While Bitcoin and Ether have corrected slightly after their sell-off on Thursday, blockchain technology is already mature enough to meet the critical needs of "at least certain segments of the banking and financial markets," according to a policy memo from the Reserve Bank of Canada.

The memo points out that blockchain offers various models of work, ranging from proof of stake protocol, real-time two-way settlements to real-time service, high security, and automation. The bank believes that the securities markets, including mortgage-backed securities, have a high potential for integration into the blockchain.

The bank said that despite the formation of the blockchain for over a decade, the technology until recently did not develop to a level that would be suitable for the banking and financial markets in terms of "scale, speed, flexibility, and autonomy." However, the technology itself has evolved enough since the launch of Ethereum in 2015 to meet the critical needs of at least certain segments of the banking and financial markets.

Among the downsides, there was a weak regulation and regulatory framework that is very fluid given the speed of development of blockchain technology and the fact that it does not quite fit into existing legal and regulatory definitions.

In any case, 2021 is a revolutionary year for this industry, since the events that we have observed and will continue to observe - everything speaks of the high potential and development of this technology in the future. To say that the cryptocurrency market and the blockchain are a pyramid - now only a madman is capable.

Fed doesn't need CBDC

In his recent interview, Federal Reserve Board Governor Christopher Waller touched upon the topic of stablecoin, the regulation of which everyone expects in the near future. In his opinion, stablecoin should be governed by the same rules as banks, but there is a problem. Waller disagrees with some of the guidelines for stablecoin regulation that have been developed by the President's Working Group on Financial Markets (PWG). He explained that while banks should be able to issue stablecoins, not all stablecoin issuers need to be banks. Therefore, Waller disagrees that stablecoins should be fully subject to banking regulation.

Waller also commented on central bank digital currencies (CBDCs) that the Federal Reserve is looking into. In the near future, the regulator will release a report on the digital dollar. According to the politician, he remains skeptical about the need for a CBDC, arguing that the Fed should not create a digital dollar in order to reduce the cost of payments. He also noted that there are already "real and fast innovations" in the payment sector, which will be implemented in the near future.

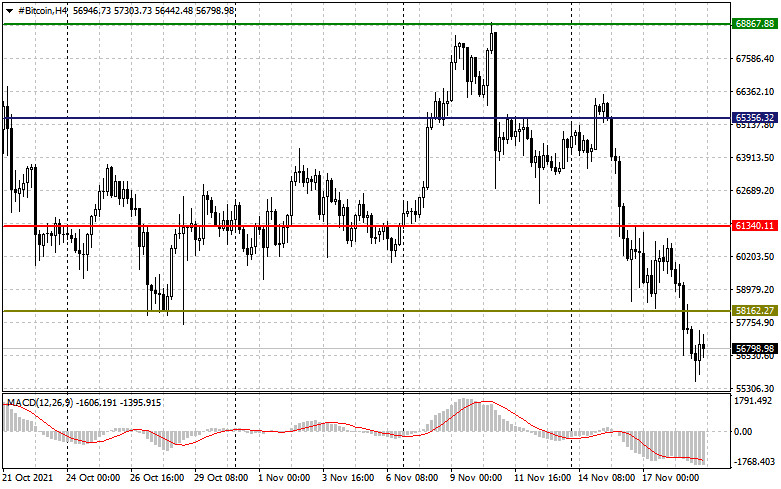

As for the technical picture of Bitcoin

Obvious problems with the level of $58,160, which buyers of risky assets managed to protect on October 17, remain. Its breakdown posed a direct threat to the bullish rally seen since July this year, following the Bitcoin crash in May.

The breakdown of $58,160 opened a direct road to the 100-day moving average, passing around $53,000. There is a level of $54,444 a little above this average, and the moving average will most likely tighten there before the range is updated. Therefore, it is clearly not worth rushing to buy the world's first cryptocurrency.

First, find the bottom, and then we will think about where it is better to enter the market. It will be possible to speak about leveling the situation in favor of buyers more safely only after the rate confidently returns and gains a foothold above $61,300.

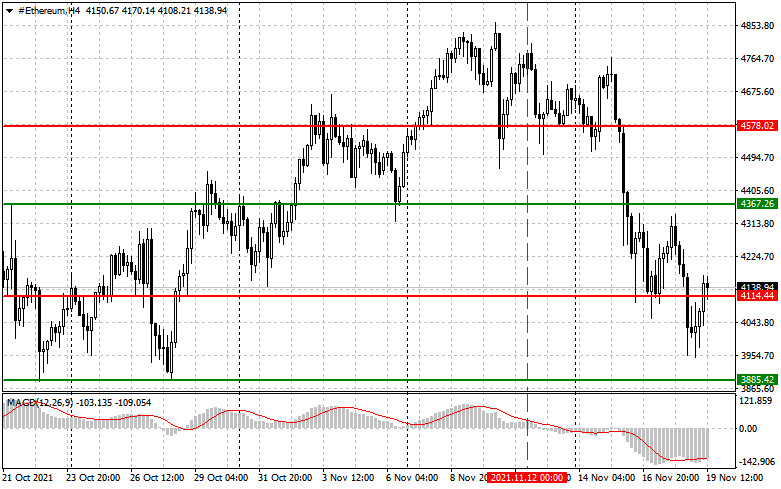

As for the technical picture of Ether

The bulls are actively fighting to regain control of the support of $4,114, which they missed yesterday. If this does not work, the situation may worsen, which will lead to another wave of decline to the $3,885 area and open a direct path to $3,600.

I advise you to enter the market from these levels in the case there are large players in the market, but for now, everything says that no one is going to go anywhere, most likely rebounds from these levels will be instantaneous.

We can talk about the stabilization of the situation with the rate after Ether has confidently consolidated above the resistance of $4,360, which will allow it to quickly return to $4,580.

The material has been provided by InstaForex Company - www.instaforex.com