The dollar gains support against the yen. In the last review on the Japanese currency, we said that the yen is under pressure from two opposite factors: the weakening of the dollar acts on the strengthening of the yen, and the growth of stock indices acts on the weakening of the yen. And over the course of a day, the balance of power shifted towards the weakening of the yen, that is, towards the growth of the USD/JPY pair. On Friday, the US stock index S&P 500 rose 0.19% to set a new all-time record. And the dollar index rose 0.82%, reaching a range on September 30. The USD/JPY pair itself has grown by 38 points.

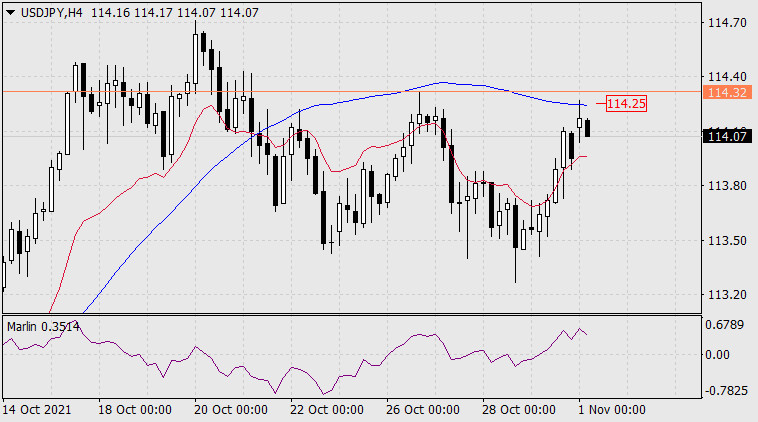

From a chart point of view, breaking the 114.32 signal level (Oct 26 high) opens the way to the target range of 115.80-116.15. Now we take this as the main scenario.

On the four-hour chart, the price has crossed the balance indicator line, which is already shifting the market interest in buying the dollar against the yen, and is preparing to overcome the MACD indicator line (114.25), and this, if successful, will lead the price to a medium-term increase. The Marlin Oscillator has already changed to a rising trend.

The material has been provided by InstaForex Company - www.instaforex.com