EUR/USD rallied as the Dollar Index is in a corrective phase. Technically, the currency pair was somehow expected to rebound after its massive sell-off. DXY's further drop could push the pair higher. As you already know from my analysis, we have a strong negative correlation between the Dollar Index and EUR/USD.

Fundamentally, the euro received a helping hand from the German Import Prices registered 3.8% growth beating the 2.0% expected. Meanwhile, the Private Loans rose by 4.1% versus 4.0% expected, while the M3 Money Supply jumped from 7.5% to 7.7%, though specialists expected a potential drop to 7.4%.

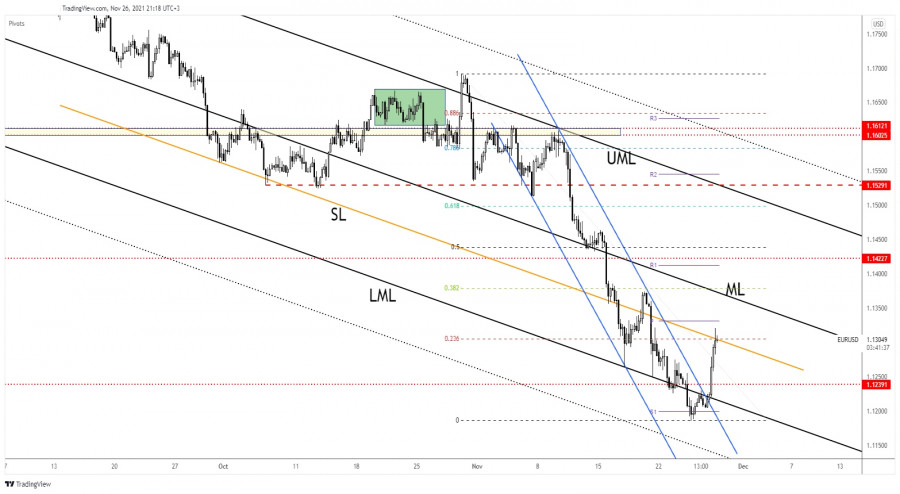

EUR/USD natural rebound

EUR/USD challenges the confluence area formed at the intersection between the 23.6% retarcement level with the inside sliding line (SL). Till now, it has registered only a false breakout. Making a valid breakout through it and stabilizing above these upside obstacles may signal that the pair could extend its rebound.

The price has shown oversold signs after failing to come back to test and retest the channel's downside line. Still, the current rebound could be only a temporary one. We can search for new short opportunities.

EUR/USD outlook

EUR/USD could extend its growth if it stabilizes above the 23.6% retracement level. The median line (ML) is seen as the next upside target. On the other hand, failing to close and stabilize above 23.6% may signal that the rebound is over.

The material has been provided by InstaForex Company - www.instaforex.com