European natural gas futures rose on Tuesday after the US imposed the further sanctions in connection with Russia's Nord Stream 2 pipeline, which the Kremlin considers illegal

Gas prices are rising again

Rising oil prices in response to plans by the US and other oil-consuming countries to use their strategic reserves also gave extra impetus to natural gas prices.

Benchmark European gas futures soared by 9.5% to 92 euros per megawatt-hour, while the UK equivalent rose by 9.4% to 231 pence per therm.

Although any actions against the Russian pipeline could raise concerns about the regularity and sufficiency of supply, sanctions are likely to be imposed too late. After all, construction of the pipeline was completed in September, and the first of the two strings has already been filled with gas. Meanwhile, the US government has already issued fines aimed at the project, which has progressed despite the efforts of its Western counterparts.

For example, in August, the US imposed sanctions on two Russian companies for their involvement in the construction of the Nord Stream-2 pipeline, as well as on a ship that was involved in the construction of the line. At the time, the move had a limited impact on European gas prices, without overshadowing major OPEC news. Now analysts believe the new fines probably will not stimulate rise in futures in the long run.

Katya Yefimova, senior fellow at the Oxford Institute for Energy Research said that in her view those new sanctions would not affect gas prices as the pipeline had already been built.

She noted that the Biden administration was required to send a sanctions report to Congress every three months. So action against the ship, which is believed to be Russian, was expected. The US decision not to penalize another ship that is affiliated with the German government shows that the White House does not want to antagonize Chancellor Angela Merkel's administration.

Despite this fact, last week the start of the line was halted after Germany's energy regulator disrupted the certification process of the Swiss pipeline operator, resulting in 15% rise in European prices.

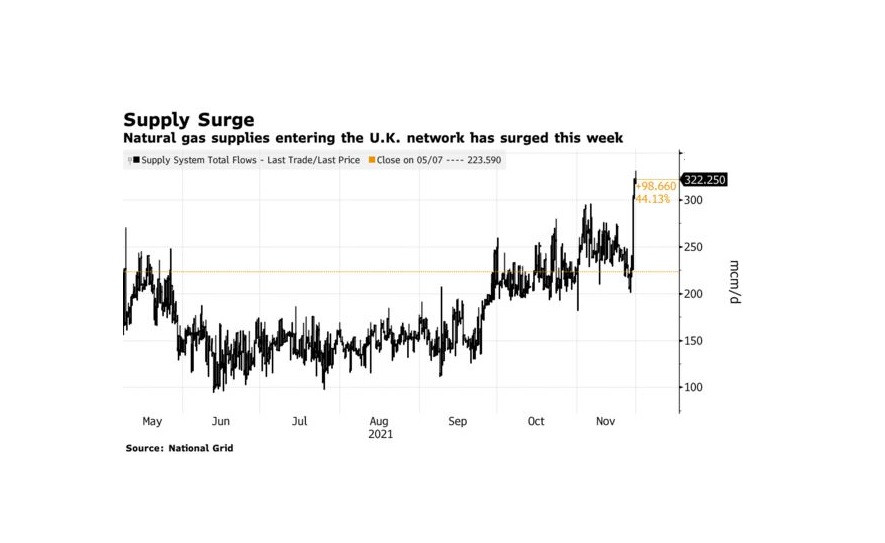

The volume of gas flowing into its network in the UK increased sharply this week, easing concerns about short-term supply.

Nevertheless, Asia increased its imports of liquefied natural gas to record levels since February, adding a bullish factor to European prices. According to market economists, while European LNG imports have grown over the past two months, increased imports to Asia are likely to reduce the resource availability to Europe.

It is probably a short-term spike. Besides, once the US releases its strategic reserves, energy prices are likely to reduce significantly. It is bad news for Russia, expecting an inflated price for energy resources on the market, which would allow it to fill a gap in the budget.

The material has been provided by InstaForex Company - www.instaforex.com