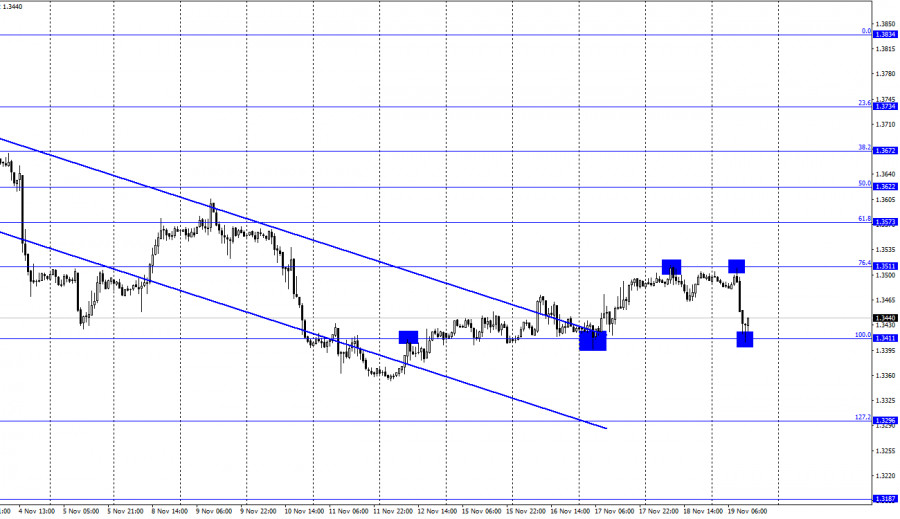

GBP/USD – 1H.

According to the hourly chart, the GBP/USD pair on Thursday performed a rebound from the Fibo level of 76.4% (1.3511), a reversal in favor of the US currency, and a fall to the corrective level of 100.0% (1.3411). The rebound of quotes from the level of 100.0% worked in favor of the UK currency, and the process of growth towards the level of 1.3511 has already begun. However, closing below the level of 1.3411 will increase the probability of a further fall in the direction of the next corrective level of 127.2% (1.3296). As I said in the review of the euro/dollar pair, at this time, there is a high probability of the growth of the US currency. It is not the euro and the pound that is falling, but the dollar is growing. Why this may be – because the situation with the pandemic continues to worsen in the European Union, and the UK quietly and imperceptibly, but continues to remain in second place in the world in terms of the number of new diseases. Over the past week, about 260 thousand people have been infected in Britain.

Let me remind you that Britain is one of the few countries in the world where almost the entire adult population is vaccinated. However, as we can see, vaccines do not save from infection, but only facilitate the course of the disease and reduce the risk of complications. In addition, the virus does not stand still but develops itself. Every few months, a new strain appears, which is usually more contagious than the previous one. Thus, the demand for the dollar can grow now as a protective asset. The retail trade report for October was released in the UK today. Although this indicator turned out to be slightly better than traders' expectations, the pound did not feel any joy about this. On the contrary, just in the morning, its new fall began. At the same time, negotiations between the European Union and Britain on the issue of the Northern Ireland border are continuing, but so far there is no new information about this. If the parties fail to reach an agreement, it may also put pressure on the British position.

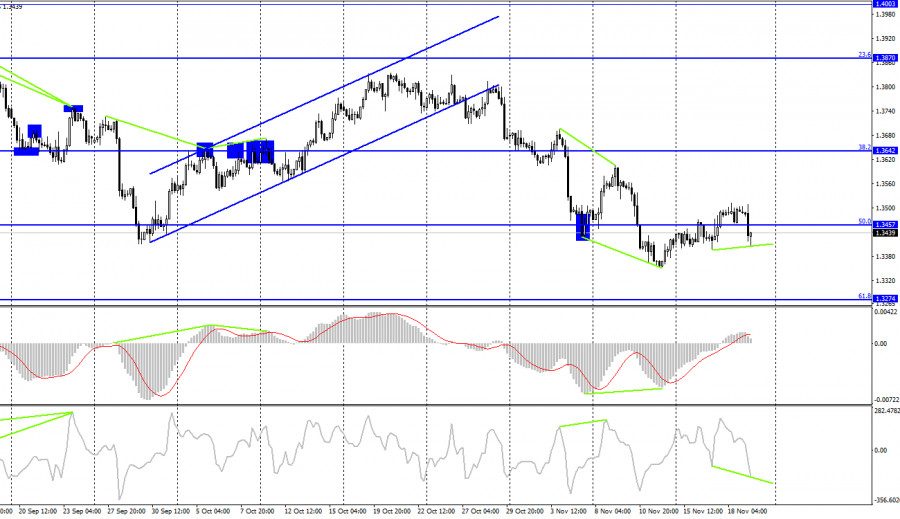

GBP/USD – 4H.

On the 4-hour chart, the quotes of the British performed a reversal in favor of the US currency and closed under the corrective level of 50.0% (1.3457). Thus, the process of falling can now be continued in the direction of the next Fibo level of 61.8% (1.3274). However, the emerging bullish divergence allows us to count on the resumption of growth in the direction of the Fibo level of 38.2% (1.3642). If it is canceled, then the chances of continuing the fall will increase.

News calendar for the USA and the UK:

UK - change in retail trade volume, taking into account fuel costs (07:00 UTC).

On Friday, all the reports that were scheduled for that day have already been released in the UK, and nothing interesting appears in the calendar in the US. The information background will be practically absent today.

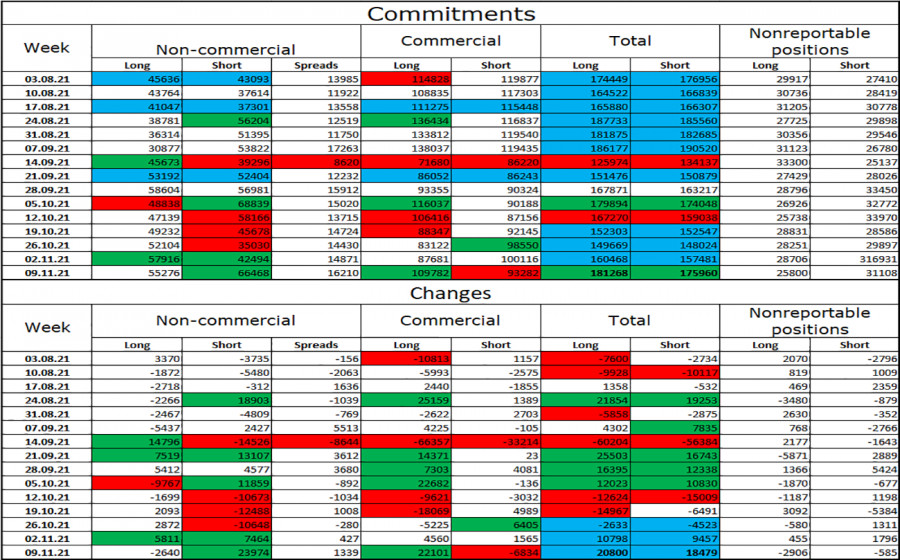

COT (Commitments of Traders) report:

The latest COT report from November 9 on the pound showed that the mood of the major players has become much more "bearish". In the reporting week, speculators closed 2,640 long contracts and opened 23,974 short contracts. Thus, the number of long contracts in the hands of major players in just one week has become more than the number of short contracts by 11 thousand. But a week ago, the advantage was reversed by 17 thousand. However, in recent weeks, speculators do not have any clear mood and then increase purchases, then increase sales, and the total number of long and short contracts for all categories of traders remains approximately the same (181K - 175K). Thus, after several weeks of an active buildup of shorts, a period of increasing longs may come.

GBP/USD forecast and recommendations to traders:

I recommended selling the Brit if there is a rebound from the 76.4% level (1.3511) on the hourly chart with a target of 1.3411. This deal has already worked. New sales – at the close under 1.3411 with a target of 1.3296. I recommend buying the British when rebounding from the 1.3411 level on the hourly chart with a target of 1.3511.

Terms:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy foreign currency not to make speculative profits, but to ensure current activities or export-import operations.

"Non-reportable positions" are small traders who do not have a significant impact on the price.

The material has been provided by InstaForex Company - www.instaforex.com