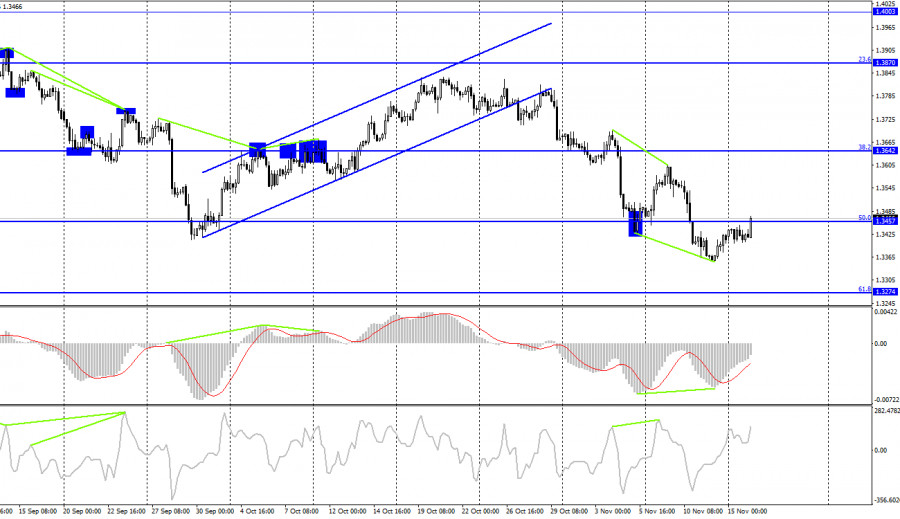

GBP/USD – 1H.

On the hourly chart, the GBP/USD pair continued its upward trend on Monday. On Tuesday it consolidated above the downtrend corridor, which has long characterized traders' sentiment as bearish. However, now the upside process for the pound could continue towards the next retracement level of 76.4%, 1.3511. The information backdrop on Monday for the GBP was very weak. Central bank president Andrew Bailey recently gave a speech. However, traders did not hear anything new from him. Their inactive trading is proof of that. However, the information backdrop has become more interesting today. Although I did not expect traders to react so strongly to reports which had not previously caused them any interest.

Nevertheless, Britain's unemployment rate fell from 4.5% to 4.3%. Claims for unemployment benefits declined by 14,500 and average wages rose by 5.8%. Thus, the pound continued to rise. However, the information backdrop is now quite challenging for the currency and even though it is out of the trend range, the fall in quotations could resume. Notably, London cannot reach an agreement on the conditions of checks and customs on the Northern Ireland border with the EU. London and Brussels are now exchanging mutual threats to withdraw from the protocol or the whole Brexit agreement. Several media sources have already stated that a trade war between the EU and Britain may be about to start. Thus, the situation could deteriorate sharply for the British at any moment. It can only be supported by the Bank of England, which is showing a willingness to raise rates and roll back its quantitative stimulus program, as well as the Federal Reserve.

GBP/USD – 4H.

On the four-hour chart, the GBP made a return to the 50.0% retracement level of 1.3457. A rebound from this level will allow traders to expect a reversal in favour of the US currency and a renewed fall towards the 61.8% Fibonacci level of 1.3274. A close above the 50.0% level would increase the possibility of further upside towards the next 38.2% retracement level of 1.3642.

News calendar for the USA and the UK:

UK - Unemployment Claims Change (07-00 UTC).

UK - Unemployment rate (07-00 UTC).

United Kingdom - Change in average earnings (07-00 UTC).

United States - Change in Retail Sales (13-30 UTC).

United States - Change in Industrial Production (14-15 UTC).

On Tuesday, the UK has already released all the reports that have been scheduled. The US reports are expected to be published. The information backdrop today is average in strength.

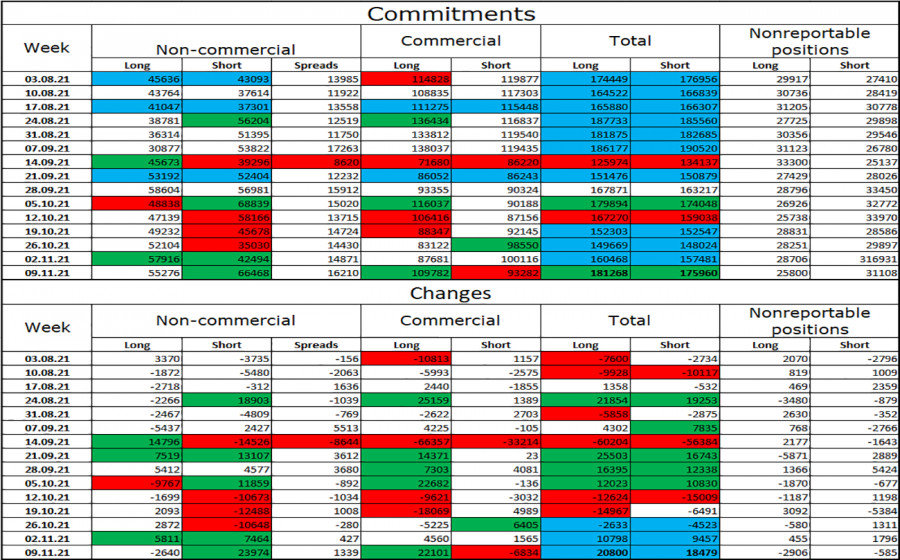

COT (Commitments of Traders) report:

The latest COT report from November 2 on the pound showed that the mood of the big players has become much more bearish. In the reporting week, speculators opened 2,640 long contracts and 23,974 short contracts. Thus, the number of long contracts in the hands of major players still exceeds the number of short contracts by 11 thousand. In recent weeks, major players do not have any clear mood and then increase purchases, then increase sales, and the total number of long and short contracts for all categories of traders is the same (181K - 175K). Thus, after several weeks of an active build-up of longs, it may be the turn of shorts.

Forecast for GBP/USD and recommendations to traders:

I do not recommend selling the GBP yet, as the pair has just left the downtrend corridor. I recommended to buy the pound at closing above the downtrend corridor on the hourly chart with the targets 1.3511 and 1.3573. Now these trades can be held open.

Terms:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy foreign currency not to make speculative profits, but to ensure current activities or export-import operations.

"Non-reportable positions" are small traders who do not have a significant impact on the price.

The material has been provided by InstaForex Company - www.instaforex.com