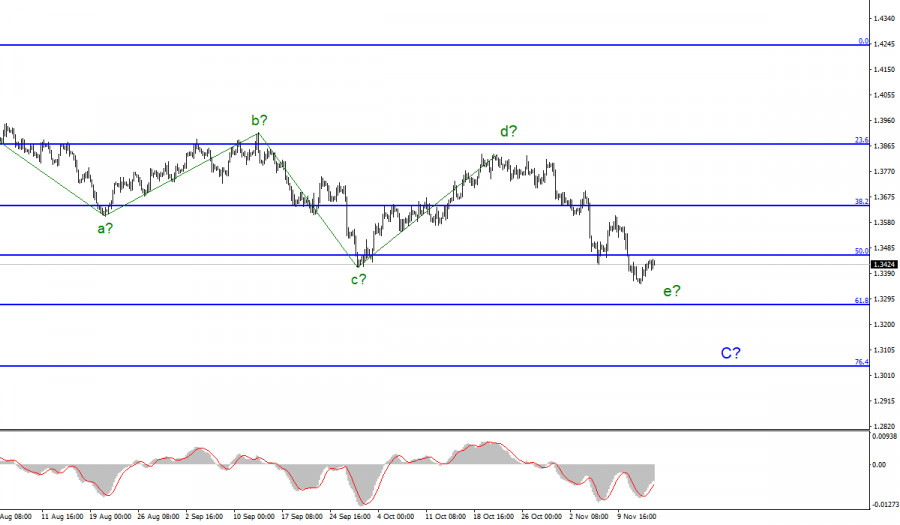

Wave pattern

The wave counting continues to look quite complicated due to deep corrective waves as part of the downward trend section, but at the same time, it is quite convincing. Inside the last wave C, presumably five internal waves are visible, and each subsequent one is approximately equal in size to the previous one. A successful attempt to break through the low of the proposed wave c indicates the five-wave appearance of the last wave C.

However, all waves in the composition of C or A are almost equal in size. Thus, the minimum entry below the low of wave c in C may already mean that wave e is nearing its completion and may even fail to fall to the 61.8% Fibonacci level. Thus, to complete not only e but also the entire wave C, you need to be ready.

So far, I am not considering the option of complicating the proposed wave C. The internal wave count of the wave e in C does not look clear and, therefore, can take any form of complexity.

A slight deviation in quotes gives hope to the pound.

The exchange rate of the Pound/Dollar instrument increased by 70 basis points on Friday, and by another 20 on Monday. However, the amplitude of today's movements is very weak. As in the case of the Euro/Dollar instrument, the news background could negatively affect the desire of the markets to trade actively.

In their speech, ECB President Christine Lagarde, and BoE Governor Andrew Bailey did not give the markets important information. Rather, on the contrary, what Bailey and Lagarde said has long been known to the markets, and they are even beginning to get annoyed by the fact that from time to time they continue to point out the "temporality" of the current high inflation.

Prices are rising very fast for the EU or the UK and continue to accelerate. And central banks are not taking any action yet to reduce inflation. The Bank of England has yet to meet expectations at the November meeting. Note that a few days before the meeting, there was information that the regulator could raise the interest rate by 15 basis points.

However, there were no compelling prerequisites for expecting a tightening of monetary policy in November. Especially for a rate hike, when the Bank of England has not even started tapering the stimulus program yet. Nevertheless, for some reason, the markets felt that Bailey was to blame for the collapse of their expectations and now there is much less trust in his words than before.

General conclusions

The wave pattern of the Pound/Dollar instrument looks quite convincing now. A downward wave has formed, but it is not impulsive. The expected wave e may be nearing its completion, and the MACD indicator has formed an "up" signal.

Therefore, if the quotes do not move away from the reached lows too far, the next "down" signal can still be considered for sales with targets located near the 1.3270 level, which equates to 61.8% Fibonacci level. But a successful attempt to break through the 50.0% Fibonacci level will cast doubt on the further construction of the wave e.

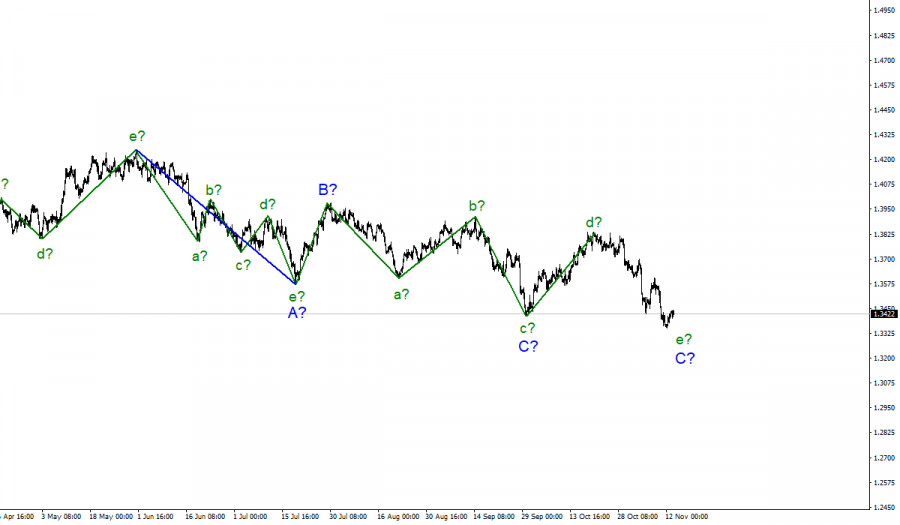

Starting from January 6, the construction of a new downward trend section began, which can turn out to be almost any size and any length. At this time, the proposed wave C may be nearing its completion, but there is no confirmation of this yet. The entire downward section of the trend may lengthen, but there are no signals about this yet either.

The material has been provided by InstaForex Company - www.instaforex.com